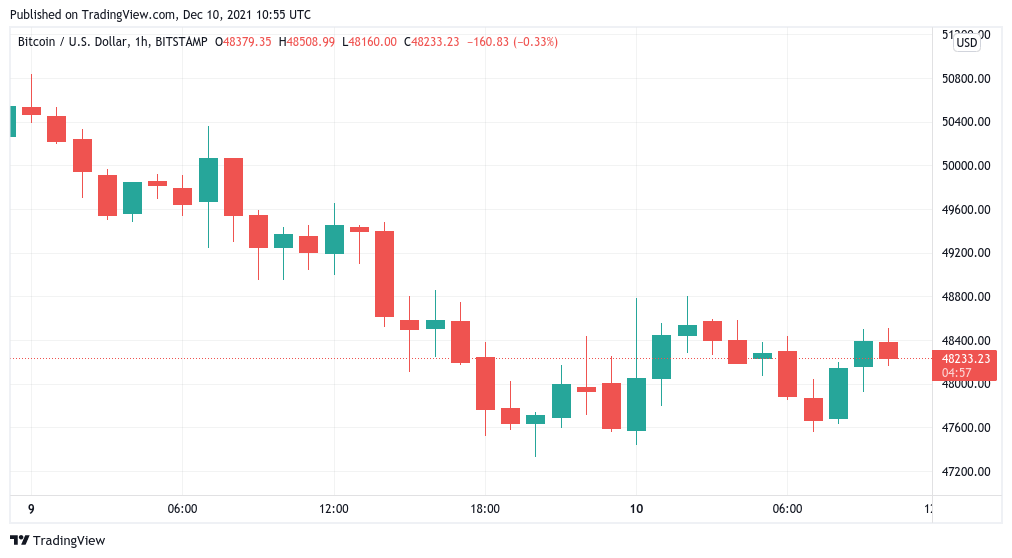

After the recent decline in the BTC/USD chart, it declined to $47,350, but as of this morning, it managed to rise above $48.000.

Data from TradingView showed the pair hovered around $48,300 at the time of writing as markets prepare for the November Consumer Price Index (CPI) reading.

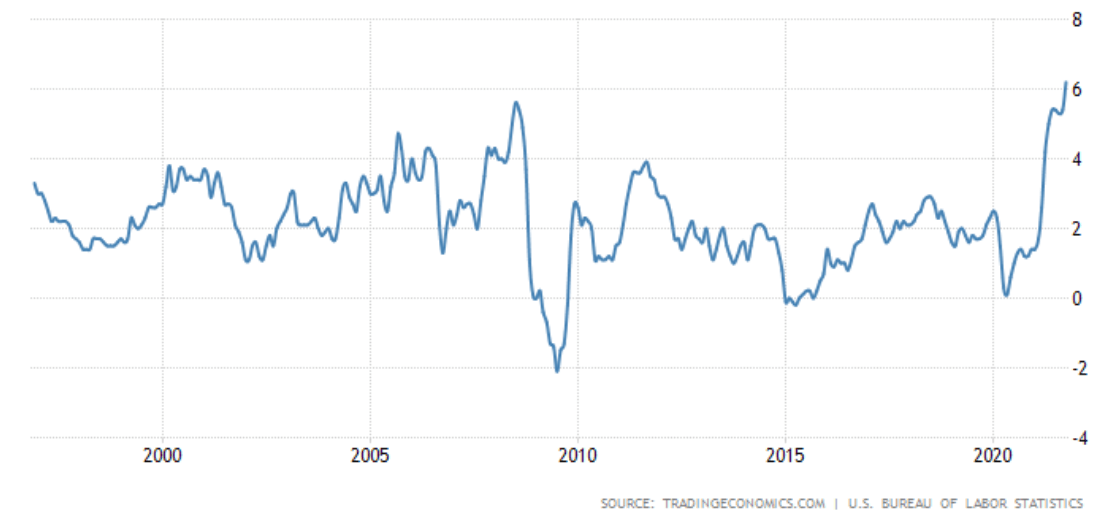

As Cointelegraph reported, economists predicted that this month’s annual inflation data would outpace October at 6.7% (6.8% according to the updated data).

While last month’s shocking CPI news led to an uptick among Bitcoin and crypto assets, there was caution among analysts ahead of Friday’s numbers.

Popular trader Pentoshi explained, “At this point, he thinks the CPI data is controversial.”

On the macro side, he added, the “real” potential market move should come next week, when the United States Federal Reserve gives indications of the Federal Open Market Committee’s policy on the central bank’s asset-reduction policy.

According to commentators, increasing the rate of contraction, reducing asset purchases will put pressure on risky assets, which will lead to poor performance for Bitcoin, he says. For Arthur Hayes, the former CEO of derivatives platform BitMEX, this will only reverse once the FED returns to “business as usual.”

“For those deciding whether to allocate more fiat to crypto, it’s worth waiting. I don’t see money getting any freer or easier. Therefore, after the Fed rate hike in March 2022 or June 2022, it would be useful to sit on the sidelines until things settle down.”

“Watch out for the festivity of vomiting in risky asset prices should the Fed rise, followed by a quick resumption of zero-interest rate policy and aggressive bond buying. When the Fed signals a return to business as usual, it’s time to back up the truck.”

“Watch out for the festivity of vomiting in risky asset prices should the Fed rise, followed by a quick resumption of zero-interest rate policy and aggressive bond buying. When the Fed signals a return to business as usual, it’s time to back up the truck.”

Such a forecast is linked to current mid-term forecasts for Bitcoin, which carries its cycle further in 2022, not this month as previously stated.

“Drops take time. Unfortunately they do. And we’re getting close to that with Bitcoin. After that, we will enter another great cycle in 2022. Everything is fine.”

He added that compared to 2017, the last post-halving bull run, Bitcoin is “probably” more towards the end of its peak phase than its end.

Meanwhile, the discrete data showing Bitcoin’s price action from 2017, which has been copied almost daily, is facing a major test this month.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.