glassnodeHe noted that while several on-chain data for Bitcoin (BTC) are still in a bearish range, the recent price recovery will require increased demand and fees charged over the network to continue.

The “The Week On Chain” report, which evaluated the low growth experienced last week by Glassnode, drew attention to some important data.

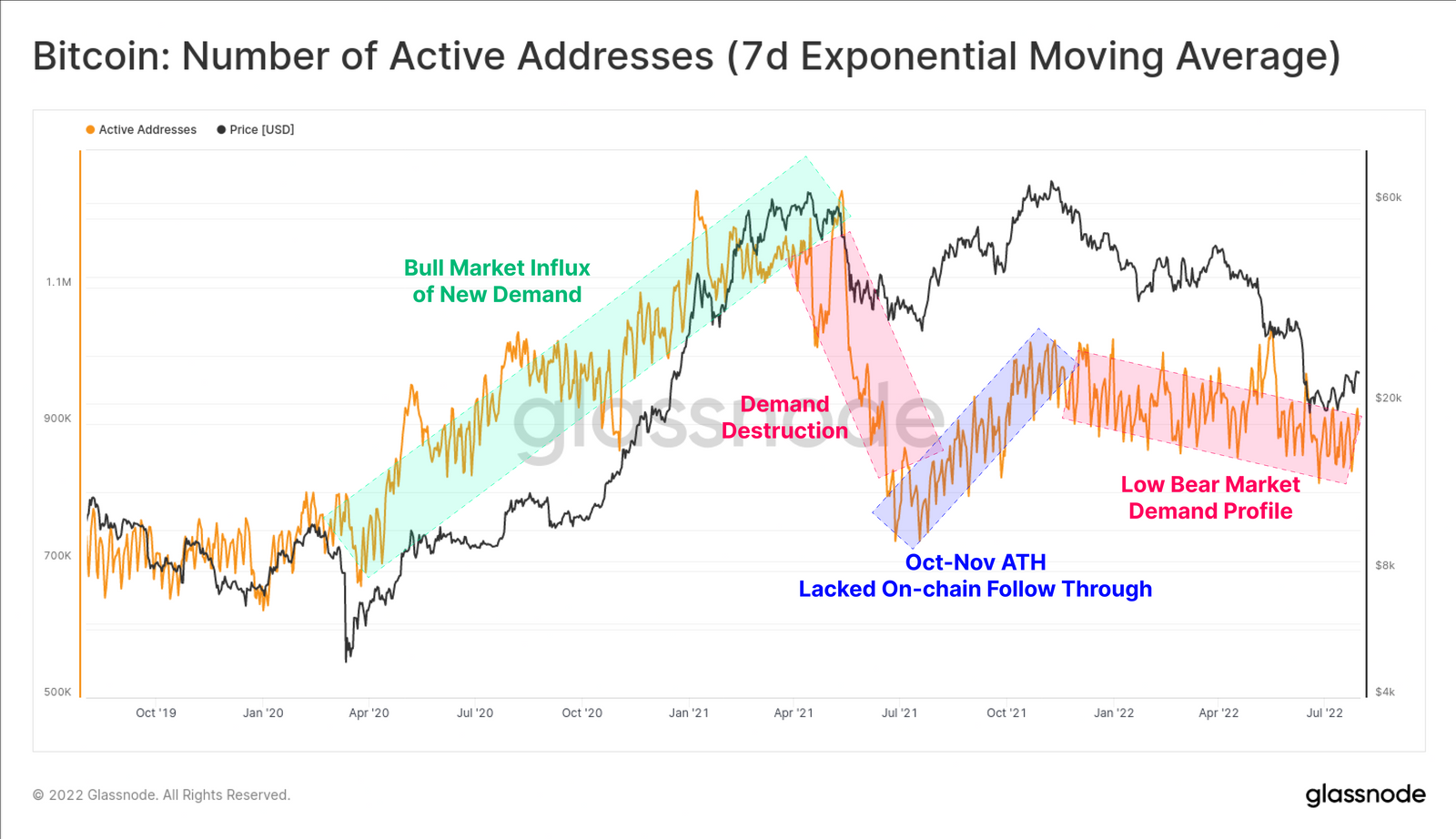

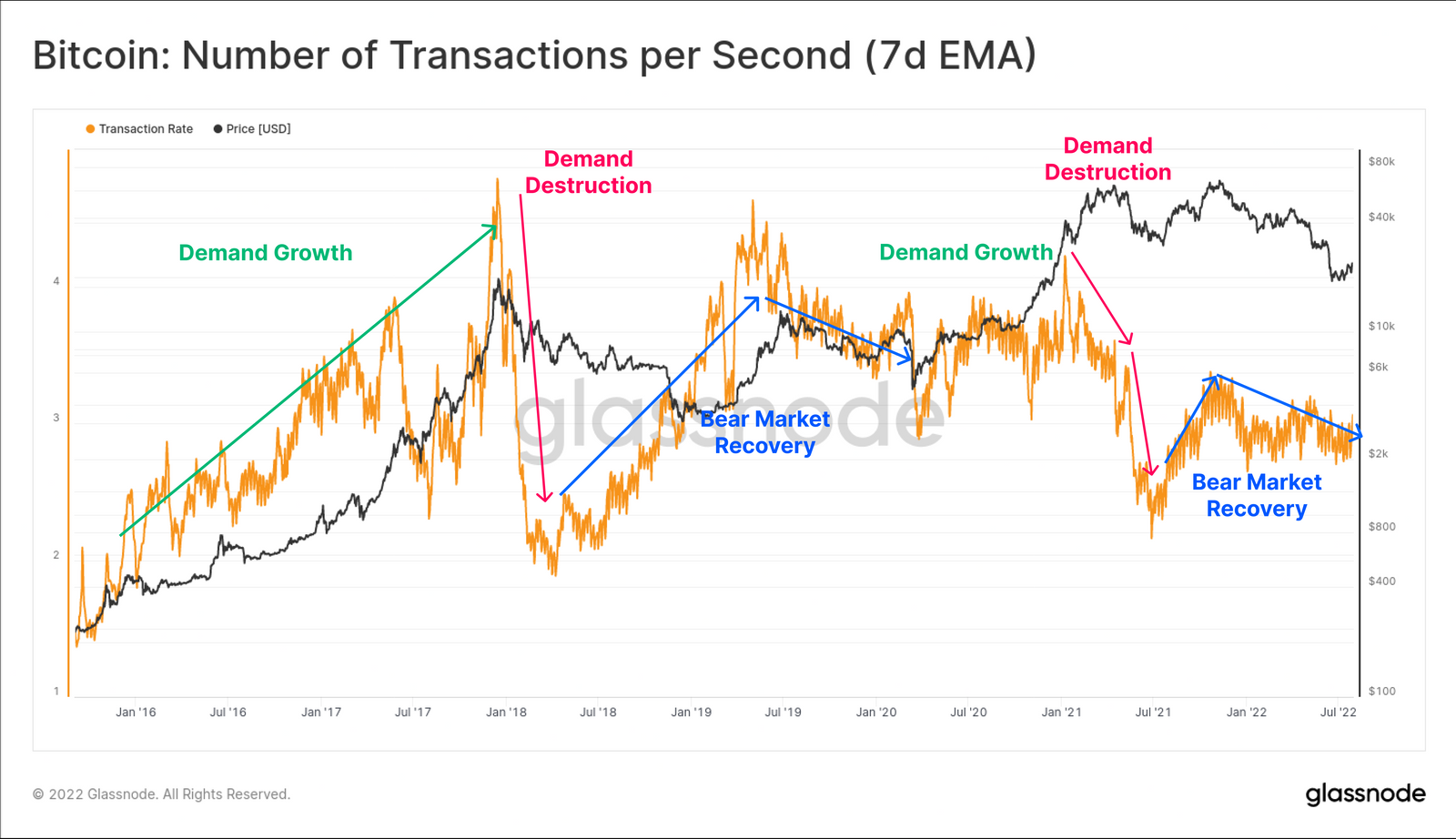

Analysts point to side growth in transaction demand, active Bitcoin addresses staying “in a down channel” and low network fees to dampen investors’ excitement about the 15% rise in Bitcoin price last week. However, BTC is currently down 2% in the last 24 hours and continues to trade at $22,899 below $23,000, according to CoinGecko.

Koinfinans.com As we reported, the report includes a decline in on-chain activity and a return from speculative investors to long-term investors. bear marketIt begins by highlighting the characteristics of The report, which states that the Bitcoin network still displays each of these features, is remarkable in this respect.

Glassnode shared a comment that the drop in network activity could be interpreted as a lack of new demand for the network from speculative traders on long-term holders (LTHs) and investors with high levels of faith in network technology.

“Apart from a few higher activity spikes during major capitulation events, current network activity indicates very little new demand inflows yet.”

Unlike last week, when a significant level of demand for Bitcoin appears to have formed and bottomed out at $20,000, the additional demand needed to sustain further price increases cannot be observed. Glassnode refers to the steady decline in active addresses as the “lower bear market demand profile” that has been in place since December last year.

The analysis also pointed out that there are similarities between the current network demand model and the one established in the 2018-2019 period. Similar to the previous cycle, the network demand is bitcoin priceIt dried up after April 2021, an all-time high in As prices rebounded to a new high, there was a notable recovery in demand and lasted until the following November.

However, since November last year, demand has been on a downward trend with a big drop during mass sales in May:

“The Bitcoin network remains dominated by long-term investors, and there has been no significant new demand return yet.”

Glassnode added that weak demand from anyone other than Bitcoin enthusiasts has forced network fees into “bear market territory.” Last week, the daily fees were just 13.4 BTC. In contrast, when prices hit ATH last April, daily network fees exceeded 200 BTC.

Assuming that fee rates increase to a notable degree, Glassnode suggests that it could mean that demand is increasing, helping to sustain more “constructive structural change” in Bitcoin network activity:

While we haven’t seen a notable increase in fees yet, keeping an eye on this metric could possibly signal a recovery.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.