Nowadays, it is of great importance to carry out tax transactions easily and quickly. In Turkey, real persons and companies have a tax identification number (TIN) so that they can carry out their tax-related transactions smoothly. So, how to query tax number and why is learning tax number necessary?

This tax is allocated by the tax offices to each taxpayer, that is, to each individual and company liable to pay taxes. tax numberis a unique ID used in all tax-related transactions.

tax refunds, tax debt inquiry If you do not know how to query the tax number used in many transactions such as, we can take you to our detailed content.

What is a tax identification number?

Tax Identification Number (TIN)is a unique 10-digit number given to each taxpayer by the Revenue Administration of the Republic of Turkey and determining his tax identity.

Tax identification number for individuals, Turkish republic identification number It is the same as . It is specifically allocated for companies and other legal entities, and the tax transactions of the legal entity are carried out with this number.

Why is a tax identification number needed?

Natural and legal persons, real and legal persons who are the addressee or parties to these transactions during the performance of the works determined by the Ministry of Finance. tax identification number of legal entities and include the tax number in the documents and records related to these transactions.

If you do not have a tax identification number, these transactions cannot be made. getting a tax identification number obligation arises.

Where are institutions and organizations using tax identification numbers?

- Tax debt inquiry

- tax payments

- tax returns

- Tax refund requests

- Monitoring taxpayers’ activities

- Inspections carried out by the tax office

- In invoice arrangements

- Notary transactions

- In title deed transactions

- In follow-up procedures to be carried out in accordance with the Execution and Bankruptcy Law

- In registration procedures to be carried out in accordance with the Highway Traffic Law

- When using checks and promissory notes

- Opening a postal check account

- When purchasing a passport

- In all kinds of bonds, bills and debt securities transactions

- In credit card reading machine transactions

- In money transfer transactions

- In transactions to be carried out by institutions within the scope of the Capital Markets Law

- In money lending transactions

- In transactions made by private financial institutions

- In Mail Center operations

- In financial leasing transactions

- In insurance transactions

Tax number. How to query?

- Step #1: Open the Interactive Tax Office website from your browser.

- Step #2: Click on “User Login”.

- Step #3: Enter your TR ID Number, Tax ID Number or User Code and your password. If you wish, you can also log in with your e-Government password.

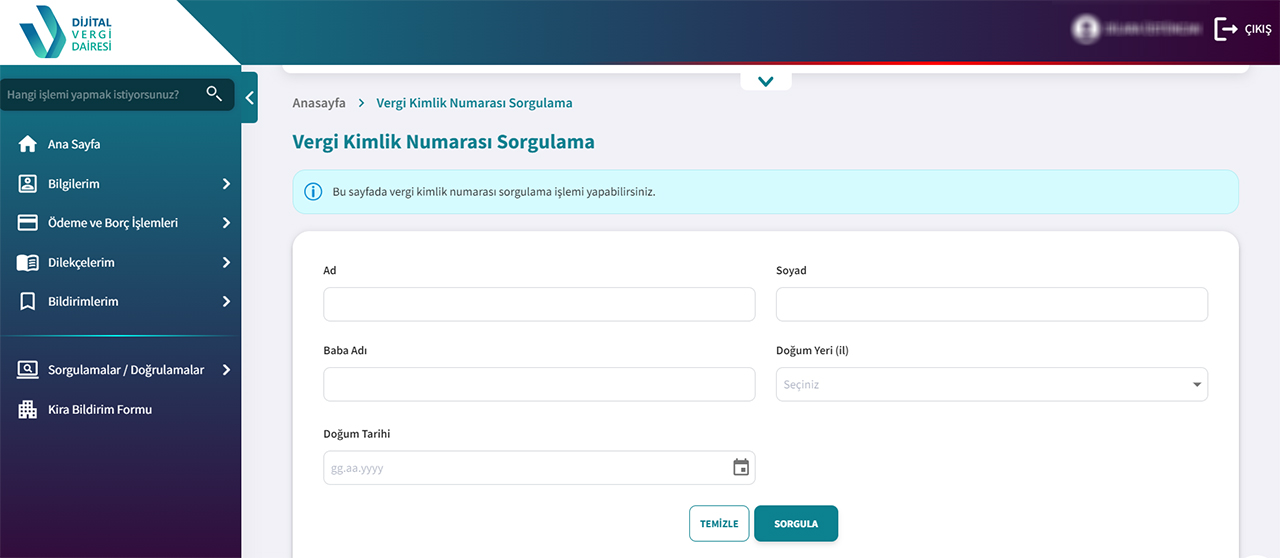

- Step #4: Click on the “Inquiries/Verifications” section on the left and select the “Tax Identification Number Inquiry” option in the first row.

