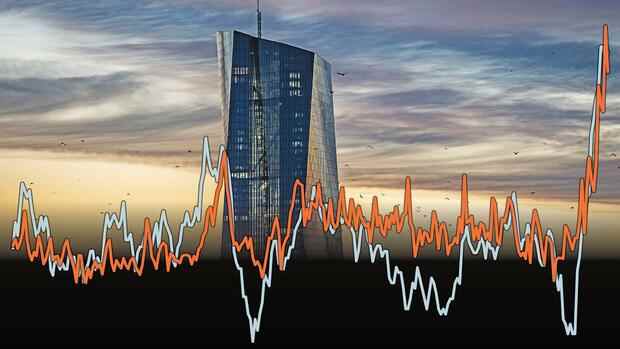

The new indicator can act as an early warning system: over the past 20 years, it has been very similar to inflation rates and often precedes them.

(Photo: dpa, Handelsblatt)

Berlin The I index for inflation presented on Wednesday has met with a positive response. As is well known, the economy is also determined by psychology, explained Federal Finance Minister Christian Lindner (FDP). “The new inflation index reflects this. This makes it an additional analysis tool,” Lindner told Handelsblatt.

Behind the I-Index is a joint project of the Technical University of Dortmund and the Handelsblatt. The “Dortmund Center for data-based Media Analysis” (DoCMA) has developed an early warning system for the development of inflation based on several million newspaper reports. Whether rising inflation rates will become entrenched will be largely determined by consumer and business expectations. Expectations are decisively influenced by the media.

The I index runs largely parallel to the official inflation rates and partly anticipates the development. In addition, the I-Index indicates which causes of inflation determine how much media coverage and thus have a significant impact on the inflation expectations of consumers and companies.

More about the I-Index:

Top jobs of the day

Find the best jobs now and

be notified by email.

The I-Index is not the first attempt to learn more about economic developments from newspaper reports. In the early 2000s, The Economist introduced the R-Word Index. This counted the term recession in reports in American daily newspapers.

Influence on political work

However, the new I-Index does not just look for “inflation”. Rather, algorithms filter for related terms, creating links and forming clusters that can determine inflation narratives.

Economists therefore largely rate the I-Index as a helpful tool that could be incorporated into the strategy of ministries and central banks. “It can be assumed that the ECB and other actors will adapt communication strategies with regard to the I-Index as soon as it is properly established,” says Lars Feld, President of the Freiburg Eucken Institute.

And Gunther Schnabl, head of the Institute for Economic Policy in Leipzig, says: “Every new aspect – including the I-Index – is helpful to get a more comprehensive picture of inflation expectations in the euro area.”

At the same time, there are suggestions as to how the I-Index can be expanded to gather further insights. “New insights from the index would probably result if you examined it for different countries,” says Ifo President Clemens Fuest. So far, however, the I-Index has only referred to German newspaper articles.

An example: When it comes to the causes of inflation, the I-Index has placed central banks at the top of the list by a wide margin over the past few months, although inflation was driven by more expensive raw materials and energy during this period. Evaluating the I-Index in different countries and languages ”could lead to significantly different results with regard to the causes,” explains Carsten Brzeski, chief economist at ING Germany.

For years, Germans have been said to be particularly skeptical about the European Central Bank (ECB). An I index evaluated in several countries could show whether this is actually the case. If not, the central bank might have to fundamentally change something in its communication.

The I-Index cannot do that yet, says economist Schnabl. Unlike the I index, monetary policy is designed for the entire euro area. However, the DoCMA researchers have already announced that they intend to expand the I index. In addition to other countries, the inclusion of other sources, such as social media, is also conceivable.

More: The I-Index – the new measurement of inflation