November was a bullish month for the cryptocurrency market. We witnessed this situation especially in the first half of the month. According to crypto analyst Valdrin Tahiri, the following 5 altcoins are likely to attract even more attention in December. Among these, there are tokens such as LINK, which Turkish crypto investors are interested in.

5 altcoins to be on your radar in December, including LINK!

Chainlink (LINK) staking allows early entry

- Price: $14.79

- Market Value: $8.235 billion

- Ranking: 12

Chainlink Staking v0.2 was launched this year. Priority transit took place on 28 November. However, it was only valid for existing v0.1 LINK stakers. Addresses eligible for early access will be able to stake on December 7, and staking will be opened to the public on December 11. Staking v0.2 will build on the existing foundation in v0.1 and provide greater flexibility, enhanced security, a dynamic reward mechanism and modular architecture.

LINK price has fallen since reaching a high of $16.58 on November 11. This decline fell to $12.86 six days later. Since then, the price has increased in a move supported by the Relative Strength Index (RSI). Meanwhile, the RSI jumped at 50. Thus, it created a hidden bullish divergence (green), which is a sign of trend continuation. If LINK price continues to rise, the next resistance will be at $18.30, formed by the resistance trend line of the ascending parallel channel. A 22% upward move is required to reach this.

Despite this bullish LINK price prediction, a close below the November 17 low of $12.86 (red) would invalidate the bullish count. In this case, it is possible for the LINK price to drop by 27% to the support trend line of the channel.

ImmutableX (IMX) released its new mainnet

- Price: $1.28

- Market Value: $1.606 billion

- Rank: 39

ImmutableX launched its zkEVM Testnet in August, aiming to be the home of gaming on Ethereum. More than 50 games have already committed to building on zkEVM. Upgraded testnet from Polygon Edge to Geth in November. It will also launch manin-neti in December.

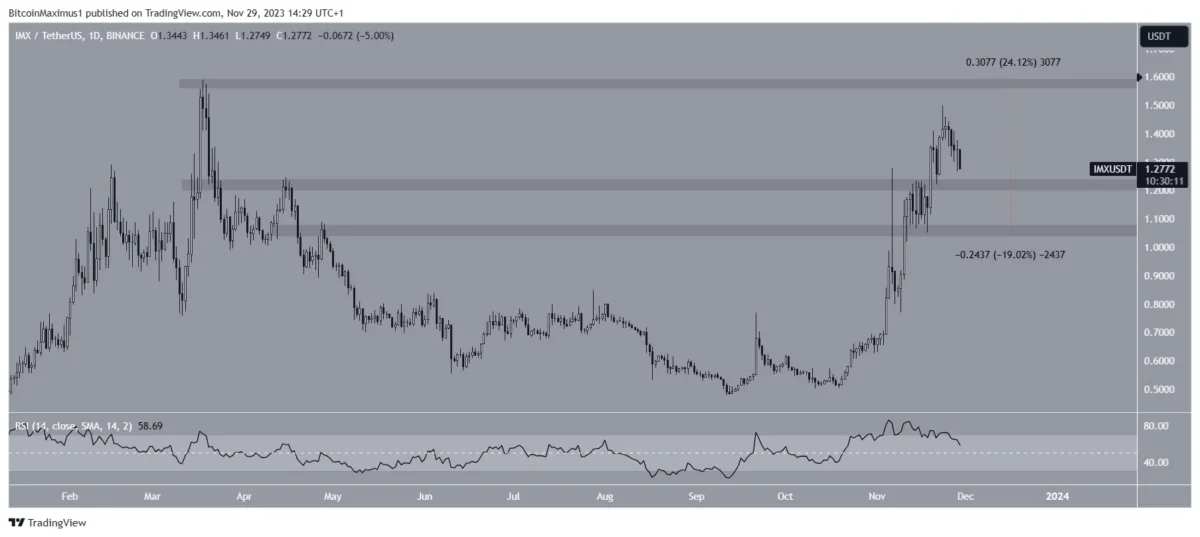

cryptokoin.comAs you follow from , IMX price has increased rapidly since the beginning of November. The price increase peaked at $1.50 on November 23. The price then dropped slightly. However, it is currently trading above the $1.20 horizontal area, which is expected to provide support. If IMX price rebounds, it is possible for it to rise 24% to the next resistance at $1.60.

Meanwhile, despite the bullish IMX price forecast, a daily close below the $1.25 area is likely to lead to a 20% decline to the next closest support at $1.

NEO upgrades main-net

- Price: $10.84

- Market Value: $764,286 million

- Rank: 65

NEO upgraded test-net on November 21st. Additionally, it will upgrade its main-net on December 4. The new upgrade will bring various improvements and optimizations. NEO price has increased rapidly since breaking out of a descending resistance trend line on October 26. The upward move reached a high of $15.46 on November 5. However, the price could not sustain its upward movement. It also formed several long upper wicks (red symbols), which are signs of selling pressure. Despite the decline, NEO price is trading above the main horizontal support area at $10. If it bounces, a 35% upward move is possible. In this case, it will reach the $14.50 resistance area.

Meanwhile, despite the bullish NEO price forecast, a close below the $10 area is likely to trigger a 30% decline to the next support at $7.50.

MultiversX (EGLD) stakers vote for governance proposal

- Price: $43.36

- Market Value: $1.138 billion

- Rank: 50

EGLD members vote on the first protocol governance proposal. Voting started on November 23 and will continue until December 3. So far, nearly 98% of participants have voted in favor of the Sirius 1.6 Protocol upgrade, which includes improvements such as optimized consensus signature checks, advanced voting, and multi-key support for blockchain parts.

EGLD price broke out of the long-term descending resistance trend line in October. In this move, it reached a high level of $53.45. Although the price subsequently declined, it is still trading inside the horizontal support area at $43. As long as this is the case, the trend remains upward. If the price continues its rise, a 45% increase is possible. In this case, it will reach the next resistance at $63.

On the other hand, if EGLD closes below the $43 zone, it is likely to decline 25%. This will confirm the long-term descending resistance trend line.

At the end of the list comes Kava Network (KAVA)

- Price: $0.765

- Market Value: $747,165 million

- Rank: 68

The last altcoin of December is Kava Network. Its developers will release KAVA 15 on December 15. While there isn’t much information about their upgrades, the team held an AMA on November 29 to discuss the new developments.

KAVA price broke out of a descending resistance trend line on October 20. It has increased rapidly since then. The upward movement reached its highest level on November 11 at $0.87. The price of KAVA then fell. However, it is still trading above the horizontal support area at $0.70. In this case, the most likely future outlook is a 30% rise to the next resistance at $1.

Meanwhile, despite the bullish KAVA price forecast, a close below the $0.70 zone is possible, leading to a 25-fold decline to the $0.57 level.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!