In the third quarter of 2023, the crypto market, including KAVA, saw a significant increase in staking activities. While some networks lead the way in this regard, other cryptos offer a better staking return. Aptos and Sui emerged as the most staked altcoins based on the percentage of circulating supply locked.

Aptos, Sui and Solana are among the most staked

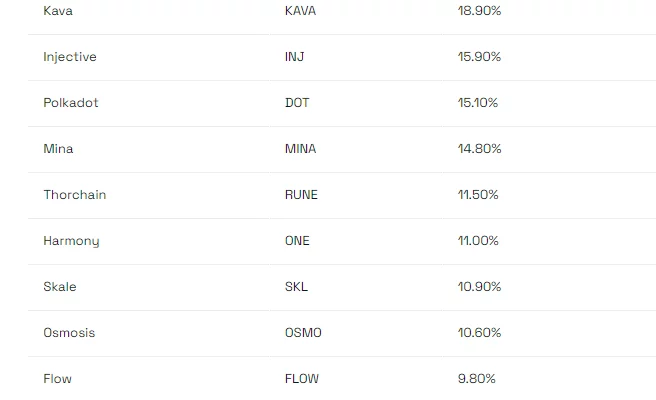

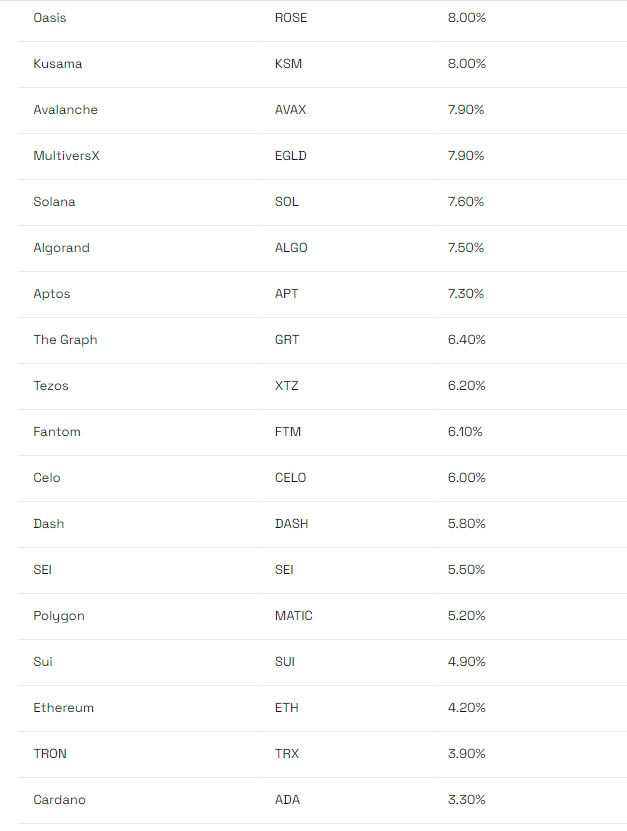

A new study has shed light on the average staking rate, which refers to the percentage of tokens staked on a given crypto network from the circulating supply. The report points out the average staking rate for the most staked KAVA and 34 altcoins. This shows that it reached an all-time high of 52.4% in the 3rd quarter of 2023. It also reveals that the figure is higher than the 49.3% level in the previous quarter. The two charts below show the staking returns of cryptocurrencies.

Staking, a process where coin holders participate in the functioning of a Proof-of-Stake (PoS) Blockchain by locking a certain amount of coins, has been praised for its ability to secure the network and deter malicious activity. The higher the stake rate, the more strengthened the network is against potential attacks. In the last quarter, Aptos and Sui staked 84.1% and 80.5% of their supply, respectively. Accordingly, it was at the top of the list. They were followed by Mina, Solana and Cosmos and KAVA.

Top 10 Cryptocurrencies offer staking returns below 7.5%

Despite the increase in staking rates, the report points to a situation in the average staking return. Accordingly, it recorded a slight decrease, decreasing by 0.4% to 10.2%. This continues the downward trend that began in March 2022, when the average return reached 15.4%. Among the top 10 cryptos by market cap, only Polkadot and Cosmos offered returns above 7.5%.

Ethereum has also seen an increase in staking activity, gaining a 79% share in the PoS sector. However, it is noteworthy that transaction activities are shifting from Ethereum’s main network to various Layer-2 networks. Accordingly, Ethereum’s lowest value on record is in question. It led to a 4.5% staking return in the third quarter.

KAVA and staked altcoins

The total value of staked altcoins also increased by 3% compared to the 2nd quarter of 2023, reaching a total of 73.5 billion dollars. On the other hand, annual rewards for stakers have experienced a decline. Accordingly, it decreased to 4.1 billion dollars. On the other hand, this figure means a decrease of 7% compared to the last quarter and 18% compared to the previous year.

Additionally, the market cap of the largest PoS altcoins fell by 7% to $254 billion. Despite this quarterly contraction, the year-over-year analysis reflects a stronger market. Additionally, when we look at Kriptokoin.com, cryptos, excluding stablecoins, indicate an increase of 10% to 40%.

To be informed about the latest developments, follow us Twitter’in,Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.