- Step #5: Fill in the requested information and click on the “Inquiry” section.

Also via e-Government tax identification number. learning you can perform the operation. To do this, you must log in to e-Government and click the search button. “tax identification number verification” Just write. After the required authentication, you can directly access Step #2.

Do real persons have a tax identification number?

As of July 1, 2006, there is a separate application for natural persons. tax number Republic of Türkiye identification number started to be used instead. After the tax numbers before this date were matched with the TR ID numbers, natural persons could only write their eleven-digit TR ID number in documents that required a tax number.

In the transactions to be made by Turkish citizens who are settled abroad and have been living abroad for more than 6 months with a work or residence permit in their country. tax number. condition not wanted. All that is required is a photocopy of work or residence permit documents. If these are not available, a photocopy of your passport is required.

Do foreign nationals have a tax identification number?

Since TR ID numbers are not given to foreign nationals who are not Turkish citizens, these people do not have the ID numbers given to them by the tax offices. tax number consisting of ten digits They can use it.

How can foreign nationals obtain a tax identification number?

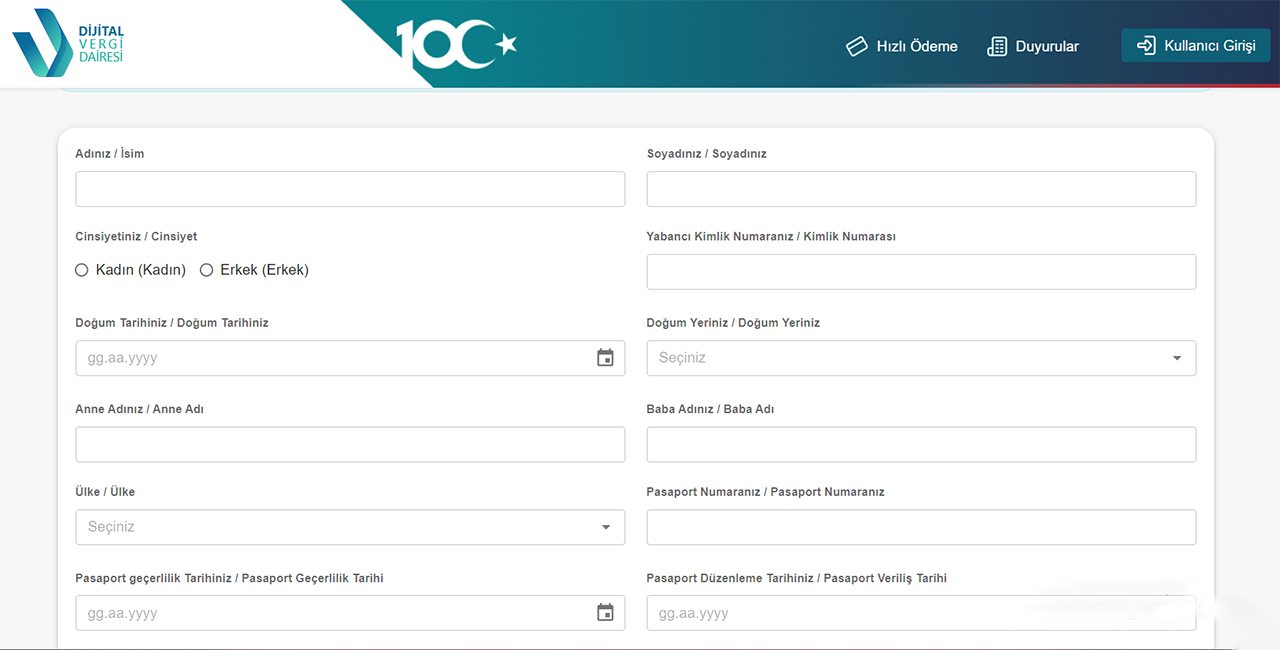

via Digital Tax Officeforeign nationals, tax identification number They can take it. To do this, just click on the link and fill in the required fields.

After all the information on the screen is filled in, it is necessary to click on the “Apply” button. Will be given to foreign nationals tax identification number, It is processed based on the passport number.

Our other content that you may wonder how it is done:

RELATED NEWS

How to Make a Title Deed Inquiry Online?

RELATED NEWS

How to Calculate Square Meters? We Explained Step by Step

RELATED NEWS

What is the ‘PNG Format’ Used for Transparent Background Images, What Does It Do, How Is It Done?

RELATED NEWS

How to Set Up a Modem from Scratch? Here’s What You Need to Know Step by Step

RELATED NEWS

What is ‘EFT’, one of the money transfer methods, and how is it done?

RELATED NEWS

How to Make MTV (Motor Vehicle Tax) Payment?

RELATED NEWS