The cryptocurrency market is exactly for investors with a high risk appetite. One of these traders sold his house at the height of the 2021 bull run and took a huge position with all his income. Here’s what happened…

Bought HEX with all his investment: Here’s $2 million in crypto loss

According to an unreleased documentary called “The Highest of Stakes,” a trader sold his house at the height of the 2021 bull run and bought HEX with a portion of his income. The video clip in question, which was released on YouTube on September 23, 2021, is a promotional for the upcoming documentary.

The video above sheds some light on the home sale in question. The trader’s wife expresses her disapproval of the investment in HEX. However, the trader sold his house and bought around 240,000 HEX for this risky venture. On September 23, 2021, HEX was trading at $0.43. This means that the value of 240,000 HEX exceeds $1 million. However, at the current price of $0.007891, HEX is worth $2,086.75, which is a 99.79% loss.

Similarly, a TikTok phenomenon known as Money_talk_tok made a loss after investing $500,000 in XRP.

Pepe 2.0 investor turned $900 into $176,000 in hours

cryptocoin.comAs you follow, the past weeks has seen multiple altcoins rally promoting version 2.0. Meanwhile, a trader turned a modest $900 investment into $176,000 in 24 hours. This remarkable achievement was achieved on Pepe 2.0 (PEPE2). Another investor turned 0.125 ETH into $1.14 million in just a few days.

Pepe (PEPE) gained popularity after its launch on April 17, 2023. However, it later encountered initial concerns about the contract owner’s ability to modify transaction taxes and blacklist functions. Despite these warnings, PEPE experienced a significant boom. It is currently listed among the top 100 altcoins on various centralized exchanges.

The highly profitable positions of the above traders garnered appreciation from some well-known names on Twitter.

Here is the huge altcoin short loss: $2 million melted

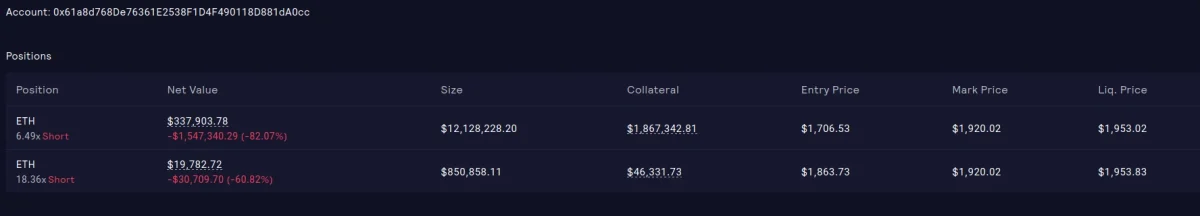

The last big bet resulted in the loss of most of the $2 million leveraged position. In a series of screenshots shared on Reddit on July 3, a trader at GMX aggressively “short” Ethereum with high leverage. This decision caused the investor to lose hundreds of thousands in USD.

Ethereum price has gained 20% in two weeks while the trader is shorting ETH. Ethereum price has been rising since mid-June 2023. Spot rates expanded by 20%. It is currently trading above $1,900. Despite the recent price surge, the same trader has shorted ETH at spot rates at around $1,700, according to the records. He started to expand his short position from June 26.

The trader opened two short positions in total. One was 19X leveraged and $12 million. Another was 7X leveraged and $1 million. As prices rose, he lost $12 million from his 19X leverage position. This did not prevent the trader from opening another position. According to his trading history, he opened another short with a stop at $1,999 with 30X leverage.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow on. Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. Therefore, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.