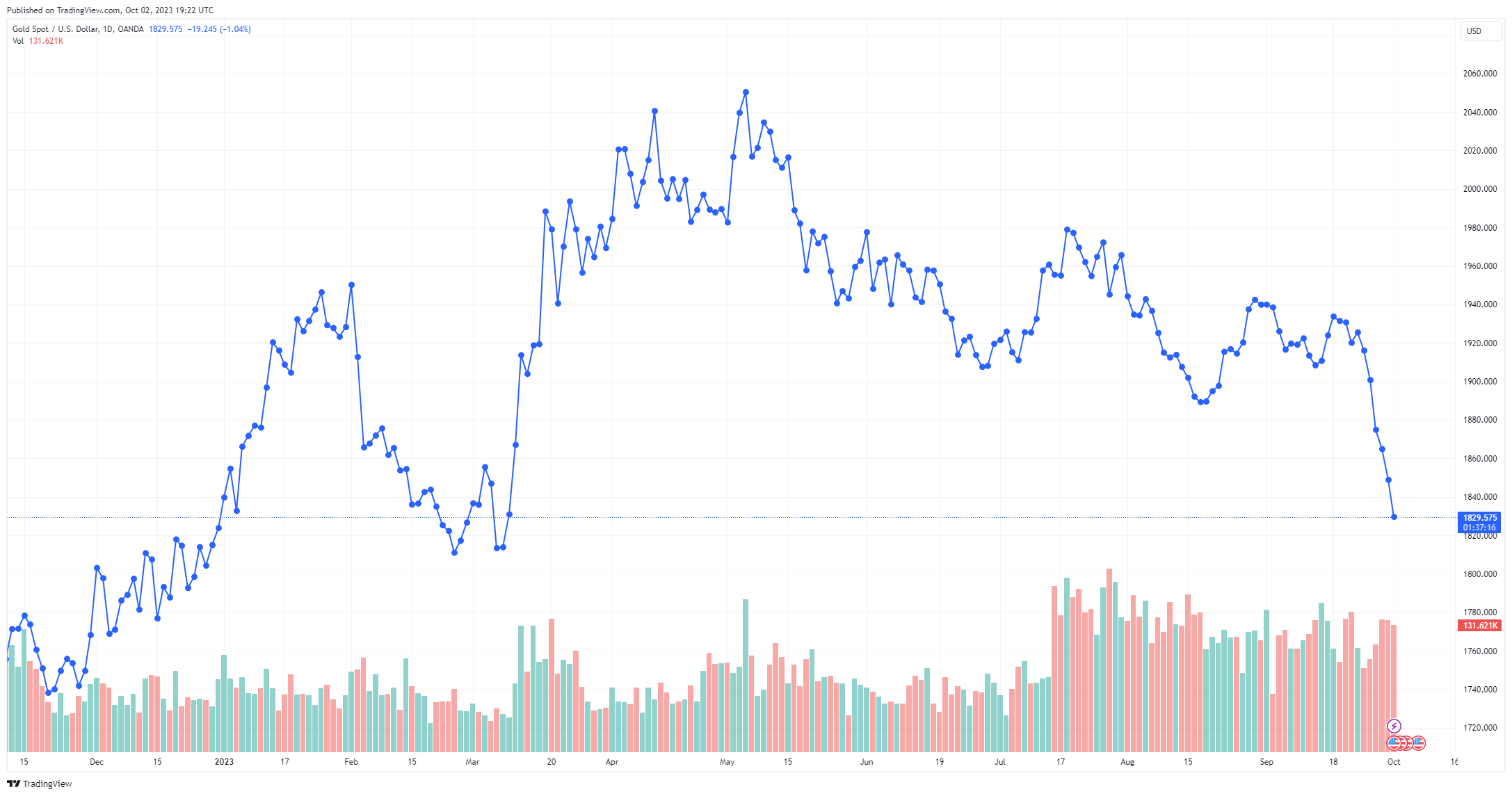

Markets are watching gold prices fall below $1,830 as the fourth quarter begins. However, according to Heraeus’ latest precious metals report, conditions and interest rate history are in favor of gold bugs in the medium and long term.

What course do gold prices follow after the Fed pivot?

cryptokoin.comAs you follow from , gold saw sharp declines within a week. However, according to analysts, the gold price will tend to rise after the first cut of the US interest rate cycle. Analysts note that, on average since 1984, gold is 10% higher one calendar year after the Federal Reserve cuts interest rates for the first time following an interest rate hike cycle, and 18% higher two years later than it was on the day the decision to cut interest rates was made.

In this context, analysts say, “The dollar tends to weaken. Yields on U.S. Treasury bonds fall. Additionally, the economy tends to deteriorate. “It is possible that all these factors could act as a tailwind for the gold price.” They comment. Analysts say it is only a matter of time before Fed Chairman Jerome Powell starts cutting interest rates after the yield on the 10-year Treasury bill peaks. In this regard, they make the following assessment:

The last rate hike of the cycle also tends to coincide with the peak in the yield on 10-year U.S. Treasury bonds. Since 1984, rate cuts have never lagged more than a year and seven months from the peak of 10-year U.S. Treasuries. Excluding 1989, discounts followed the peak by ~10 months on average.

The performance of gold increases with interest rate cuts!

However, analysts also state that this does not constitute a guarantee. They note that two years after the first interest rate cut in 1995, the gold price fell 16% to $325.50. On the other hand, the upward relative performance of gold following interest rate cuts has increased since the 2001 cycle. U.S. government bond yields hit a 16-year high of 4.7% Monday EDT. Heraeus analysts make the following comment:

The yield on long-term US Government bonds has not reached 4.5% since September 2007, when interest rates were reduced by 50 basis points from 5.25% to 4.75% and the US was on the brink of recession. This suggests that the higher-for-longer message from the Fed may now be sinking in for investors. It raises the expectation that there may be a longer period before interest rates start falling for this cycle.

Gold is struggling in the short term, but…

Analysts agree that gold’s short-term outlook is challenged by the rise in yields. They note that the average rate tightening cycle lasts 21 months, with a total Federal Funds rate increase of 3.02%. However, they underline that this point is clearly behind us. Based on this, they come to the following conclusion:

Historically, long-term yields peak shortly before the Fed stops raising short-term rates. Inflation may continue to rise after the Fed reduces interest rate hikes. The increase in consumer prices in August shows that although the Fed paused interest rate hikes in September, inflation may not yet be under control and gold may face difficulties at least until the new year or until yields rise.

Dollar gaining strength, $1,800 an important support for gold

Another key hurdle for the yellow metal is the strength of the US dollar, which continues to outperform, with DXY flirting with 107 on Monday afternoon, a level it has not breached since November 22. Analysts interpret this situation and the technical outlook of the gold price as follows:

The strength of the US dollar last week may be a sign that investors are starting to accept that interest rates could be higher for longer. The dollar is up ~7% against other major currencies since mid-July. The next major technical support for gold is at $1,800, a price the precious metal hasn’t seen since the days before Christmas last year.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!