The allegations that banks closed cash advances via credit cards fell like a bomb on the agenda. So what was the source of this development? Can a cash advance be withdrawn? Here is all the information…

In the issue of the Official Gazette published on 17 May (yesterday), Central Bank of Türkiye Republic A communiqué published by This communiqué numbered 2023/11 was actually about the banking sector. Most of the citizens who opened and read that communiqué in the Official Gazette today could not even understand what it meant. Because the communiqué is quite difficult for an ordinary citizen. contains technical terms.

However, most citizens of the said regulation will make it difficult later understood. With the Communiqué of the Central Bank on Amending the Communiqué on the Establishment of Securities, banks have become the “cash advance on credit cardThey started to disable the ” feature. The development is also on the agenda of social media.

So what does it say in that paper?

To the Communiqué No. 2023/11 published in the Official Gazette from here you can reach.

The translation of this statement in the language we can understand is as follows:

The new regulation, which the Central Bank of the Republic of Turkey also sent to the banks, is in fact the financial transactions such as credit and cash advances through credit cards. aims to curtail. Let’s explain like this; It was possible to use cash advances with an interest rate of 1.36% from the credit card. The cash advance amount that could be used could vary depending on the limit of the credit card. Compared to the interest rates on consumer loans, it is 1.36 percent. to be too lowNaturally, this led citizens to apply for cash advances instead of consumer loans.

With the latest regulation, the job of banks has been made more difficult. The central bank said to other banks, “If the citizen whose credit card limit is above a certain level makes a cash advance use, this usage made according to the credit type up to 30 percent include in the securities facility“. This caused banks to terminate the cash advance application by credit card. Because in this case, the bank’s money is due to the cash advance used. would have been blocked.

What did industry sources say?

Hamide Hangul from Dünya Newspaper according to the news Banking sources had the following to say on the subject: Consumers were meeting their needs with this cash advance. He was taking a cash advance on his credit card. With an interest rate of 1.36. With the securities requirement, most banks from monday cash advance from credit card closed.

Although the Central Bank of the Republic of Turkey took the decision in the past few days, the banking sector is actually in this situation. has been bothered for a while. Hamide Hangul is responsible for borrowing from sector stakeholders at low interest rates. that they are not satisfied He wrote what he had said at least a month ago.

Let’s get to the main issue: What happened now?

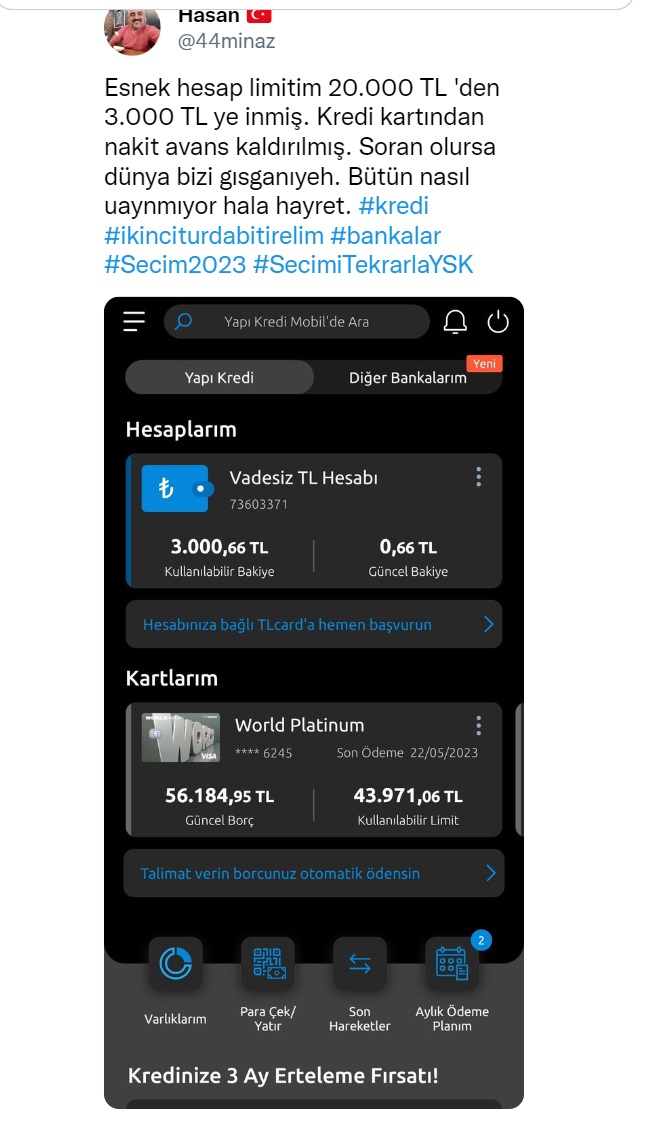

What happened was also on the agenda on social media. Some social media users are now using their credit cards. unable to withdraw cash advance they claimed. Let’s take a look at some Twitter posts that talk about not being able to withdraw cash advances:

As the Webtekno team, we tried to use cash advances from different banks. So what happened?

With our friends at the Webtekno office, we decided to withdraw cash advances from different banks to see if these allegations were true. we tried. As a result of our experiments, we have seen that we can withdraw cash advances from almost all banks, whether public or private banks. However, there is a problem here as well. The availability rate of cash advance withdrawals varies from bank to bank. For example; In some banks, cash advances up to 10% of the card limit are taken. Some rate this 3 percent to 5 percent to their level has downloaded. In other words, what is happening in the banking sector is not fully understood.

In summary:

There is no such thing as closing the cash advance system. All banks are hanged by their legs, so to speak; banks, as a result of the regulation published by the Central Bank of the Republic of Turkey. takes decisions on the cash advance application ‘on its own initiative’.

Among these decisions lower the advance limitThere are different applications such as reducing the number of installments, not giving cash advances. However, let us underline that there is no obligation imposed on banks by the BRSA or the CBRT. Each bank completely determines how it will decide.