The Central Bank of the Republic of Turkey announced the interest rate decision, which directly affects the dollar rate and inflation, with a delay of 5 minutes due to the problem of accessing the website. While the dollar rate saw its historical peak, economists commented on the effect of this decision.

We are in a period where the dollar – TL exchange rate breaks its own record every day, the products in the markets go up every month, and the price hikes in invoices and fuel are not on the agenda. Although the share of TRT in the bills was withdrawn and the hikes in fuel were deducted from the SCT, the economy has now become the number one agenda item for all of us.

As a technology-oriented medium, we are not used to giving economic news, but we try to convey the results that seriously affect our lives, from the food we buy to the technological products, as much as we can. Central Bank’s interest rate decisions and their its effect on the dollar, inflation, that is, our lives. is one of these topics.

The dollar – TL parity, which skyrocketed with the effect of the interest rate cut from 18% to 16% in October, peaked on November 18, when the interest rate was lowered to 15%. Economists made statements on Twitter about this decision and its effects.

Mahfi Eğilmez commented on the uncertainty before the decision and shared the message “Get well soon” when the decision was announced:

In addition, Eğilmez summarizes the issue from the following point of view in his article “The Reasons for the Depreciation of TL” published on his personal website:

“Interest rate is the result of inflation, not the cause. The reason for inflation is the risk increases in the economy. These range from the budget deficit to the current account deficit, the wrong economic policy followed, the risk-increasing discourses and statements, the backward moves in social and political life, the relations with neighbors and other countries, and the developments in foreign policy. It covers many reasons. The increase in risks distorts expectations in the economy.”

“This deterioration distorts the expectations of domestic investors as well as the expectations of foreign investors. As a result of these deteriorations, the TL depreciates. The depreciation of the TL increases the costs of imported inputs and the TL equivalent of foreign debts, raising the production costs. This in turn leads to higher prices and inflation.”

Özgür Demirtaş, emphasizing that the interest rate should not be lowered before the decision by saying “People don’t get sleepy”; congratulated Hungary for raising interest rates:

Along with Hungary, interest rates were also increased in Asian countries.

Istanbul Chamber of Commerce President Şekib Avdagic emphasized that the main issue is not the interest rate decision but “uncertainty”:

In addition, Reuters did not conduct a survey for forecasts before the interest rate decision for the first time, and cited “uncertainty” as a reason, just like Avdagic.

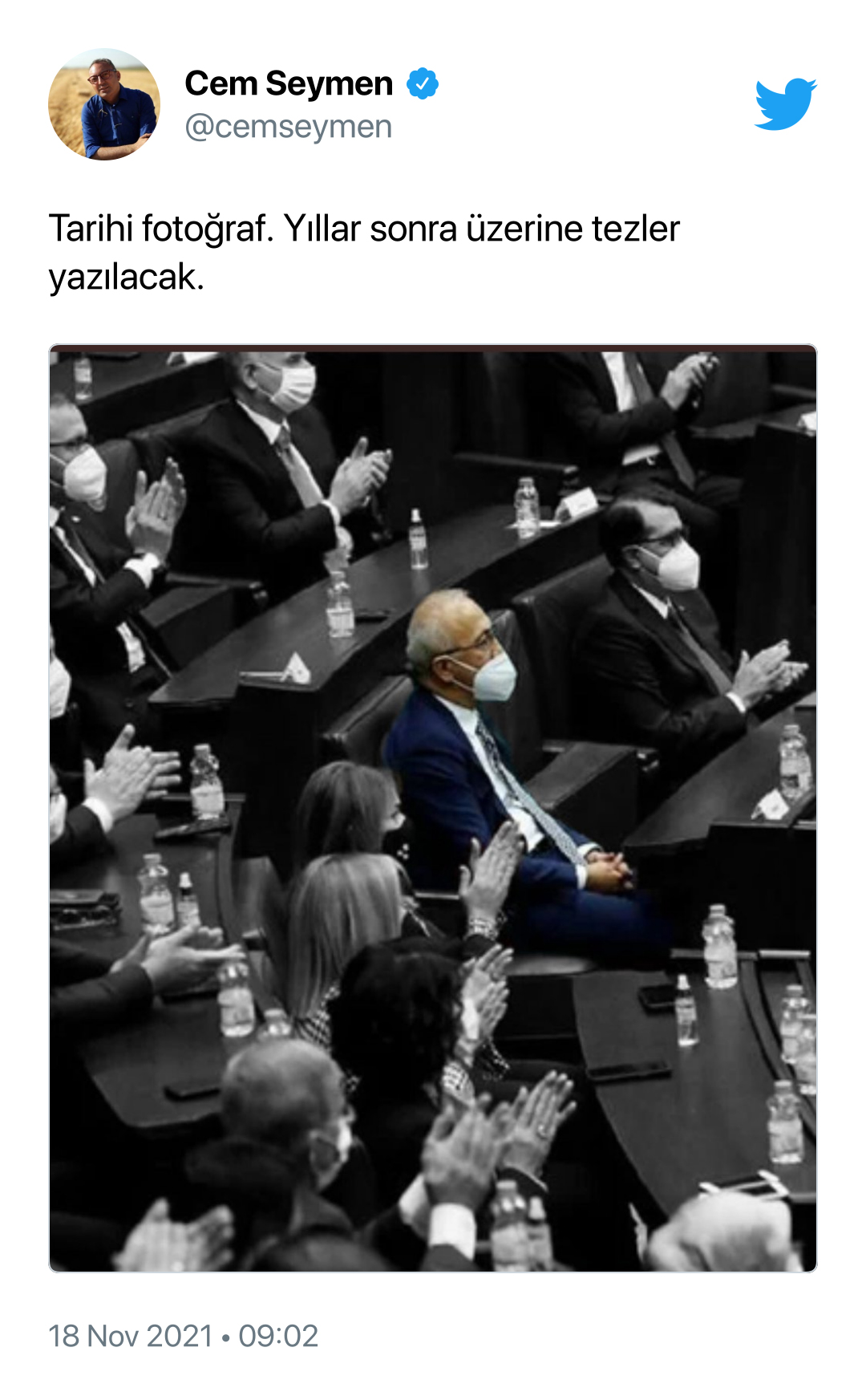

Journalist and Economist Cem Seymen shared the following photo taken during President Erdogan’s announcement of interest rates on November 17, before the decision was announced:

In this photo taken during the President’s statements, it is seen that Finance Minister Lütfi Elvan is not applauding. As a matter of fact, these comments and inferences were criticized by Economist Ümit Akçay. Erdogan gave the first signals that interest rates would be lowered on November 17.

Economist Ümit Akçay approached the issue as follows:

According to Akçay, “Still the ships have not been burned”: