The cryptocurrency market witnessed a surge in investor interest last week. Cryptoasset investment products recorded the second-largest weekly inflow ever, totaling a staggering US$1.84 billion. This bullish sentiment was further strengthened as trading volumes reached a record high of over US$30 billion during the week, at times even exceeding 50% of global daily Bitcoin trading volume on established exchanges.

CoinShares: Weekly inflow close to ATH

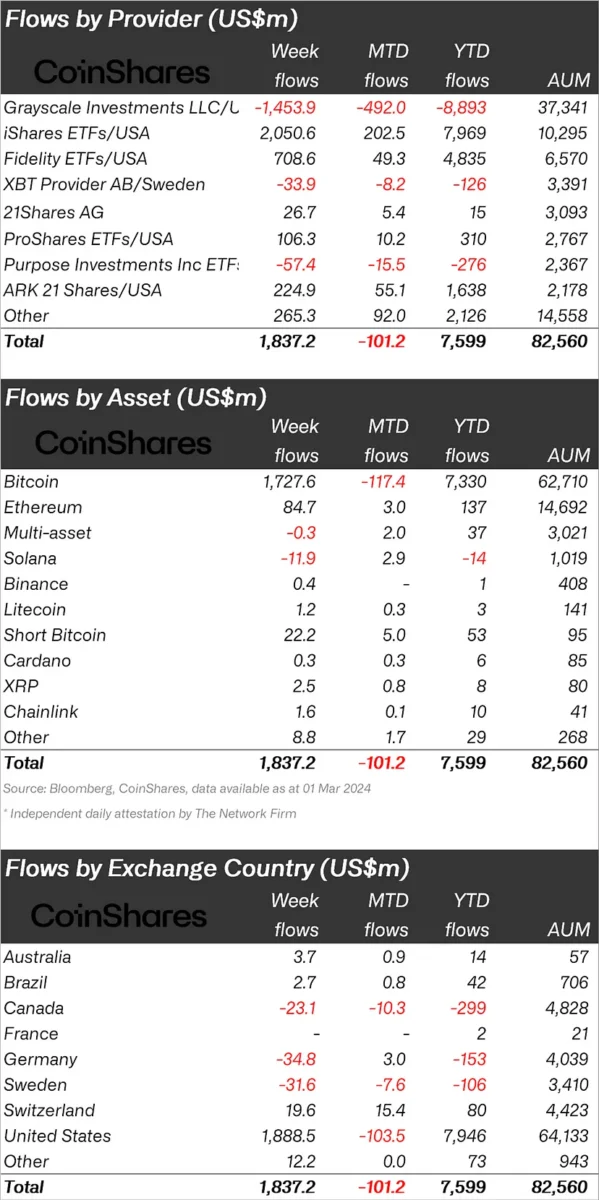

These inflows mark a significant shift in the market, pushing total assets under management (AuM) close to its all-time high (ATH) of $82.6 billion, according to CoinShares’ latest weekly report. cryptokoin.com As we reported, this figure remains slightly below the peak of $86 billion reached at the beginning of November 2021.

The United States emerged as the dominant power, generating net inflows of US$1.88 billion. However, this enthusiasm has been tempered somewhat by outflows from established players such as Grayscale, whose Bitcoin ETF recorded outflows of US$1.46 billion. This negative trend was offset by the arrival of new issuers, which contributed to total inflows of US$3.2 billion during the same period.

Bitcoin is at the forefront

Surprisingly, 94% of the total inflows of $1.72 billion went directly to Bitcoin. This overwhelming preference for the world’s leading cryptocurrency underscores investors’ confidence in its long-term value proposition. Interestingly, recent price swings appear to have emboldened short sellers, who have doubled down on their bets, with an additional $22 million flowing into short bitcoin investment products.

On the other hand, although not as dominant as Bitcoin, Ethereum experienced its biggest weekly inflow since mid-July 2022, attracting $85 million. However, AuM remains significantly below its peak of $23.7 billion, currently at $14.6 billion.

What is the situation with other altcoins?

The report also revealed contrasting trends among other prominent altcoins. Polygon saw a positive inflow of $7.6 million, representing 22% of its AuM. In contrast, Solana experienced outflows totaling US$12 million, an indication of investor uncertainty regarding the project. As can be seen below, there were also entries in Litecoin, BNB, Cardano, XRP, Chainlink.

Overall, CoinShares’ report paints a picture of a resurgent cryptocurrency market, especially for Bitcoin. Despite the presence of short sellers, significant inflows and record trading volumes indicate a healthy level of investor optimism and potentially signal the beginning of a new bull run in the crypto asset space.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.