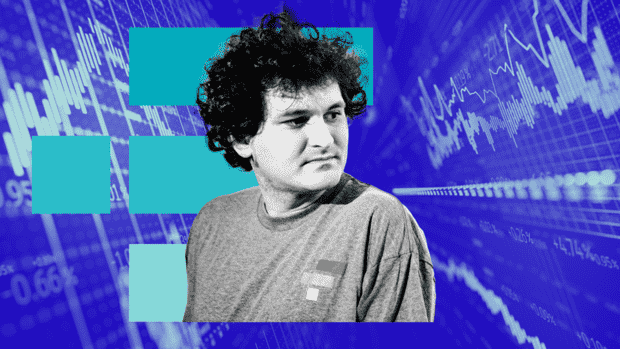

So many questions, and a 30-year-old ex-billionaire carries the answers in his heart to the Caribbean or to jail. The bankruptcy of the crypto exchange FTX, the merciless fall of its founder and crypto poster boy Sam Bankman-Fried (SBF) and the investigations that are now to follow and will probably take a lot of time, all of this now looks like a reality show à la “The Big Short”.

How often should a Ponzi principle in connection with own transactions deprive many investors of their invested assets until it is clear that a large whole rarely arises from nothing?

Now, eight billion missing customer dollars later, most of them are again very surprised: Hey, how could that happen? Simple answer: through a total lack of oversight and control on the one hand and a naïve, deluded trust in supposed corporate miracles on the other.

The bits and pieces of information that is now becoming public point to a quasi-feudal system of self-service by a small group of people who are linked to one another in a variety of ways.

Top jobs of the day

Find the best jobs now and

be notified by email.

They live together in a luxury resort in the Bahamas and control two companies from there: FTX and the trading company Alameda Research, whose name sounds so scientific and non-profit that nobody was surprised at the close business ties between the two companies. SBF decided everything with a small group of confidants according to the principle: loyalty beats competence.

Miriam Meckel is a German journalist and entrepreneur. She is co-founder and CEO of ada Learning GmbH. She also teaches as a professor for communication management at the University of St. Gallen.

(Photo: Klawe Rzeczy)

Now, running two companies with a polyamorous harem from the Bahamas can be a hilarious notion. Then when about a million customers are ripped off eight billion dollars, it’s less fun.

John Ray, the newly installed CEO of cryptocurrency exchange FTX, who now has to steer the remnants of the company through the bankruptcy process, said: “Never in my entire career have I seen such a total failure of control and such a widespread lack of trustworthy financial reporting as has been seen in is given in this case.” That’s saying something, because: John Ray managed, among other things, the bankruptcy of Enron, which leveled the Texan energy company to the ground in 2001 – one of the biggest economic scandals in US history.

US President Biden also fell for Sam Bankman-Fried

Much more interesting than the insane revelations of a lack of supervision and control in connection with limitless overestimation of self and others is the scandal behind the crypto crash.

Not only was SBF the crypto prodigy, he was also the main protagonist of a movement called “effective altruism”. The philosophical and social movement relies on being more effective in charitable work in order to reach as many people as effectively as possible with aid campaigns. She has a particularly vibrating resonance chamber in Silicon Valley, and SBF was her fixed star.

>> Read also: FTX founder donated 38 million dollars to US Democrats – bankruptcy of billions reaches the US government

The 30-year-old described himself as not collecting his incredible wealth for himself, but to give it to those who are in need. That sounds great and like real purpose. World-renowned investment firms like Sequoia Capital, millions of simple investors, yes, even the incumbent US President fell for it.

Naive personality cult in the tech industry

Only now the whole beautiful coat of paint has flaked off the facade with a big bang. And if you take a closer look, you have to admit: There is no facade either, just a black hole where a fancy house of cards for self-marketing used to stand.

This naïve personality cult in the tech industry is really getting on my nerves. That’s not belief in the abilities of a genius, that’s a cult – fed by confused ideas of omnipotence and infallibility that a misguided Silicon Valley attitude brings to those who stage themselves accordingly: as mysterious nerds who, under the cloak of the common good, join the effective Indulge in egoism and who don’t care about anything beyond their company’s success.

>> Read also: El Salvador’s state finances are trembling

How many times do we want to be persuaded that one person can save the world if they act boldly and crazy enough? How many times do we have to fall flat on our faces before we realize that experience and success don’t just have a first letter in common?

The former Bank of England boss once said: “If someone is explaining something to you about finance and it doesn’t make sense, ask the person to explain the argument again. If the answer still doesn’t make sense, get on your feet and run.”

It’s so tiring and boring to hear the same stories over and over again about the founding geniuses making our world a better place – only to eventually put total disenchantment on the history books. There are effective altruists. These are the many true entrepreneurs who create jobs, prosperity and innovations – mostly beyond any public attention.

In this column, Miriam Meckel writes fortnightly about ideas, innovations and interpretations that make progress and a better life possible. Because what the caterpillar calls the end of the world, the rest of the world calls a butterfly. ada-magazin.com

More: A child prodigy crashes, taking $220 billion with it: lessons learned from FTX’s mega-bust.