Two large-volume altcoins listed by Binance are gaining bearish momentum despite support from whales. Technical analysis shows that eroded critical support levels could result in further declines.

SHIB remains in the red despite accumulation of altcoin whales

According to data from Etherscan, SHIB whales made a total of nearly 30 billion purchases in less than an hour. In the last hour, the first major investor bought 4.4 billion tokens from Binance, followed by another investor who bought 19.9 billion SHIB from Coinbase.

Also, another investor bought 48.6 million SHIB from Binance. Other major transactions recorded include 1.6 billion SHIB, 2 billion SHIB, and 13.5 billion transfers between unknown wallets.

Recent purchases were not the biggest transactions of the week. 3 days ago, a Shiba Inu whale bought 3.48 trillion SHIB, making it the 29th largest Shiba Inu owner. The acquisition, Shibarium Beta Testnet, demonstrated the growing interest of crypto whales in SHIB after the Puppynet launch.

The top 100 Ethereum whales have accumulated over $601.2 million in SHIB, which makes up almost 12% of their combined portfolio. On average, each wallet holds 496,214,650,935 SHIBs and is worth over $6 million.

SHIB keeps falling

Despite the buying spree, the SHIB price is falling. At the time of writing, SHIB is trading at $0.00001061, down 3.2% in the last 24 hours.

A possible explanation for this latest downtrend could be the performance of the crypto market, which has affected many altcoins. The leading cryptocurrency Bitcoin is experiencing a significant price drop that has a ripple effect on the entire market.

Another possible factor could be an oversupply of SHIB. Additionally, investors who bought SHIB during the initial excitement may have sold their tokens to make a profit, which could lead to a price drop. Meanwhile, in the past 3 days, approximately $500 million has been removed from the market cap of SHIB, which has further reduced the market cap valuation.

Polkadot bears are back on the scene: Altcoin could revisit this level

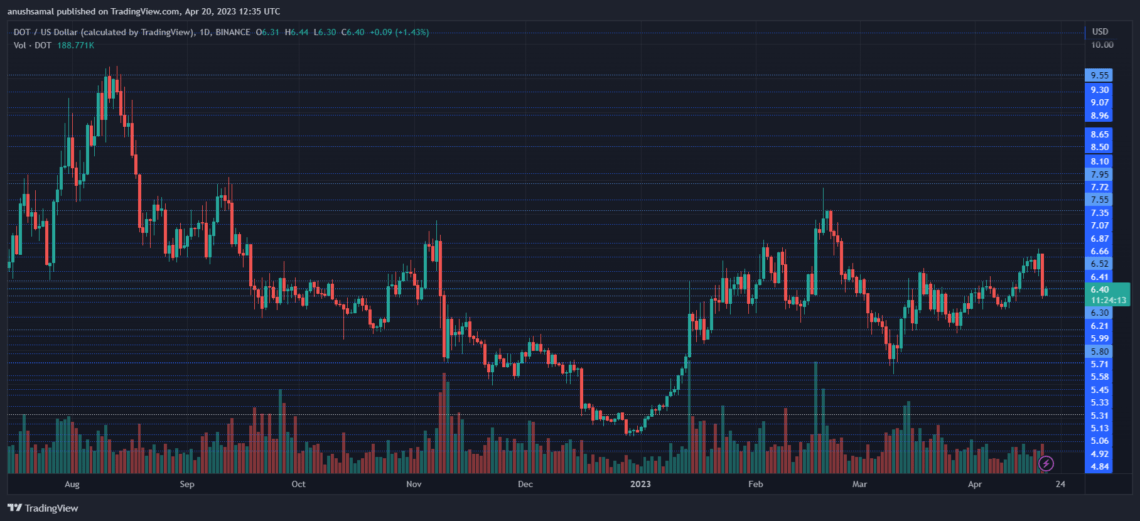

Polkadot price has been rallying for the past few days, but failed to sustain the momentum as the bulls’ advance stalled at pressure time. The altcoin has slumped 4% in the last 24 hours, causing almost 1% depreciation on the weekly timeframe, erasing most of the weekly gains.

The technical outlook for the DOT shows signs that the downtrend is increasing. It is currently trading below a key resistance level. The resistance level needs to be overcome for the bulls to experience some relief.

However, demand and accumulation remain low on the one-day chart, which is worrying. If the bears press again, Polkadot could drop directly to the local support level. The strength of the broader market will be crucial for Polkadot to regain its lost value.

What does technical analysis say about DOT?

Polkadot price is hovering around $6 with the overhead resistance of $6.60, a crucial level for the altcoin. This level had previously acted as a bearish block or sell zone. If the DOT manages to surpass the $6.60 price level, it could face another resistance at $6.80 before eventually reaching $7.

However, if it fails to break the overall ceiling, the next support levels will be $6 and then $5.80, respectively. The amount of DOT traded in the last session was in red, which indicates that demand has dropped. Overall, Polkadot price action is largely dependent on the ability to surpass the critical resistance level of $6.60.

Meanwhile, after a long hiatus, news of two new important partnerships came from Polkadot. cryptocoin.com We have included the details of Fetch.AI and Peaq partnership in this article.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.