Good morning, dear readers,

SAP is one of the last major German corporations in which a representative of the founding generation is in charge. Still. Because yesterday evening, the SAP co-founder and chairman of the supervisory board, Hasso Plattner, announced his departure for the coming year.

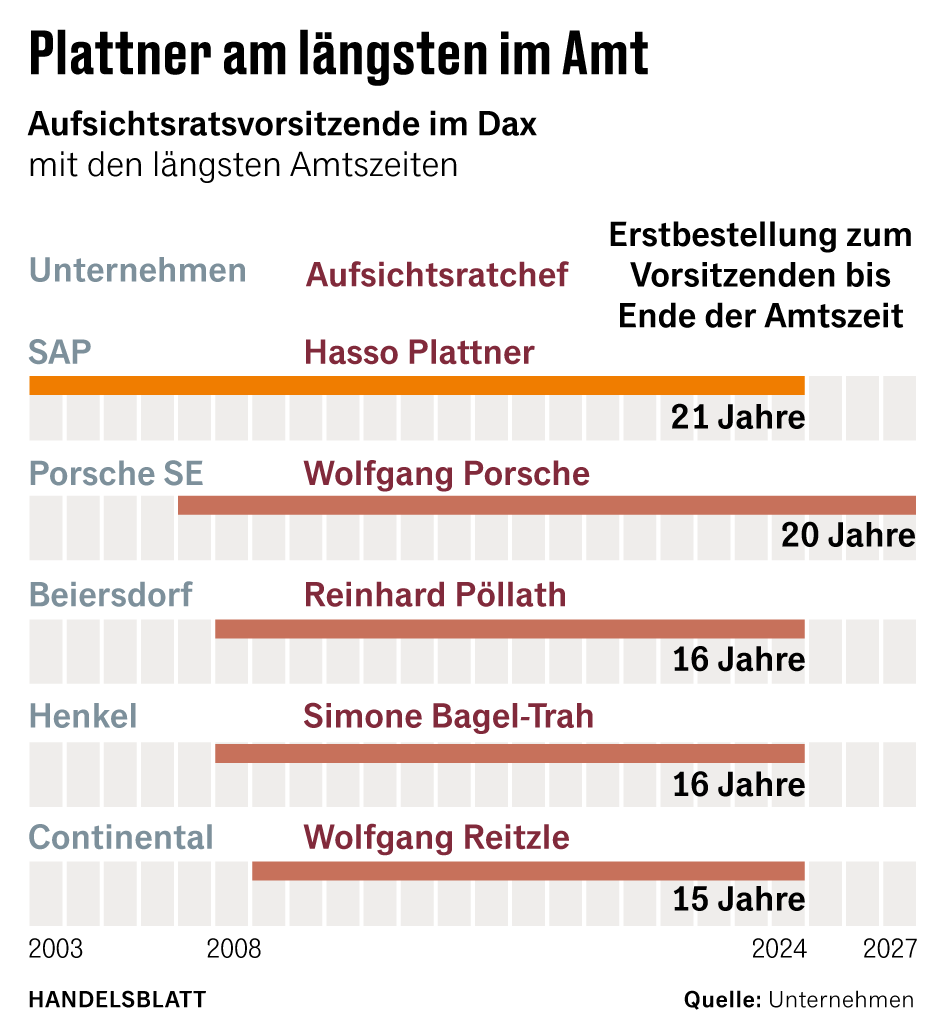

Punit Renjen, head of the auditing and consulting firm Deloitte until the end of 2022, is then to follow Plattner. His term of office ends in May 2024. The youngest of the five SAP co-founders will not stand for re-election at the age of 80. He is already by far the longest-serving head of the supervisory board in the Dax, as our chart shows.

´

Plattner, who studied communications engineering, co-founded the company 51 years ago. From 1997 to 2003 he was spokesman for the board of directors, after which he took over the management of the supervisory body.

SAP, on the other hand, is not only the most successful start-up company in Germany, but also the only German IT group of world importance. Our IT editor Christof Kerkmann was able to interview Hasso Plattner about his departure at short notice. It becomes clear: The entrepreneurial legend can do everything – except corporate German.

Plattner prefers to express his opinion directly, for example on the Ukraine war: “It’s terrible what Russia is doing – it’s not just Putin and his clique. I’m radical: I had a lot of Russian friends, especially in sailing, I don’t talk to them anymore.”

