Matrixport considered listing spot Bitcoin ETFs in Hong Kong through its Southbound Stock Connect program. Mainland Chinese investors could pour $25 billion into potential spot Bitcoin ETF products, according to Matrixport. Meanwhile, Chinese funds have reportedly applied to issue ETFs through their Hong Kong subsidiaries.

Matrixport: Hong Kong’s spot Bitcoin ETF approval will attract serious funding!

Hong Kong is one of the world’s leading financial centers and China’s outward investment gateway. According to recent news, Hong Kong is set to approve a spot Bitcoin ETF tied to Bitcoin (BTC). According to Singapore-based crypto services provider Matrixport, it could raise up to $25 billion from Chinese investors through its investment vehicle Southbound Stock Connect program. Southbound Stock Connect allows qualified mainland Chinese investors to access eligible shares listed in Hong Kong. In a report published on Friday, Matrixport included the following assessment:

A possible approval of spot Bitcoin ETFs listed in Hong Kong could attract several billion dollars in capital as mainland investors take advantage of the Southbound Connect program, which facilitates up to RMB 500 billion in transactions annually. Based on potential available capacity, this could result in HK$200 billion or US$25 billion in available capacity for HK Bitcoin ETFs.

What is Matrixport’s prediction based on?

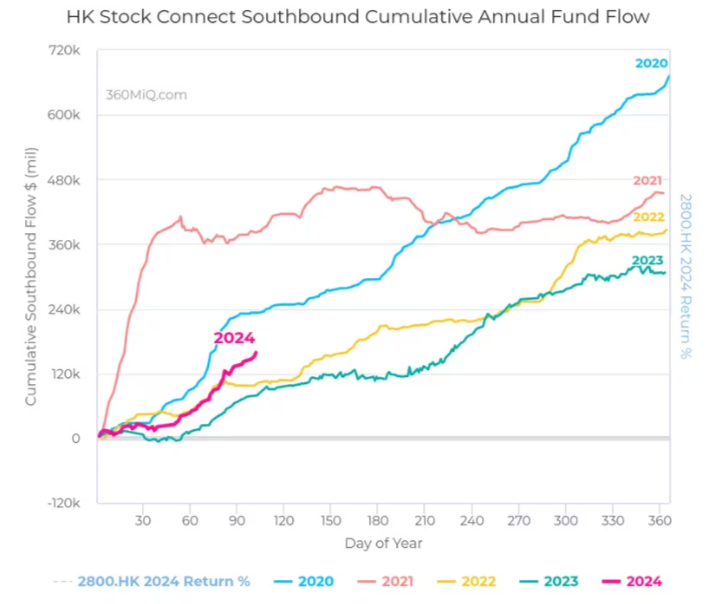

The forecast is based on the blue-sky assumption that the average amount of unused annual Southern Link quota over the past three years will be channeled into spot ETFs. The Stock Connect program allows mainland Chinese investors to buy Chinese stocks worth HK$540 billion annually. But according to data source 360MarketIQ, flows in the past three years amounted to HK$450 billion, HK$400 billion and HK$320 billion. It was also HK$100 to 200 billion ($15 to $25 billion) below the limit. Matrixport makes the following statement:

Therefore, there remains a potential HK$100 billion to HK$200 billion in quota for Bitcoin ETF investment flows. If the approval occurs without any restrictions. HK$200 billion is equivalent to $25 billion.

Chinese investors are looking for alternatives!

However, it is not yet clear whether the upcoming spot ETFs will be available to mainland Chinese investors. However, mainland China is turning to alternative assets. The recent increase in gold prices in Shanghai is proof of this.

Meanwhile, China’s currency, the RMB, is at its lowest level in 17 years. On the other hand, the fact that the Central Bank of China continues to purchase gold shows that there is a demand for diversification. In Hong Kong, it is also notable that mainland funds are interested in issuing ETFs. Mainland-based funds are applying to issue spot Bitcoin ETF products through their Hong Kong subsidiaries. This means qualified mainland investors could potentially gain greater access to Bitcoin.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!