A leading crypto analytics firm has shared a detailed review of Bitcoin to see what is driving BTC’s latest rally.

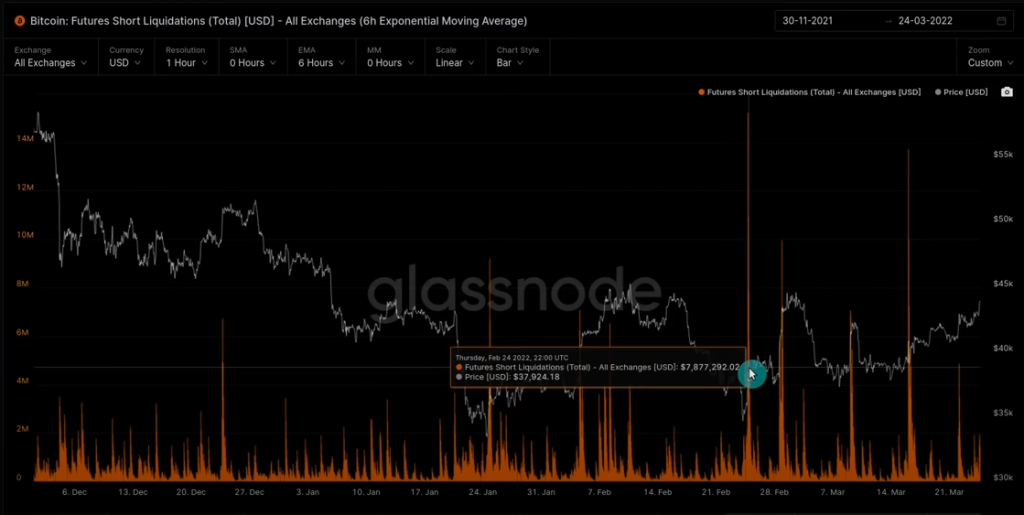

In a new video, Glassnode stated that short position holders, or in other words those who bet that the Bitcoin price will drop, are responsible for creating a bottom for BTC.

“Short liquidations usually happen when we are experiencing very strong upsides. Essentially, people are very comfortable when the market has a certain trend. They see it going down and going down… Finally, they feel safe enough and they’re like, ‘You know what? I’m tired of my long position being squeezed (long squeeze). I will go short.’ they say. Impressively, they managed to do that right at the bottom and then they got stuck in the opposite direction and the trend started to change.”

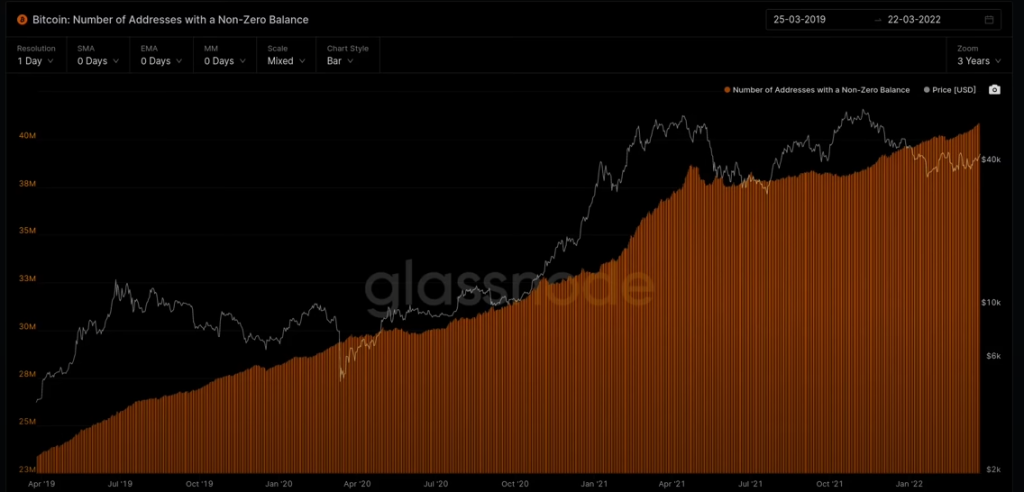

Looking at Glassnode’s chart, the change in trend seems to have started on February 24, when liquidations of short positions skyrocketed as BTC traded around $37,000. While short position holders accelerate the first step of the BTC rise, Glassnode also emphasizes that the rally cannot be sustained without organic demand. The analytics firm is also evaluating the number of Bitcoin addresses with a non-zero balance to show that investors continue to buy BTC despite the macroeconomic backdrop.

“Watch what momentum we’ve had over the last few weeks. It’s really starting to curve upward. So even though we’re in depressed prices and in what I would call a bear market, we’re seeing these people… Despite all this, all the geopolitical uncertainty, the macro headwinds, the Fed’s hike rates – all the risks in the economy right now – people are still hoarding BTC.”

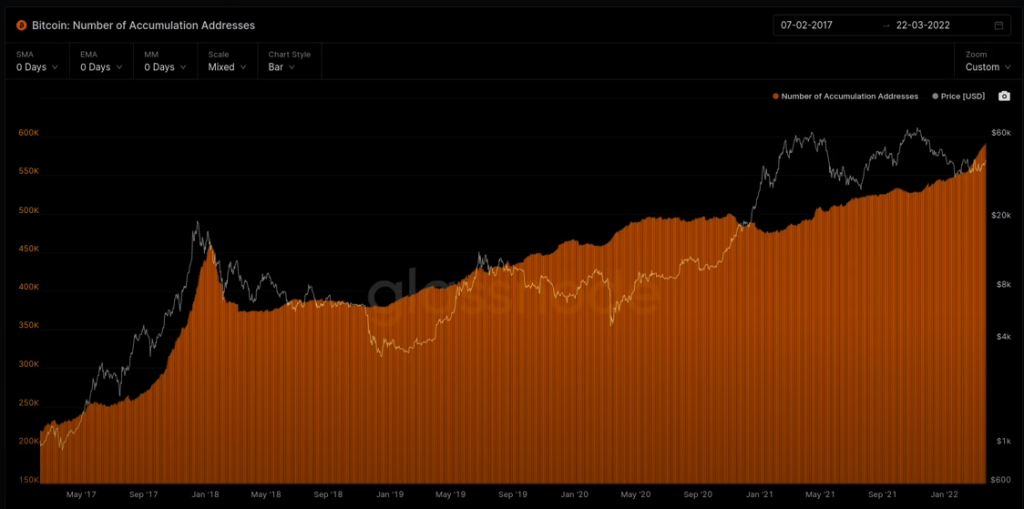

According to Glassnode, another metric showing the increasing demand for Bitcoin is the number of BTC savings addresses. The analytics firm defines the metric in question as the number of addresses that continue to add BTC to their savings:

“Notice how much this has risen in recent weeks. A very, very significant increase in the overall balance of savings therefore indicates that there are more people saving in the near term. It paints a picture of shorts squeeze on one side, but there is also real organic demand, which we can see from address growth.”

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.