It is quite normal for you to want to know your bank debts and credit information for your future plans and current financial order. Many users wonder if e-Government bank debt is visible, the answer to this question is yes. Let’s take a closer look at how to make an e-Government bank debt inquiry and see what you need to do step by step.

Almost everyone nowadays has at least one bank account and one credit card. Borrowing through these accounts and cards is a burden we have to take in this economic system. Well, if we want to use new loans, wonder about our current financial situation and plan our future, we can use the internet. Is e-Government bank debt visible? Yes, this is possible with the e-Government bank debt inquiry process.

With the e-Government bank debt inquiry process, you can access the most up-to-date report prepared on your behalf by the Banks Association of Turkey. In addition to credit limit and debt information, it is possible to see the transactions you have made in the past in this report. It’s a simple process but if you haven’t done it before, come as it can be a bit complicated How to make an e-Government bank debt inquiry Let’s take a closer look and see the steps you need to follow.

How to make an e-Government bank debt inquiry? Here’s what you need to do step by step:

- Step #1: Open the e-Government website via the link here.

- Step #2: Log in with your e-Government account information.

- Step #3: Type Risk Center Report Application in the search bar and open the Banks Association of Turkey / Risk Center Report Application page from the search results.

- Step #4: Click on New Application, then Apply.

- Step #5: When you receive a password message on your phone, refresh the page and click the View Report button.

- Step #6: Enter the password and security code sent to your phone on the page that opens.

- Step #7: Re-enter the password you received on your phone.

- Step #8: You can see your information in the Risk Center Report tailored for you.

Step #1: Open the e-Government website:

As the first step of the e-Government bank debt inquiry process, you should open the e-Government website via your mobile internet browser or desktop internet browser. You can download this process to your mobile devices with iOS or Android operating systems from the App Store or Google Play Store. e-Government mobile application You can also do with

Step #2: Log in with your e-Government account information:

To continue the process after opening the e-Government website You must log in with your e-Government account information. If you do not have an e-Government account, you can create an account by following the steps we explained in our article here.

Step #3: Type Risk Center Report Application in the search bar and open the Banks Association of Turkey / Risk Center Report Application page from the search results:

After logging into the e-Government platform using your account information, you will perform the e-Government bank debt inquiry process. to reach the page in the easiest way. Type Risk Center Report Application in the search bar and search. Among the results, click on the Banks Association of Turkey / Risk Center Report Application option to scatter the page.

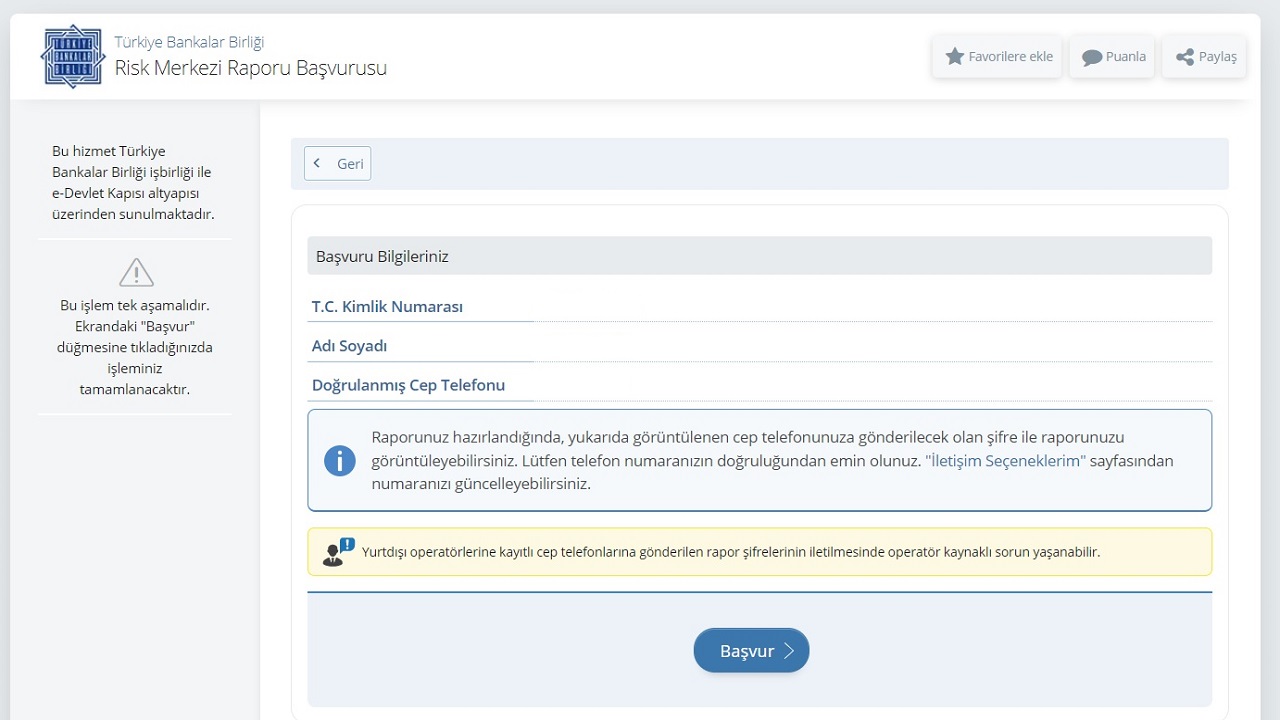

Step #4: Click on New Application, then Apply:

After you open the Banks Association of Turkey / Risk Center Report Application page, an informative text will appear. After reading this text Click on the New Application button in the upper right corner of the screen. Continue the e-Government bank debt inquiry process by clicking the Application button at the bottom of the new page that opens.

