In a surprising move over the weekend, the FTX bankruptcy address staked an impressive sum of over 5.5 million SOL (Solana) and over 24,000 ETH (Ethereum), worth a total of $152 million, as shown by Blockchain addresses associated with the BTC and altcoin exchange. Here are the details…

Altcoin staking from FTX

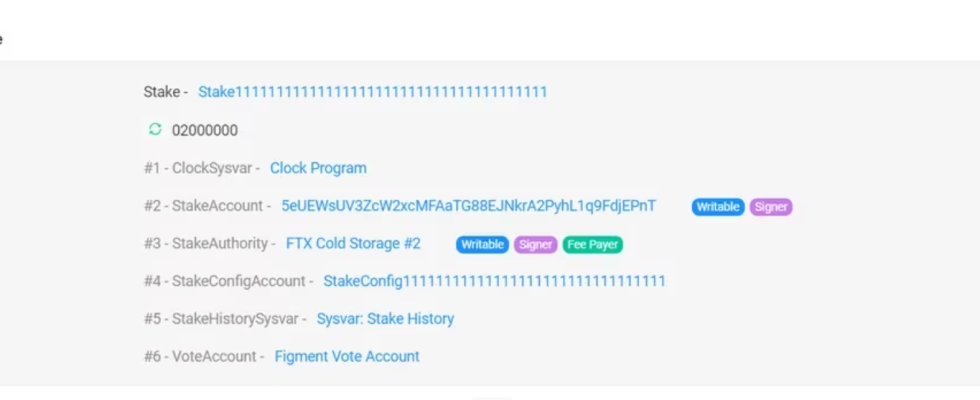

Staking, the practice of locking cryptocurrency assets on a blockchain, serves the dual purpose of supporting the network while generating token rewards. This strategic decision by the property points to potential significant gains in the coming years as rewards accumulate on staked positions. According to blockchain records, these assets are staked in separate transactions. Currently valued at $122 million, SOL appears to have found its home in Figment. It will also generate a significant 6.79 percent annual return on holdings here, equivalent to over $8 million in SOL tokens. This figure will continue to grow as returns compound over time.

This move on Solana’s Blockchain reflects the network’s robust staking ecosystem and has attracted significant attention from crypto enthusiasts and institutions alike. The 6.79% annual return on SOL positions is critical. On the Ethereum side, transactions indicate that ETH is staked directly on the network. Staking Ethereum is expected to generate an annual return of 3.4%, corresponding to approximately $1 million in ETH tokens. Staking Ethereum is not a new concept. As one of the most established Blockchain platforms, Ethereum has been at the forefront of the staking movement, offering investors opportunities to secure and grow their assets while contributing to the security and scalability of the network.

Relationship between FTX and Solana

It is worth noting that FTX, one of Solana’s initial investors, is a regular buyer of a significant amount of SOL tokens, which are unlocked in accordance with a scheduled vesting schedule. This investment, which has a value of over $ 1.16 billion as of September 2023, is an example of the stock market’s moves towards Solana. The dramatic turn of events for FTX began when its disclosures about the state of its balance sheet led to the stock market crash last year. New CEO John J. Ray III has been vocal about the lack of financial controls at the company, while founder Sam Bankman-Fried is currently on trial.

This move by the FTX bankruptcy estate to invest a significant amount of SOL and ETH reveals the ongoing transformation in the cryptocurrency world. It not only secures assets, but also offers the potential for significant rewards, exemplifying the ever-evolving nature of the crypto market. Staking in particular has emerged as a promising way to generate passive income while actively contributing to the security and sustainability of blockchain networks.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.