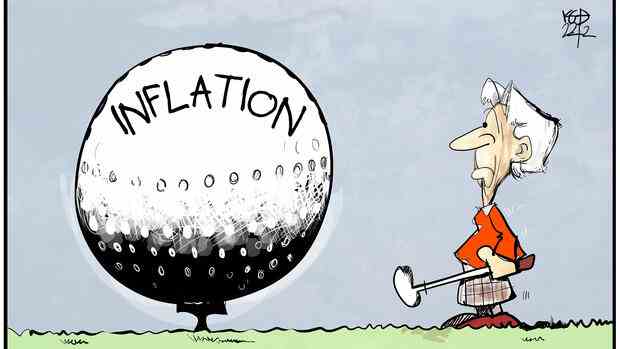

The year of inflation 2022 is coming to an end. And as if ordered, the percentages are softening somewhat, allowing central banks such as the European Central Bank (ECB) and the Fed in the US, as well as their counterparts in the UK and Switzerland, to slow down their rate hikes accordingly.

The ECB managed to scare the markets so badly with its tough rhetoric that prices plummeted. Apparently there was a great fear of appearing too soft.

The example shows that central banks should learn lessons from 2022. Here are a few suggestions.

First: In situations of upheaval, it is important to look more at the big picture than at mathematical models. The biggest pandemic since the “Spanish flu” temporarily brought entire productions to a standstill and was therefore extremely expensive. That this was followed by a surge in inflation is anything but surprising; but models are blind to historical events.

The same applies to the biggest war in Europe for more than 70 years. The criticism that the central banks could not prevent price increases is therefore often exaggerated. But they have to be accused of having seemed too careless with their rhetoric for too long.

Top jobs of the day

Find the best jobs now and

be notified by email.

Secondly: Investors and monetary politicians must not place too much trust in trends. As long as nothing unusual is happening, it is often helpful to recognize trends and orient yourself towards them. Since 2020, however, the thinking of monetary policymakers has been shaped too much by the long period of low inflation. And due to the construction, this also applied to their models.

>> Read here: According to experts, this is how real estate prices are developing

Third: In dramatic situations it is better to react too early than too late. Earlier interest rate hikes would not have prevented the rise in prices because monetary policy takes effect with a delay of around a year anyway. But they would have strengthened the credibility of the central banks.

Also, more importantly, they would have reduced the risk that monetary tightening would linger on for too long, causing unnecessary damage to economic growth. Exactly this danger exists now and has already prompted the central banks to slow down.

Fourth: The central banks must deal more openly with the fact that monetary policy works with a time lag. Significant interest rate increases signal determination and can dampen inflation expectations and thus the rise in wages and salaries. But they do not affect prices immediately.

Fifth: The central banks must be even more careful not to react too much to the capital markets and politics. The Fed had earned the reputation of stepping in as a savior in times of need in the event of large price losses.

“The coming year will show whether the central banks are on the right track”

The US Federal Reserve is also under pressure on this point because many Americans are dependent on the stock markets for their retirement provision. In order to free itself from this role, it then had to react particularly harshly when inflation rose.

And yet this week’s price reactions again show that the markets have too much faith that the central bank will soon be there to help them again. This is counterproductive: Higher rates mean looser financing conditions and thus less effective monetary tightening, so that the Fed has to readjust.

The ECB, on the other hand, is always in danger of being too conspicuous about the cohesion of the euro zone: that is the task of financial policy, which is happy to avoid it.

The coming year will show whether the central banks are on the right path – which they started a little too late in 2022.

More: Worry about wage-price spiral: Swiss central bank doubles the key interest rate