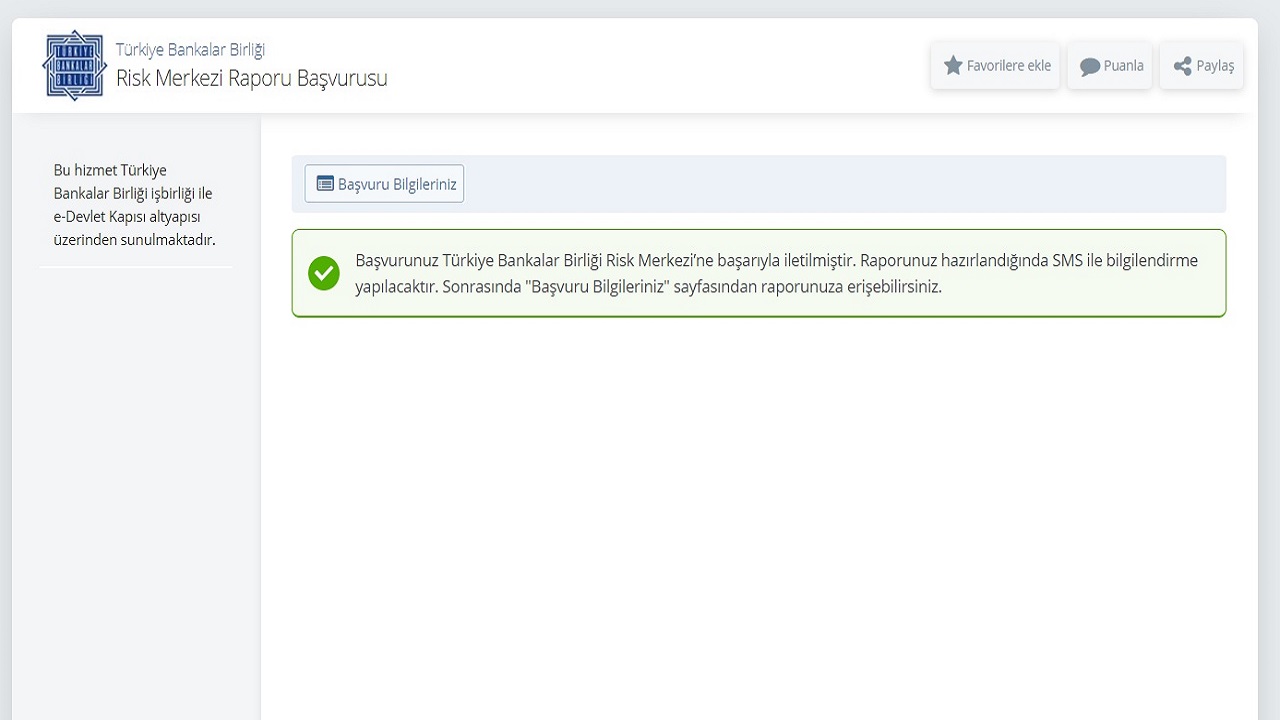

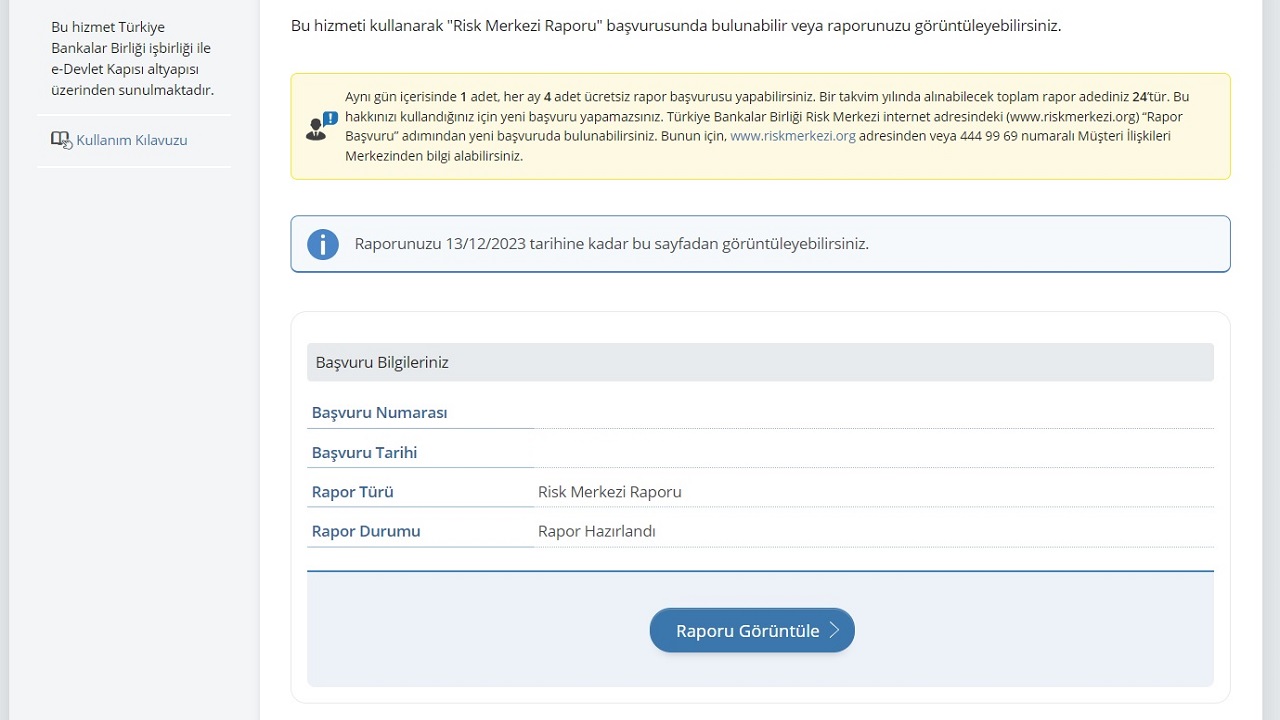

Step #5: When you receive the password message on your phone, refresh the page and click the View Report button:

After making the necessary application on the Banks Association of Turkey / Risk Center Report Application page after a period of time that varies according to the system density. A password will be sent to your mobile phone to access the report. If you have received this password, your report is ready. Open the relevant page by refreshing the page or following the above steps again and continue the process by clicking the View Report button.

