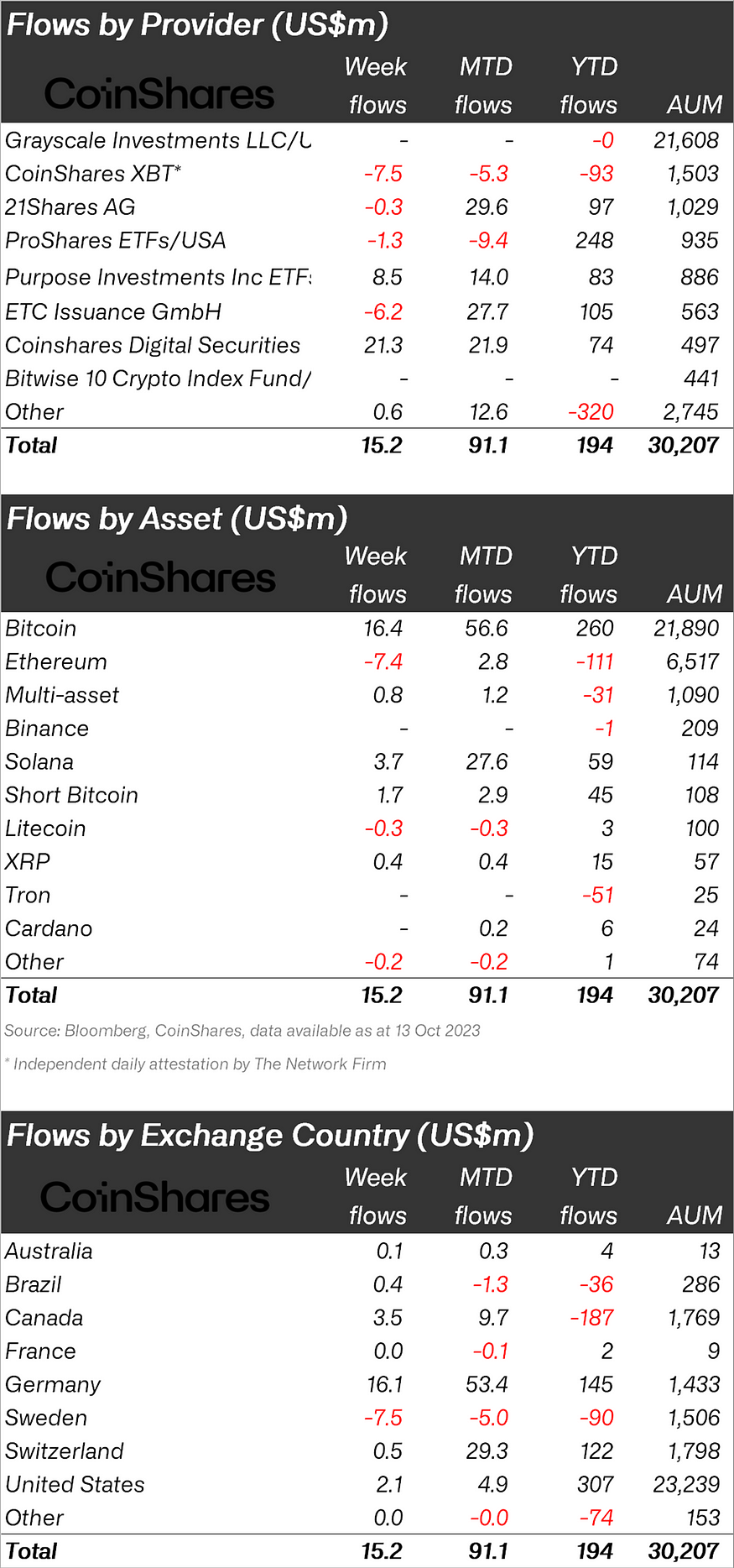

Digital asset investment products, led by Ethereum and Bitcoin, showed resilience, with inflows totaling $15 million for the third week in a row. The market remains turbulent. On the other hand, these consistent inflows are a positive sign for the cryptocurrency investment industry. However, transaction volumes are still 27% behind the 2023 average.

Bitcoin dominates inflows

Institutional investors selling Ethereum continue to flock to Bitcoin. Accordingly, Bitcoin continues to attract significant investments with an inflow of $16 million last week. This brings year-to-date inflows for Bitcoin to $260 million. Additionally, short-focused Bitcoin products also saw inflows of $1.7 million during the same period.

On the other hand, the fortunes of altcoins are mixed for institutional investors selling Ethereum. Accordingly, among the altcoins, Tezos, Litecoin and Chainlink experienced a total outflow of $ 0.25 million, $ 0.28 million and $ 0.31 million, respectively. These outflows reflect some investor caution in the altcoin market. However, XRP showed a modest inflow of $0.42 million. This marked the 25th consecutive week of positive investment sentiment for XRP. These consistent entries are especially considered in light of recent legal challenges against the SEC. This indicates strong support within the investor community.

Ethereum’s lackluster performance

Unlike Bitcoin’s success, Ethereum could not achieve the same success. Despite the recent launch of a futures-based ETF, investor interest remains lukewarm. Ethereum saw an outflow of $7.5 million last week. Accordingly, it deleted most of the entries observed in the previous week. Protocol design concerns and other factors may be contributing to this lackluster performance. These outflows also point to a period in which investor preferences may change depending on the week. On the other hand, when we look at it regionally, there is a different situation. Accordingly, minimum entries into the USA continue. Additionally, Europe saw net inflows totaling $7 million last week. On the other hand, Sweden was the only country where outflows were seen.

As Kriptokoin.com, the cryptocurrency investment environment remains robust despite ongoing market fluctuations. There is steady support for XRP, along with ongoing investor interest in Bitcoin and select altcoins. Accordingly, this situation reveals the resilience of the sector. However, as can be seen in the example of Ethereum, the mixed performance of the sector attracts attention. All of this underscores the importance of being knowledgeable and cautious when navigating the cryptocurrency market.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.