Popular crypto analyst Michaël van de Poppe shared his predictions for Bitcoin and said that based on on-chain data, Bitcoin (BTC) may be preparing for an uptrend.

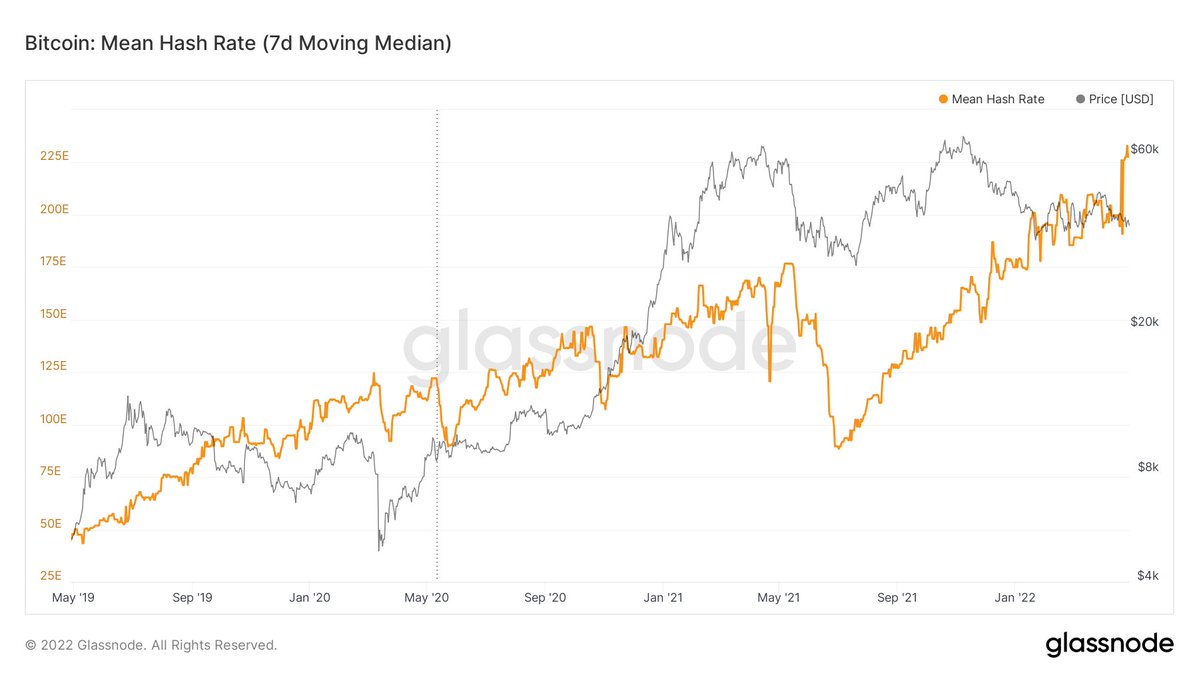

The analyst tells his 589,000 Twitter followers that the Bitcoin hash rate has reached an all-time high, often historically preceded by BTC rallies. told.

“The crypto ban continues as the Bitcoin hash rate hits an all-time high.

This shows that the demand for Bitcoin mining is increasing, the network is becoming more secure and eventually the price will follow this metric.”

Bitcoin’s hash rate refers to the total computing power used for BTC mining and power operations. The higher the hash rate, the higher the network’s resistance to an attack. Hence, this metric is also an important security indicator.

Besides, Van de Poppe, looking at the possible short-term outlook for Bitcoin, stated that a break of $38,000 or $40,500 in a new strategy session could be critical for BTC price.

“You should wait until you get a clear break below $38,000. This will likely present short-term opportunities.

If we break above $40,500, there will be a trend change in that area (resistance will turn into support), which will likely be the long (position) zone. It’s been a long time since $39,000 and if Bitcoin decides to hold a crucial support level which is the $39,000 region, at this point I would actually expect a little more long (position) for altcoins.

If we break $40,500, I think the next level we should look at is $43,000 by taking liquidity and $43,2000, which already represents a move of about 10%.”

On the other hand, the analyst said that, given Bitcoin’s sideways, low volatility price action, a big wave of action is approaching. He thinks an upside break rather than a downside break is more likely as it’s time for the US dollar index (DXY) to correct.

“There is a big break in the corner. If the USD shows additional weakness, I assume we will go up. Especially if the Fed doesn’t announce a heavier tightening than we expected. This will mean that the dollar will weaken further and Bitcoin will make an upward move.”

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.