Bitcoin is entering a week where macroeconomic events will be quite important, still trading above $20,000. After its highest weekly close since mid-September, BTC/USD remains committed to higher highs. So, what will affect Bitcoin and altcoins this week? In this article, we share analysis insights on Bitcoin, on-chain data, and key agenda items of the week. Here are the details…

The last days of the FOMC countdown

The headline news of the week comes with the meeting of the Fed and the Federal Open Market Committee (FOMC). On November 1-2, officials will make a decision on the rate hike, which is overwhelmingly priced at 0.75 percent. This will match the Fed’s previous two hikes in September and July. However, markets will be watching whether there will be any changes in attitudes towards monetary policy at these meetings. The interest rate decision will be made this Wednesday. The statement coincides with 21st Turkish time. Fed Chairman Jerome Powell will deliver a speech later at 9:30 p.m.

The market is talking about the end of an aggressive monetary policy that went into effect almost a year ago or a neutral stance. For Bitcoin and risk assets in general, this could provide serious fuel for growth as conditions ease. But looking at the short term, commentators expect a standard reaction to the upcoming FOMC announcement. “We may see a small pullback this week, like when the FED will announce rates,” popular trading account IncomeSharks told Twitter followers. An accompanying chart showed the expected pullback after further potential upswing going forward.

An alternative perspective came this weekend from analyst Kevin Svenson. He warned of rising inflation expectations. Therefore, he does not think that interest rate hikes will end in the near future. warned that there is little reason to hope for a rate hike cut in the near future. According to CME Group’s FedWatch Tool, the probability of a lower than 0.75 percent hike is currently 19 percent. Another analyst, Tedtalksmacro, showed similarities with Svenson’s view.

A “double top” pattern has formed on the Bitcoin chart

Bitcoin managed to avoid massive volatility as it closed the weekly candle at around $20,625 on Bitstamp. Thus, the highest six-week weekly candle close was realized for BTC/USD. Meanwhile, the daily chart retains the 100-day moving average as current resistance. However, the well-established trading range where the pair has been moving for months remains firmly in place. Even last week’s rise failed to produce a significant paradigm shift.

For analyst Mark Cullen, this signals that we will “wait and see” for Bitcoin’s next move. In the new analysis from Oct 31, he noted that BTC/USD has returned to a familiar Fibonacci level based on last week’s rise. He stated that BTC climbed to $ 20,400 in the last 61.8 Fib retracement and has held at this level so far. It makes me wonder if we’ll see $21,000 this week depending on any catalysts at the FOMC meeting.

Tedtalksmacro came to a similar conclusion for macro markets in general – they expect the “same old tough stance” from the Fed. So even the FOMC’s lack of surprise should be enough to continue the bullish tone of the past week. Meanwhile, crypto trader and analyst Il Capo of Crypto described the two spikes above $21,000 as a “clear double top” for Bitcoin. However, the analyst’s downside target of $14,000 remains valid.

Have we seen lows for Bitcoin?

Comparisons between this year and 2018, Bitcoin’s last bear market, are currently drawing attention. But for some, it’s too early for comparisons. “Similar to the bottoms in 2015 and 2018-2019, Bitcoin prices are in a tight range,” said on-chain analytics platform CryptoQuant. He pointed out that similar to the processes in question, BTC has been between $18,000 and $20,000 for almost two months. CryptoQuant pointed to two key on-chain metrics, MVRV and UTXO Realized Cap, that support the theory that the next bear market bottom is still far away.

cryptocoin.com As we reported, MVRV divides the market value of Bitcoin by the realized value. In the words of popular analyst Willy Woo, it is “useful” for spotting macro tops and bottoms as well as overbought/oversold conditions. UTXO Realized Cap is the price at which different BTCs were transferred compared to the previous time and gives an idea of the profit and loss. According to the analysis, levels above $21,000 must be maintained for the current trend to change.