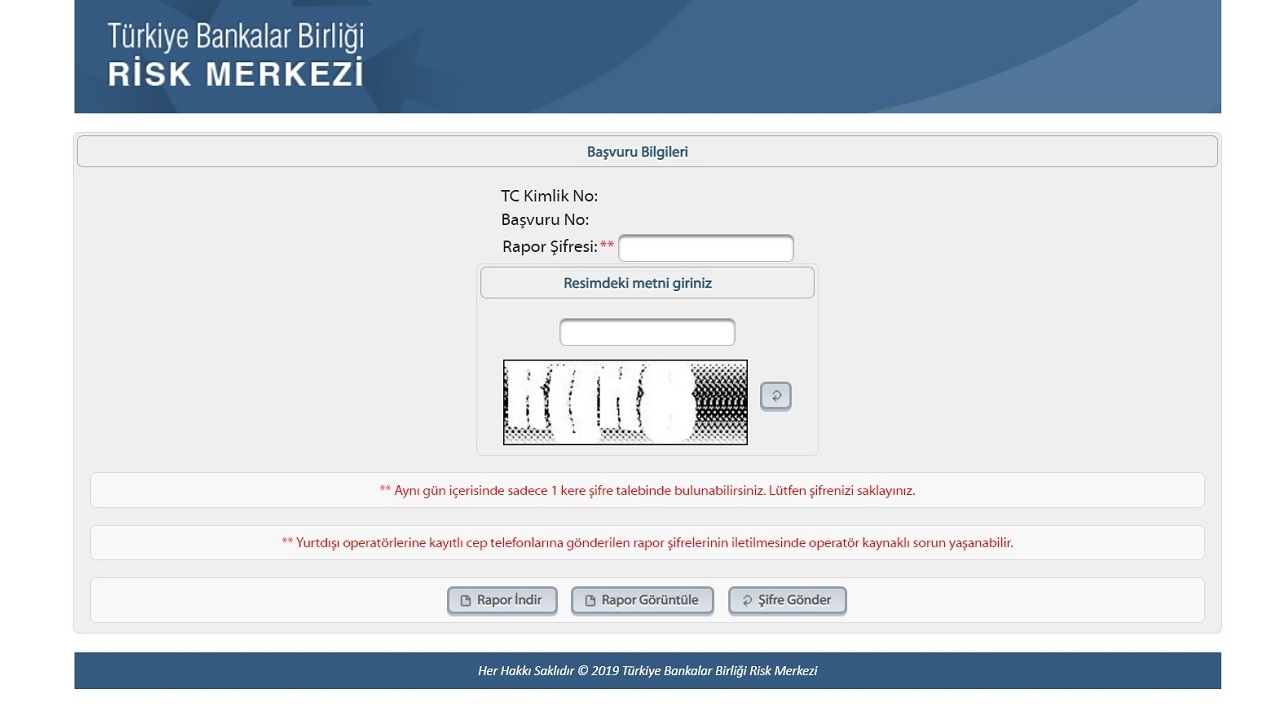

Step #6: Enter the password and security code that came to your phone on the page that opens:

After clicking the View Report button on the Banks Association of Turkey / Risk Center Report Application page, the system will prompt you. It will direct you to the interest page of the Banks Association of Turkey. Your TR ID number and application number will already be written on the page. In order to view the report, you need to enter the password sent via SMS on your mobile phone and the security code you see on the page.

Step #7: Re-enter the password you received on your phone:

