Crypto analyst William Suberg notes that the lack of bullish momentum has left Bitcoin (BTC) reluctant this week as macro clouds gather on the horizon. At $37,900, even this closeness was not enough to meet analysts’ demands, and the very familiar range behavior that Bitcoin displayed throughout January therefore continues. The analyst shares five critical events to consider when calculating the next moves of Bitcoin and altcoins. We also share the analyst’s explanations. cryptocoin.com compiled for our readers.

Bears lower Bitcoin (BTC) weekly close

Even meager gains on the weekly close were a short-lived reason to celebrate this Sunday’s Bitcoin bulls. At midnight, a rejection candle instantly swept away as BTC dropped to $36,650 on Bitstamp. As analyst Scott Melker points out, the strong volume accompanying the move underlines the unreliable nature of weekend price action when it comes to establishing a position. As some other sources said last week, Scott Melker reiterated that $39,600 must be reclaimed for more bullish outlooks to prevail.

Just as analyst Rekt Capital was not inspired by the weekly candle, who said in a recent Twitter update that BTC “continues to struggle with resistance at $38,500”:

This is the area where BTC must Close above to secure a rise above around $39,000.

With a disappointing performance behind it, Bitcoin is thus back in the same old range. This could cause some to retest lower levels, he warns. Popular trader Pentoshi commented, “I personally look forward to any competitor consolidation if we trade this 29-40k range for a long time.”

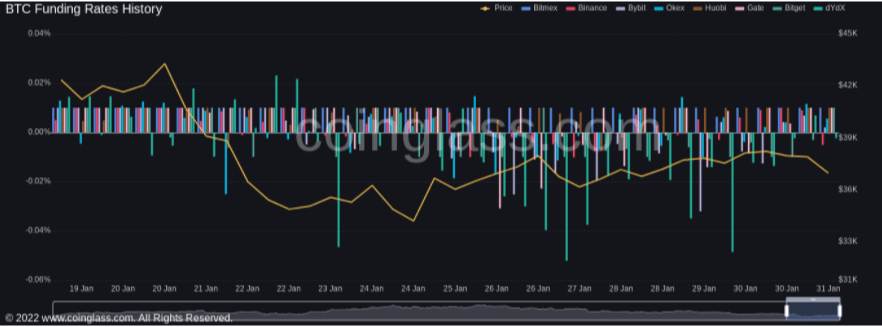

Meanwhile, the journey to highs of around $38,600 has managed to push up the previously negative funding rates in derivatives as it quickly changed from expectations of more downside to expectation of continued uptrend. However, the reversal sent funding rates broadly back into negative territory, with most of them hovering just below neutral at the time of writing.

Can the S&P 500 end its worst month since March 2020?

While Bitcoin’s monthly close won’t bring any surprises yet, exchanges can still provide some last-minute relief. With Monday’s pre-session futures, the S&P 500, with Bitcoin showing increasing positive correlation in recent months, is heading for its worst monthly performance since March 2020. The S&P is down 7% this month, and Bitcoin has started the year on a tense start as Fed policy begins to erode the enthusiasm that accompanied the unprecedented delivery of liquidity at the start of the Covid pandemic.

While the Fed is tight-lipped about the timeline for rate hikes closer to home, which should follow the “easy money” faucet to close, another problem for Bitcoiners is on the horizon. The Joe Biden administration’s upcoming crypto-related regulatory order, apparently shifted to February, could once again put the cat among the pigeons in terms of already battered emotions.

old hands age well

Behind the scenes, the more comforting trend of seasoned Bitcoin holders clinging to their holdings continues. Data from on-chain analytics firm Glassnode this week confirms that the number of cryptocurrencies that last moved five to seven years ago hit an all-time high. This group of cryptocurrencies currently total 716,727 BTC.

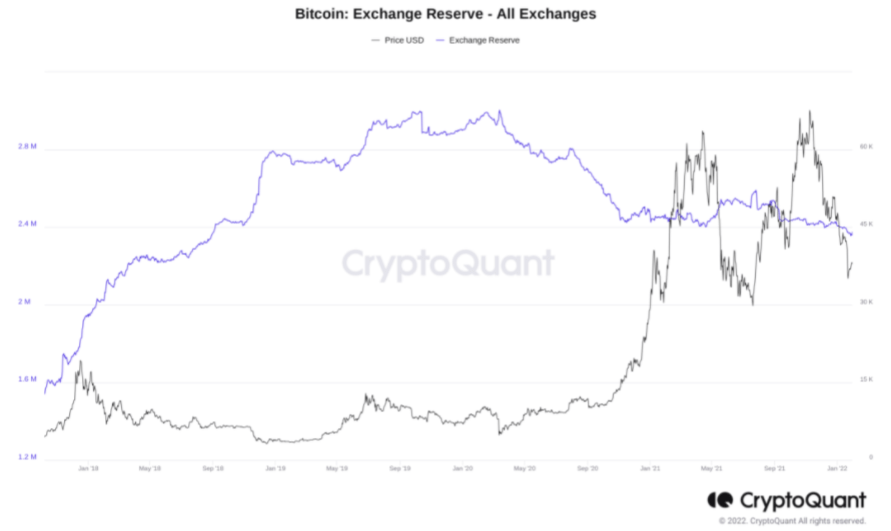

At the same time, in fact, January saw an overall decline in Bitcoin foreign exchange reserves despite price losses. Major exchanges have dropped nearly $243 million this week alone, according to Glassnode data. Separate figures from CryptoQuant, which tracks 21 major trading platforms, confirm that balances are at their lowest since 2018.

Grayscale Bitcoin Trust dives to record 30% drop

Things are not going well for the Grayscale Bitcoin Trust (GBTC). Despite data showing a resurgence of institutional interest in Bitcoin in January, demand for the industry’s flagship BTC investment product continues to decline. According to data from on-chain analytics firm Coinglass, GBTC transactions last week saw the biggest drop ever relative to the Bitcoin spot price.

This decrease in the fund’s net worth (NAV) in BTC holdings used to be a premium that investors paid for taking risks, but now the tables have long changed. On January 22, new entrants were technically able to purchase GBTC shares at around 30% below the spot price on that day. On-chain data analyst Jan Wüstenfeld adds to the situation, saying that despite the decline, GBTC does not represent a way for institutional investors to profit from “easy money” in the long run.

What does the Crypto Fear and Greed Index say about Bitcoin?

Trustworthy or not, something is happening to Bitcoin sentiment this week. After spending nearly the entire month of January in the depths of “extreme fear,” the Crypto Fear & Greed Index is finally looking up, after only a few revisits of rare lows. On Sunday, the Index broke out of the ‘extreme fear’ zone, a data range of 0 to 25, for the first time since Jan.

It’s a welcome signal for analysts that a more positive mood may finally come in, but as always, it all depends on whether such a rebound is sustainable and not interrupted by external surprises. The weekly closing hammer candle proved to be fleeting as the data sent back “extreme fear”. However, with a short trip to 29 – “fear”, the index shied away from the dubious honor of spending the longest ever in the “extreme fear” region since it was created in 2018.

Meanwhile, the volatile nature of sentiment in general has not gone unnoticed by veteran trader Peter Brandt, who has teased how perspectives have changed since the start of the weekend price correction:

I find it fascinating that many (but not all) on social media, who wore laser eyes in March/April and predicted a rocket launch for BTC in November, now predict the $30,000 level will break.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, asset or service in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.