bitcoin The price has managed to break out of the price range it has been in for months.

Now the world’s largest cryptocurrency it is approaching another critical trend line and investors are wondering how to evaluate the situation.

Bitcoin Price Approaches 200-Day Moving Average

BTC The price is approaching the 200-day moving average, which is an important threshold.

BTC has been trading below this value for about 95 days. BTC has not been trading below this value for such a long time since April 2019.

The crypto money, which approached close to 1% of the 200 MA value on March 28, is close to 4% at the time of this writing.

Chris Kline, co-founder and COO of the Bitcoin IRA platform, said:

“There seems to be a range where the BTC price is constantly going back and forth. There are tough days not only for cryptocurrencies, but also for the markets in general. There is inflation in the US that does not seem to be temporary. There is uncertainty about the rate hike and there are recession rumors. There are many factors waiting on the sidelines.”

UBS strategists, including James Malcolm and Alexey Ostopchuk, said it was difficult to find evidence of increased interest in cryptocurrencies.

Analysts pointed to stagnation in online searches, low futures volumes and funding rates for their views.

Malcolm, head of foreign exchange and crypto research at UBS, added that the crypto market is stagnant and does not seem to be experiencing any development.

The analyst stated that he still believes this year will be tough for crypto assets.

Malcolm said he thinks both bulls and bears can prevail in the current situation:

“If you look at the situation on the negative side, we are still in the region 35% lower than the November level. If you think positively, we are in a position 45% higher than January levels.”

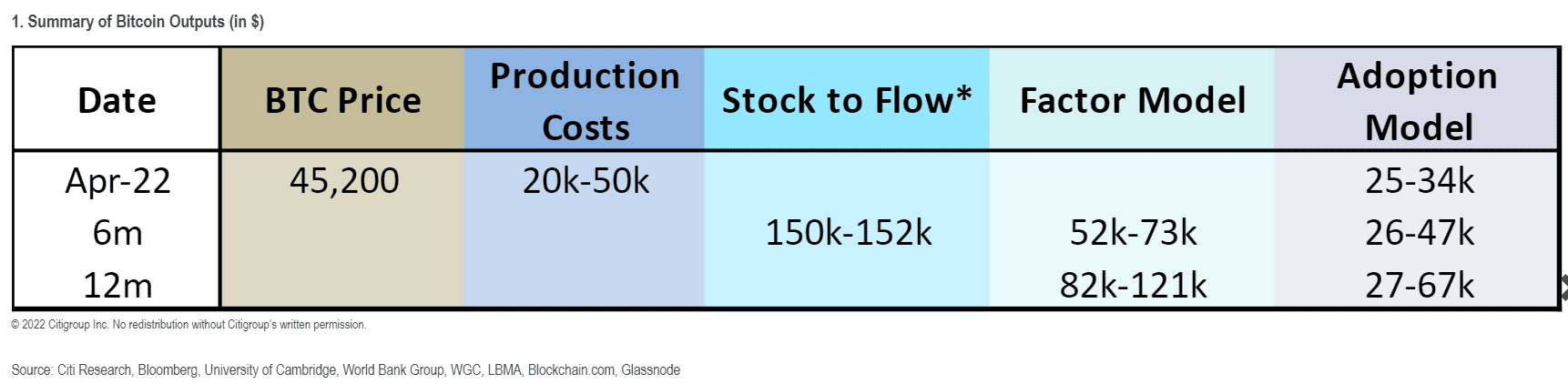

However, when Citibank analysts led by Alexander Saunders and Hannah Sheetz examined four models, including the Stock-to-Flow model, they presented data that Bitcoin price should be between $20,000 and $152,000.

*Not investment advice.