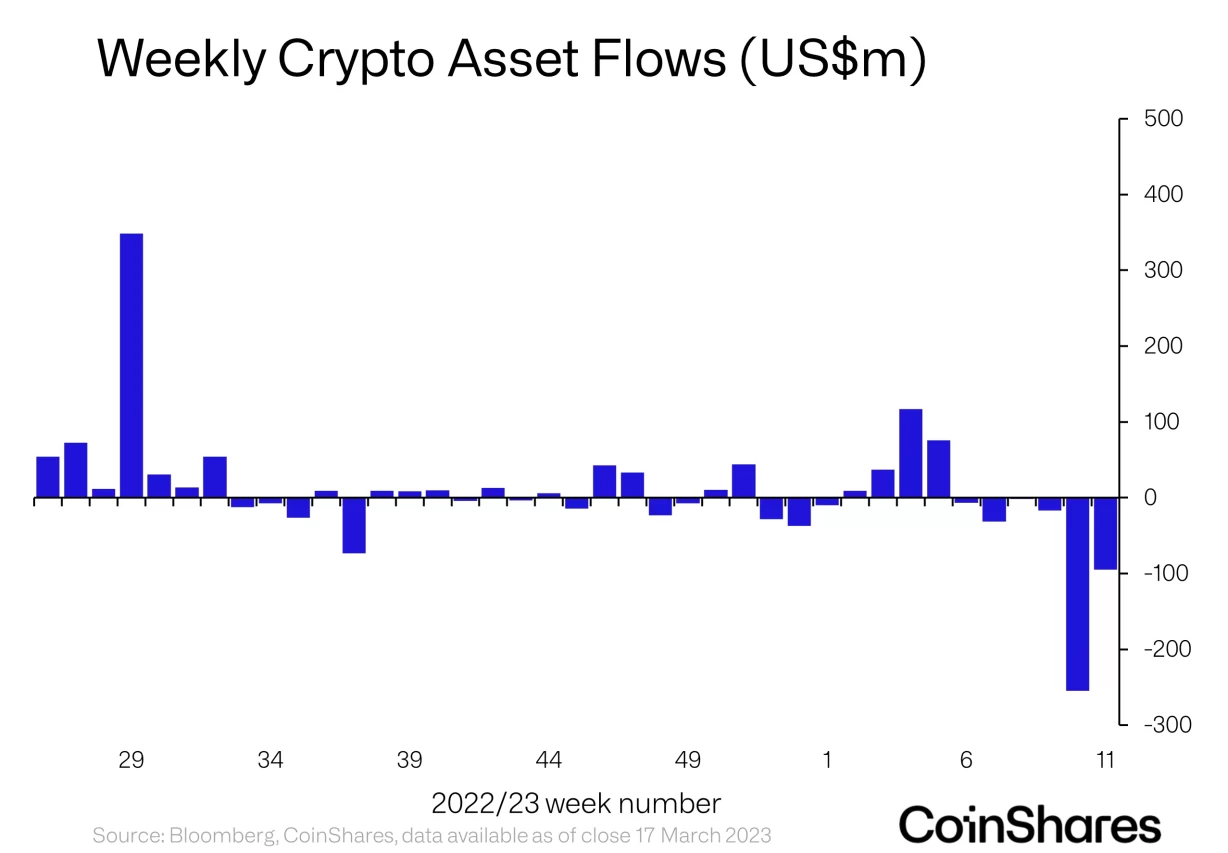

digital asset management company CoinSharesfound that institutional crypto investment products experienced their sixth consecutive week exits last week.

CoinShares, in its latest “Digital Wealth Fund Flows Weekly Report,” corporate cryptocurrency He found that investment products had an outflow of about $95 million last week, despite the rally in the market.

Digital asset investment products posted a total of $95 million outflows for the sixth consecutive week, with a five-week total of $406 million, representing 1.2% of total assets under management (AuM).

Koinfinans.com As we reported, CoinShares suggests that sales by institutions may be due to a need for liquidity rather than a bearish market outlook.

The exits are in stark contrast to the overall market, showing that this is partly due to the need for liquidity rather than negative sentiment.

NEWS CONTINUES BELOW

bitcoin (BTC) products were hit hard with an exit of $112.8 million, while entries were seen in short BTC products.

On the other hand, AuM has dropped 13% over the same period, despite a record $35 million total inflow to Short-bitcoin last week. It is clear that this sentiment is contrary to the rest of the crypto market. But partly this may be due to the need for liquidity during the banking crisis, something similar to what was seen in March 2020 when the COVID panic first hit.

Altcoins‘s similarly painted a mixed picture. Solana (SOL), Litecoin (LTC) and Polygon (MATIC) all experienced $0.2 million inflows, respectively, with the exception of Ethereum (ETH) topping $12.7 million. XRP products, on the other hand, experienced an inflow of $ 0.4 million.

You can follow the current price action here.