Some crypto analysts speculate that the recent Bitcoin (BTC) correction may be part of a longer-term pattern preceded by a massive price surge. One of these analysts is TechDev.

In a recent tweet, popular analyst TechDev shared a chart with his 383,000 Twitter followers showing striking similarities between the 1991 Dow Jones Industrial Average (DJI) and Bitcoin today.

Both charts show prices rising, then falling below the 200-day moving average, followed by an unsuccessful attempt to break above the 100-day moving average. is showing.

“Interesting construction takes 8 months.

Dow Jones ’91 and Bitcoin ’21-22′

As can be seen in the chart, after the Dow Jones failed to break above the 100-day moving average, it made a surprise recovery and continued to gain value for most of the year, breaking the 200-day moving average in early 1991. According to analyst TechDev, the second part of the model has yet to happen for Bitcoin, which could mean Bitcoin rallies are imminent.

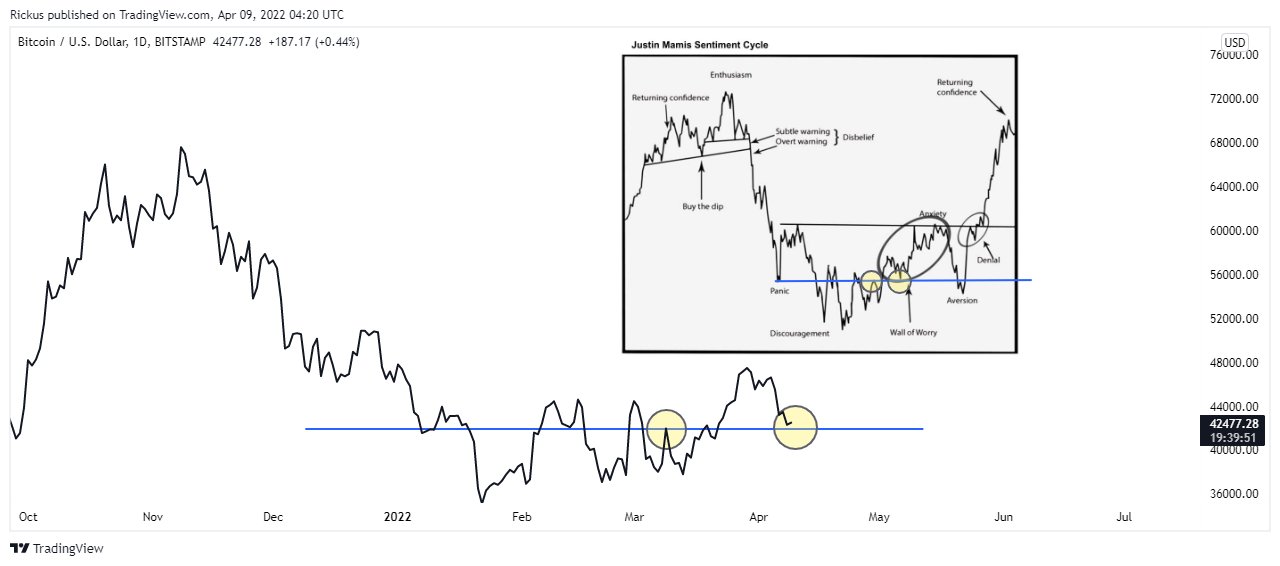

The analyst also noted that both Bitcoin (BTC) and DJI charts appear to mimic a pattern known as the Sentiment Cycle, which was originally popularized by Justin Mamis in his book The Nature of Risk. TechDev retweeted the chart below, which was first shared by analyst Rickus, comparing BTC’s recent price action to the Sentiment Cycle.

Supporting the bullish thesis, TechDev also examined a Bitcoin (BTC) chart that includes a Vortex intersection that defines trend reversals with 3-week candles. Per the interpretation of the chart, the analyst says that BTC is currently mimicking the price action of late 2020. At that time, BTC had signed a rally that lasted for about half a year.

“So far this 3-week BTC candle looks like the candle following the last bullish Vortex crossover.”

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.