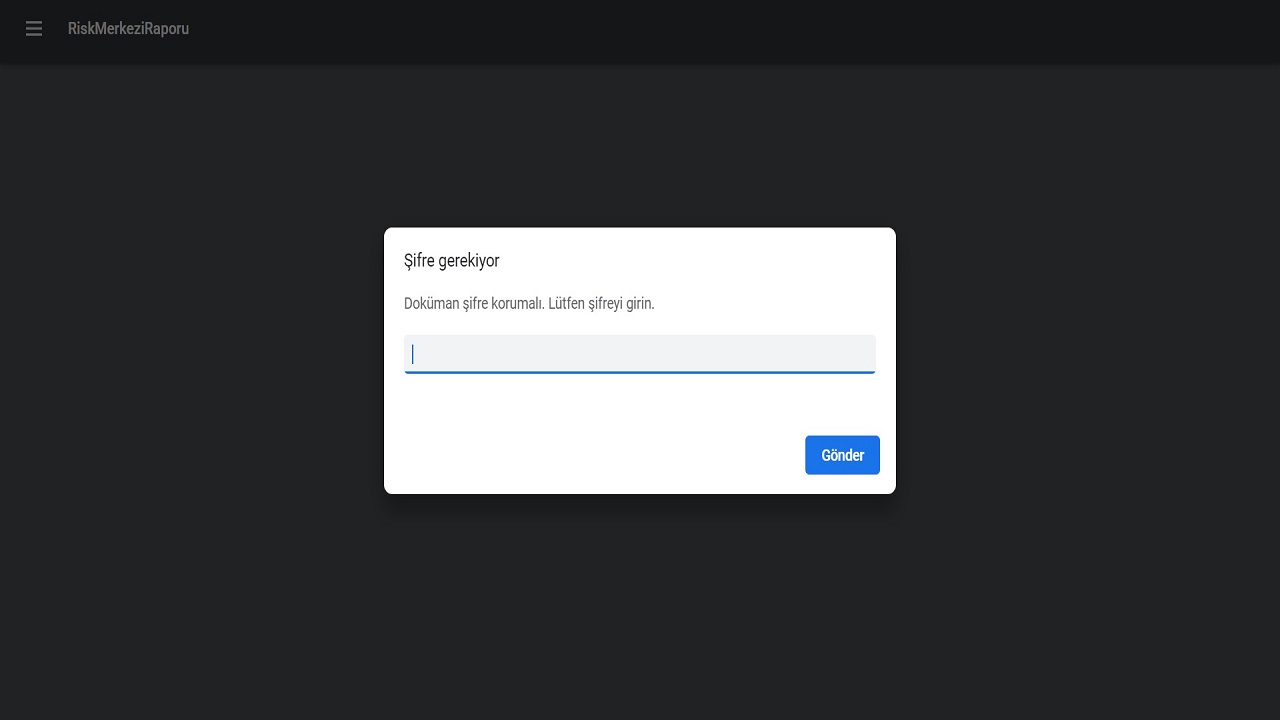

About the Risk Center Report, your bank account and credit card information you received after the e-Government bank debt inquiry process. Since it contains detailed information, it is protected with a password. You can view the report by re-entering the password sent to your mobile phone via SMS.

Step #8: You can see your information in the Tailored Risk Center Report:

After entering the last password, you can view your Risk Center Report prepared by the Banks Association of Turkey as you wish. In this report, your credit limit and debt information, credit summary, credit details, personal loan application information, tender information, promissory note information, check information, check ban and removal decision information. The information contained in the report is your most up-to-date information in the Banks Association of Turkey.

What you need to know about the e-Government bank debt inquiry process:

There are some details you need to know before making an e-Government bank debt inquiry on the Banks Association of Turkey / Risk Center Report Application page. From this report maximum 1 piece per day, In a month, you can create a maximum of 4 pieces. The maximum number of reports you can create in a calendar year is 24.

As you can imagine, the Risk Center Report is an official document and making changes to it is considered a crime. Information on personal loans, pertains to the day you created the report. Debts and credits in foreign currency are converted into Turkish lira at the Central Bank buying rate of the day before the report is issued and added to the report.

Once the Risk Center Report is created for you, it can be viewed repeatedly by following the steps above. It is also possible to download the report to any device you want. But remember, since it is a protected document, every time you want to open it, it asks you for the password sent to your mobile phone via SMS. So be careful not to delete the message in question.

Does e-Government bank debt appear? How to make an e-Government bank debt inquiry We have explained step by step details of the process you need to implement by answering frequently asked questions such as: If you encounter any problems in the Risk Center Report, you can contact your bank.