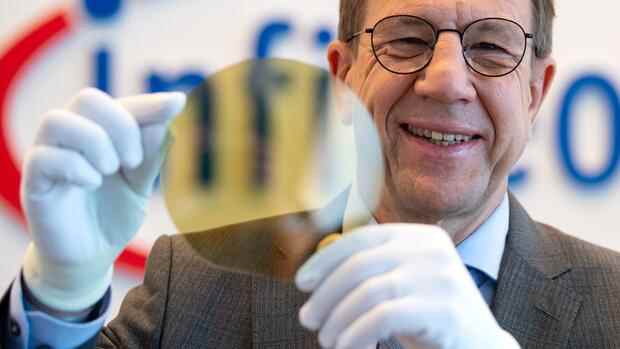

The Infineon boss presented the quarterly figures for the last time this Thursday. At the end of March, the manager will stop after almost ten years at the helm of the chip group.

(Photo: dpa)

Munich All’s well that ends well: After almost ten years at the helm of Infineon, Reinhard Ploss says goodbye with very good figures. The Dax group announced on Thursday that sales in the past quarter had increased by 20 percent to around 3.2 billion euros. The bottom line was a profit of 457 million euros, 79 percent more than in the same period last year.

The operating margin was 22.7 percent. Germany’s largest chip manufacturer has thus slightly exceeded its own forecast.

“Demand for our products and solutions continues to be very high,” said Ploss. The capacities are heavily utilized, Infineon is expanding them step by step. The ability to deliver products that Infineon manufactures itself will increase over the course of the year.

Overall, however, the demand for semiconductors is still significantly higher than the supply. Customers therefore need a lot of patience. Ploss: “We expect that the delivery situation in some application areas will remain tense well into the calendar year.” Above all, there is a lack of chips that Infineon purchases from contract manufacturers, so-called foundries such as TSMC from Taiwan.

Top jobs of the day

Find the best jobs now and

be notified by email.

The 66-year-old Ploss gives up the post on March 31st. Jochen Hanebeck then takes over for him.

Infineon’s Chief Production Officer will become the new CEO on April 1st.

(Photo: Reuters)

The previous production director need not worry about the business, on the contrary: things are going up even faster than expected. Ploss raised the forecast for the current financial year, which ends on September 30th. The group now expects sales of 13 billion euros, which is 300 million more than previously expected. The operating margin is expected to increase to 22 percent, one percentage point more than in the old plan. Infineon has not been this profitable for a long time.

The Infineon rivals are increasing massively

Not only Infineon is growing strongly, the entire industry is booming. The digitization of everyday life and electromobility ensure record sales for the corporations.

>> Read here: Billions for chips: How the EU wants to bring modern semiconductor factories to Europe

Infineon’s closest rivals have also presented convincing results in the past few days. NXP’s sales increased by a good fifth in the fourth quarter, and profits almost doubled. The group from Eindhoven is number two behind Infineon in the business with car chips.

For the current quarter, NXP CEO Kurt Sievers is again forecasting a sales increase of around 20 percent compared to the previous year. According to the manager, there is no end in sight to the boom: “In my daily dealings with customers, I see that they have an incredible appetite for more products.”

>> Read here: Chip supplier ASML: Europe’s most valuable tech group is struggling with the flood of orders

At the Italian-French competitor STMicroelectronics, revenues in the most recent quarter are up ten percent and profits are up 29 percent. Between January and the end of March, revenues are expected to increase by around 20 percent compared to the previous year. The upward trend should continue throughout the year, believes CEO Jean-Marc Chery. In order to process the orders more quickly, the head of the group wants to invest around half more this year than in 2021. More than three billion euros are to flow into new buildings and factory expansions. “But this additional capacity has already been fully booked,” said the Frenchman.

Infineon is sticking to the investments of EUR 2.4 billion planned for the current fiscal year. The focus is on expanding the factories “in order to be able to continue to serve the expected growth in demand from our customers in the medium term”.

More: Takeover thriller about Siltronic: Habeck’s Ministry of Economics lets the deal burst