Highest risk of supply shocks since 2017

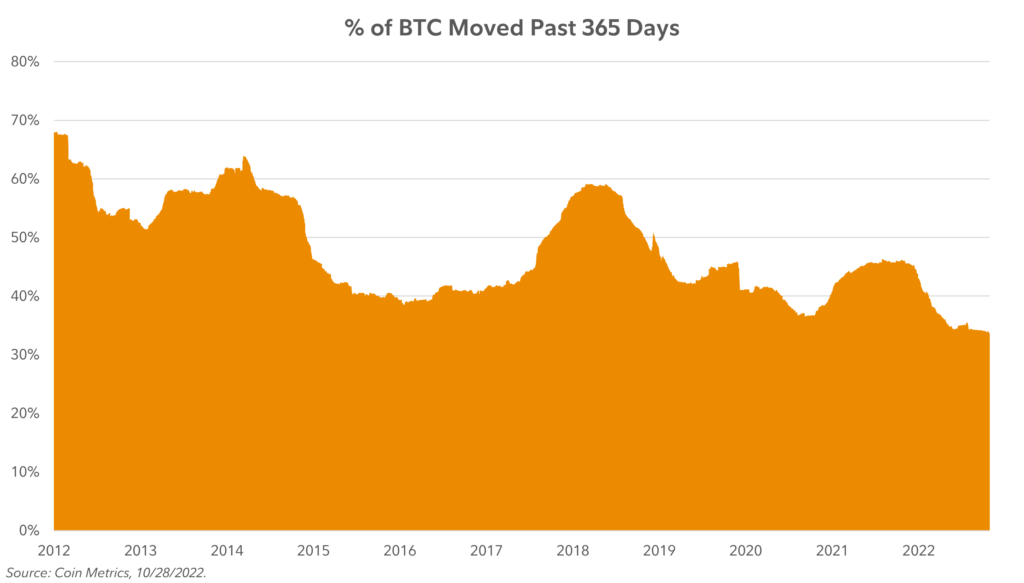

Bitcoins, which have been dormant for ten years, have been on the move lately. But overall, the BTC supply is becoming more and more liquid. This week’s new data gives the latest hint that the surge in buyer interest could trigger a significant supply shortage and consequent price increase. Fidelity Digital Assets researcher Jack Neuureuter highlighted data from on-chain analytics firm Coin Metrics. It revealed that the percentage of supply carried over the past year has been at an all-time low.

33.7 percent of all available BTC has left the wallet since the end of October 2021. This also accounts for increased volumes around $69,000, an all-time high in November. “In other words, 2/3 of the BTC supply has not moved in the last 365 days,” Neureuter added. Separate data from Glassnode, meanwhile, shows that the probability of a supply shock is increasing. The Liquid Supply Shock Ratio metric modeling the phenomenon follows a higher trend throughout 2022. It is currently at levels not seen since Bitcoin’s last halving cycle in 2017.

Bitcoin and altcoin market sentiment rises

Crypto market sentiment has improved thanks to price spikes over the past week. The Crypto Fear and Greed Index hit six-week highs over the weekend. Fear and Greed indicates how bullish or bearish the mood in crypto is. It uses many factors to calculate whether the market will experience a bounce or correction as a result. Sensitivity, currently at 34 out of 100, has helped us break out of the “extreme fear” region we’ve seen throughout 2022.

Also, data from analytics firm Santiment suggested that long-term holders are planning to HODL through volatility. “Once Bitcoin rises above $20.7k, traders are happy to hold the coin long-term,” he wrote in a tweet over the weekend. Santiment also showed that the ratio of BTC supply to exchanges is at its lowest level since 2018, the year of the last macro bear market bottom.

Macroeconomic developments that are important apart from the Fed speech

This week, there are important developments apart from the FED’s interest rate decision and the FED President’s speech. For example, today, the inflation rate in the European Region will be announced at 13:00 Turkish time. On the other hand, MicroStrategy, the company known for the size of the BTCs it holds, will announce its earnings report tomorrow at 23.15. On November 3, the inflation rate will appear in Turkey. It is also expected that the UK will announce its interest rate decision on November 10. As it is known, the UK has recently increased interest rates. Finally, on Friday, November 4, the unemployment rate in the USA will be announced.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.