On dealing with China: “I think the demonization of China is wrong. By now we should know that they are fiercely competitive and that they not only make plastic toys, too – otherwise there would not have been a shortage of chips. But our economies are deeply intertwined. We have to work together.”

About his plans for the future: “It will not be a departure for new shores. Maybe I’ll go to my museums a little more often.”

When perhaps the greatest living German founding legend retires from his company, one quickly thinks of “Capitalism, Socialism and Democracy”, Joseph Schumpeter’s late work.

In it, the economist predicted in 1942 that owner-managed companies would increasingly be replaced by “bureaucratized giant industrial units”. These corporations would be run by paid “executive bodies” who would adopt an “employee attitude” and would be owned by shareholders for whom the stock certificates would represent only a source of income.

The new record numbers for share buybacks are not suitable to allay concerns about a creeping loss of entrepreneurial spirit on the boardrooms – on the contrary. From October 2021 to the end of September 2022, the 500 largest US companies in the S&P stock market index bought back their own shares for $982 billion – more than ever before. This is shown by calculations by the balance sheet expert Howard Silverblatt from the financial data provider S&P Dow Jones, which is available to the Handelsblatt.

A year earlier, the total for such buybacks was $881 billion. The companies themselves are by far the largest group of buyers on the stock exchange. Apple spent the most money on its own shares in 2022 with $88 billion, followed by Alphabet with $60 billion.

Many German corporations are also currently paying large sums to buy their own shares. The most active buyers here are Linde with almost ten billion dollars and Siemens and BASF with three billion euros each. Most recently, Mercedes announced buybacks for four billion euros. With the buybacks, the corporations are reducing the supply of shares and distributing profits and dividends to fewer shares.

That drives the price up. Over the past decade, share buybacks in the US and Europe have accounted for about a quarter of share price gains. This is the result of an extensive evaluation that the asset manager HQ Trust created for the Handelsblatt.

(Photo: Bloomberg, Imago, Linde)

Just imagine a real estate tycoon selling more and more of his properties to himself and enjoying the increasing prices per square meter that he is getting due to the apparently high demand for his properties.

We would rightly question the commercial sense of this entrepreneur. But strangely enough, in the stock market we’re not only used to this kind of nonsense – we’re even willing to regard rising prices after share buybacks as proof of success. My Opinion: Excessive share buybacks demonstrate a tragic lack of entrepreneurial imagination.

Smartphones, which only cost a few hundred euros, usually navigate better from A to B than your own car. Even in luxury cars, the pre-installed map services are often imprecise and the displays are jerky. Mercedes Benz now promises customers a remedy and will in future integrate Google Maps into its vehicles under its own design.

It is a deal that is unique in this form in the automotive industry. A number of car brands such as Volvo, Polestar and Renault now use complete infotainment systems from Google in their vehicles. Tesla, in turn, uses Google for the map display on the screen, but not for navigation.

(Photo: Mercedes-Benz AG, mauritius images, Reuters)

Mercedes now emphasizes that it is the first carmaker to use the Google Maps platform to embed the maps in its own operating system MB.OS and also use them for navigation. The sovereignty over the customer data remains with Mercedes. According to industry circles, Mercedes is likely to transfer at least a double-digit million amount per year to Google for the licensing of the services.

There are regions in which even a Google navigation system can no longer find its way. Astronomers have now apparently discovered six giant galaxies from the early days of the universe with the help of the James Webb Space Telescope.

They were formed about 600 million years after the Big Bang and are much larger than expected, wrote Ivo Labbé of Swinburne University in Melbourne and his colleagues in an article published by the journal Nature on Wednesday.

Labbé and his colleagues initially did not want to believe the results. The discovery must also be checked and confirmed. Some of the objects may not be galaxies but supermassive black holes. Others may be smaller than currently thought. According to Labbé, one thing is already clear: anyone who works with the James Webb telescope must be prepared for surprises.

Events long ago, always new surprises and supposedly huge objects that are actually black holes: are the astronomers possibly on the trail of a cosmic variant of the Wirecard balance sheet?

I wish you a day that begins with a big bang and then slowly builds up.

Best regards

Your Christian Rickens

Editor-in-Chief Handelsblatt