The takeover of the Munich wafer manufacturer Siltronic by Globalwafers from Taiwan is in danger.

(Photo: Bloomberg)

Munich/Berlin The Taiwanese group Globalwafers excludes a new offer for the Munich rival Siltronic. “Another offer is not planned. If the transaction does not go through, we will pursue alternative investment plans, mainly outside of Europe,” said a spokesman on Wednesday at the request of the Handelsblatt.

There have been rumors in financial circles for days that Globalwafers could launch a new takeover bid. This would give the Federal Ministry of Economics more time to approve the 4.35 billion euro takeover.

The self-imposed deadline, by which the approvals of all authorities involved must be available, expires next Monday. Most recently, the Chinese allowed the deal last Friday. Only the Economics Ministry in Berlin is still refusing its blessing. If there is no approval, the takeover fails.

Siltronic shares are currently trading at around 115 euros. That’s €30 less than Globalwafers would pay per share if the deal were approved. In the current week alone, the papers have lost a good six percent in value. The stock exchange no longer believes in the takeover.

Top jobs of the day

Find the best jobs now and

be notified by email.

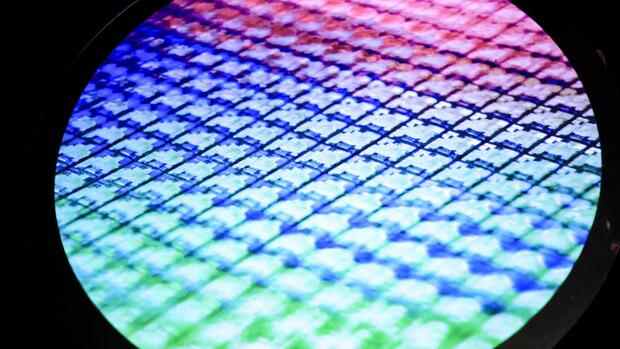

Siltronic manufactures silicon discs, the so-called wafers, the basic material for semiconductor chips. Globalwafers is number three on the world market. Together with the number four, Siltronic, the Taiwanese want to catch up with the Japanese industry leader Shin-Etsu. At the end of 2020, both sides announced the merger.

Chips are high on the agenda in Berlin

However, the Federal Ministry of Economics had reservations from the start. Globalwafers has therefore offered the federal government far-reaching concessions. This includes a “golden share” that the German state could use to influence Siltronic. If global wafers are sold, a right of repurchase could therefore apply.

Nevertheless, the Ministry of Robert Habeck (Greens) is apparently not very impressed by the planned merger. The microchip industry is considered to be one of the future areas on which the country’s technological sovereignty largely depends. Wafers are indispensable for this. A sale does not fit the political agenda.

Most recently, Globalwafers boss Doris Hsu had nevertheless shown himself to be confident. “Time is short, but legal approval is still possible,” the manager told Handelsblatt last weekend. “We offered comprehensive solutions to all concerns, including reversing the transaction. Where there’s a will, there’s a way.”

Globalwafers is looking overseas

Hsu threatened that if approval were not granted, Globalwafers would increasingly serve customers in Europe from overseas. Less money would then flow to Europe. “If the deal fails, we’re more likely to invest in America than in Europe.”

A ministry spokeswoman recently said that she was unable to comment on the status and the procedure. Investment appraisal procedures often contain very complex questions and matters that would require close examination.

In the ministry environment, the easiest solution is now considered the most likely: that the officials will not react at all by midnight on Monday and the deal is finally off the table.

More: Globalwafers boss is fighting for a billion-dollar takeover of Siltronic