According to ING Commodity Strategist Ewa Manthey, gold prices will continue to see all-time highs in 2024 due to the weakening US dollar and the effect of the Fed’s interest rate cuts.

Gold prices will remain above 2 thousand dollars in 2024

Ewa Manthey wrote an article for the Dutch banking giant on Monday. The strategist said, “Demand for safe haven assets increased in the last quarter of the year. Additionally, there are bets that the Fed will cut interest rates next year. That’s why gold prices rose,” he said. In this context, Manthey made the following assessment:

Even as concerns about a broader conflict in the Middle East have eased, gold hit a new record high in early December, supported by a softer US dollar and US Treasury yields on the US interest rate outlook. As the global rush on gold continues, we expect prices to remain above the $2,000 level next year.

This will support gold’s rise!

Despite its strong safe-haven bid, the Fed remains the single biggest driver for gold prices, Manthey says. According to the strategist, Fed policy will continue to play a key role in gold’s outlook in the coming months. Manthey states that the strength of the dollar and historically high interest rates put pressure on gold. Based on this, the strategist makes the following comment:

The latest US data showed inflation and the labor market are cooling. Additionally, markets are now pricing the probability of a rate cut in March at 50% and the possibility of a full cut in May. Our US economist expects the starting point of Fed interest rate cuts to be May and predicts a total interest rate cut of 150bp next year and another 100bp in early 2025. This will support the rise of gold.

Total assets in gold-backed ETFs continued to decline

But not everything supports gold. Because some areas of gold demand are still lagging, especially ETFs, which continue to record outflows. Manthey shares his assessment:

Total assets in bullion-backed ETFs have continued to decline this year despite rising spot prices. Outflows from global gold ETFs continued in October, but at a slower pace compared to September. Year-to-date, global outflows totaled $13 billion. This corresponds to a decrease of 225 tons in assets.

He said World Gold Council (WGC) data shows that the lion’s share of these outflows come from European and North American funds, while investment demand in other parts of the world is stronger.

There’s still plenty of room for them to pull the gold up!

“Looking ahead to 2024, we believe we will see a revival of investor interest in the precious metal and a return to net inflows as gold prices rise as U.S. interest rates fall,” says Manthey. But other areas of the market have already changed. Manthey makes the following statement:

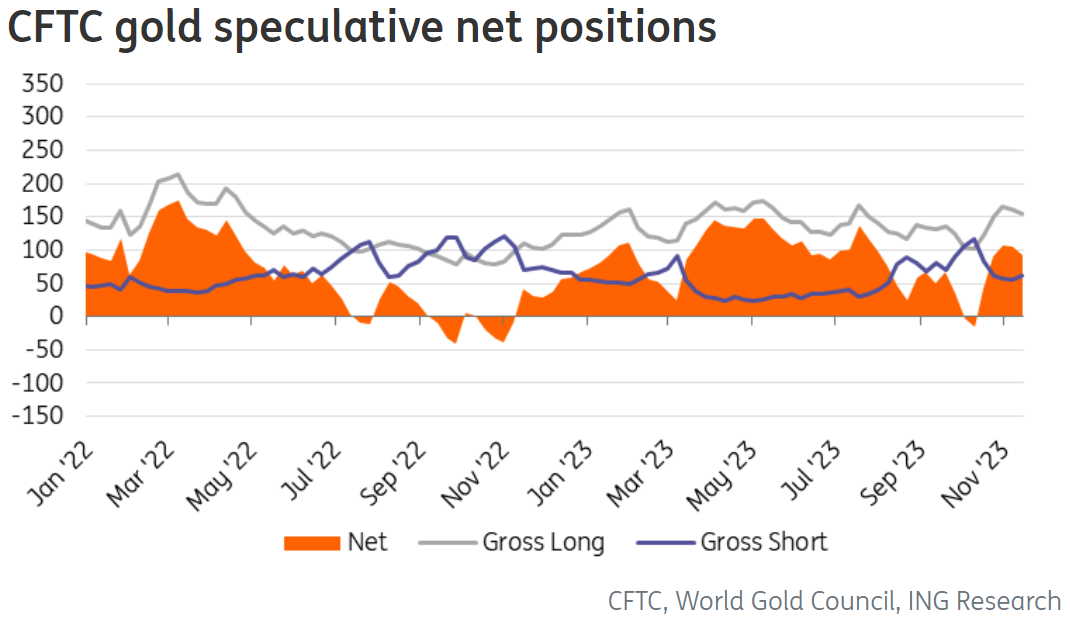

Net-long positions, reflecting sentiment in the gold market, turned positive in the second half of October as spot prices rose with the outbreak of the Israel-Hamas conflict. COMEX net-long positions were up 137% in the previous month through Oct. 29, boosted by a rise in geopolitical concerns. Compared to positioning in 2019 and 2020, overall positions in 2023 appear neutral. This shows that there is still plenty of room for speculators to push gold prices even higher by increasing their net long positions in 2024.

ING’s average price prediction for gold in 2024: $2,031

All these factors contribute to ING’s view that gold will continue its rise, reaching an all-time high in 2024, and the average price of gold will remain above $2,000 throughout the year. Manthey makes the following assessment:

Assuming that the Fed will start reducing interest rates in the second quarter of next year, the dollar will weaken, the safe haven demand will continue due to global economic uncertainty and central bank purchases will remain at high levels, gold prices will reach new peaks next year and the average will be 2,100 dollars in the 4th quarter, the 2024 average We expect it to be $2,031.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!