Monday, spot Bitcoin ETF ‘s made a strong start to the week by recording an entry of $520 million. This massive entry caused the bulls to go super bullish on Bitcoin, pushing the BTC price past the $57,000 level. It was stated that the supply shock that would occur before Bitcoin’s halving could cause BTC to exceed 55 thousand dollars in a short time.

Spot Bitcoin ETFs Record $520 Million in Net Inflows

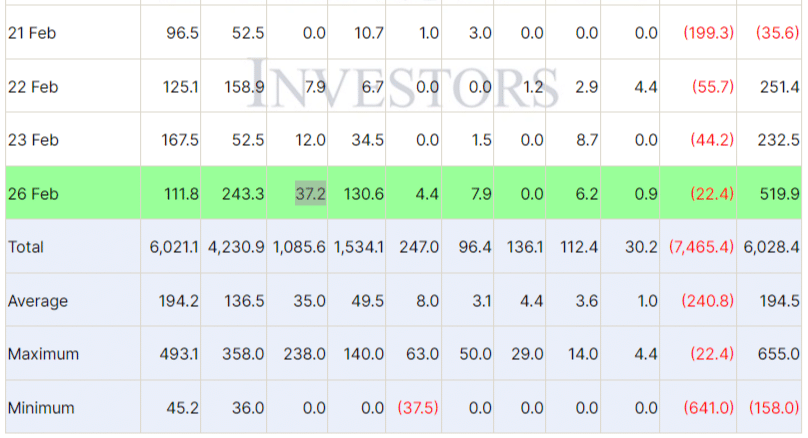

Spot Bitcoin exchange-traded funds (ETFs) recorded a net inflow of $520 million on February 26, according to data from Farside. Nearly nine spot Bitcoin ETFs experienced a massive inflow altogether, and Grayscale’s GBTC experienced another decline in Bitcoin outflows. This indicates strong bullish sentiment among retail and institutional investors.

BlackRock (IBIT) exceeded $111.8 million with a record inflow, bringing the net inflow to $6 billion. BlackRock’s Bitcoin ETF currently has around $7 billion in assets. However, the Fidelity Bitcoin ETF was the most notable performer of the day.

Fidelity (FBTC) and Ark 21Shares (ARKB) Bitcoin ETF saw inflows of $243.3 million and $130.6 million, respectively. Bitwise (BITB), VanEck (HODL) and others also recorded significant entries in the uptrend.

Moreover, GBTC experienced an outflow of $51.8 million on Friday. However, this is in line with last week’s trend. Bloomberg ETF analyst James Seyffart stated that this outflow was a record low for the fund. While the total volume exceeded $3.84 billion, net inflows reached over $55,000 in less than 30 minutes, exceeding the $57,000 level.

BTC Price Exceeds $57,000

FOMO is at its peak as the Crypto Fear and Greed Index rose from 72 on Sunday to 79 on Monday (at the Extreme Greed level). This is considered an extremely important moment, as traders’ interest in BTC is extremely high. Experts had predicted that the BTC price would reach $60,000 before bitcoin halved.

This rally comes after MicroStrategy announced the purchase of approximately 3,000 additional tokens this month. The company’s Bitcoin holdings reached 193,000 with this latest purchase.

BTC price jumped to a high market cap of $57,250, reaching 19.9% of the high of $68,600 set 27 months ago. The price is currently trading at $56.325 and is up over 10% in the last 24 hours. The 24-hour low and high were set at $50,931 and $56,728, respectively. Additionally, trading volume increased by a whopping 230% in the last 24 hours. This shows that the interest among traders is increasing.