The key interest rate is currently in the extremely low range of 0.0 to 0.25 percent.

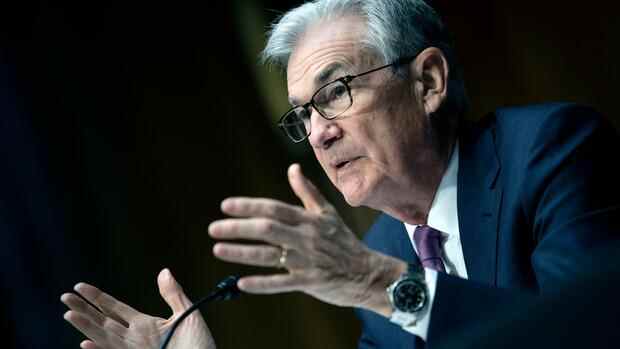

(Photo: AP)

Washington US Federal Reserve Chairman Jerome Powell expects the first interest rate hike since the beginning of the corona pandemic this month. In view of the high inflation and the extremely robust job market, he expects that at the next meeting of the Federal Reserve Board in two weeks it will be “appropriate” to raise the key interest rate, Powell said on Wednesday, according to a previously distributed speech at a hearing in the US House of Representatives say. The Federal Reserve (Fed) balance sheet, which has risen sharply due to corona aid programs, should only begin later in the year.

Powell and other Fed officials had previously indicated a first rate hike for March. Powell had not commented publicly on the matter since the beginning of the war in Ukraine. “In the short term, the impact of the invasion of Ukraine, sanctions and upcoming events on the US economy remains highly uncertain,” he said. The central bank will therefore monitor economic developments closely and react to them “skillfully”.

The Central Bank Council’s decision on a possible rate hike will be announced on March 16th. The key interest rate is still in the extremely low range of 0.0 to 0.25 percent. Observers consider an increase of 0.25 percentage points to be likely in March.

The US inflation rate rose to 7.5 percent year-on-year in January, the highest in decades. The Fed is aiming for an inflation rate of two percent in the medium term – a value that has been exceeded for many months. The unemployment rate was recently at a low four percent. The Fed is committed to price stability and full employment.

Top jobs of the day

Find the best jobs now and

be notified by email.

More: Central bank expert Adam Posen: “The Fed has lost its bet”