The key interest rate is currently in the extremely low range of 0.0 to 0.25 percent.

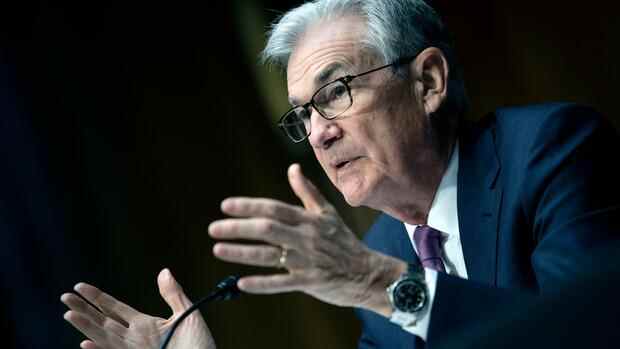

(Photo: AP)

Washington Jerome Powell stays on course. The head of the US Federal Reserve (Fed) wants to initiate a turnaround in interest rates in the US at the upcoming meeting in mid-March. Despite the current uncertainties surrounding the war in Ukraine, it is “probably appropriate” to continue, Powell said at a hearing before the US Congress on Wednesday.

“Inflation is too high,” he admitted. He prepared MEPs as well as investors for a new phase of uncertainty. After all, the situation in Russia and Ukraine will complicate the central bank’s strategy.

In view of an inflation rate of 7.5 percent recently, the Fed is under pressure to tighten its course and thus brace itself against the upward trend in prices. But the central bankers would have to be vigilant and ready to react quickly to unforeseen developments. Powell therefore left it open how quickly he believes the Fed should proceed.

After the Russian invasion of Ukraine interest rate fantasies on the financial markets had receded. While an unusually large step up of half a percentage point was initially expected, speculation is now merely that it will rise by a quarter of a point in March. Further rate hikes are likely to follow in the course of the year. The key interest rate is currently still in a corridor of zero to 0.25 percent.

Top jobs of the day

Find the best jobs now and

be notified by email.

According to LBBW economist Elmar Völker, the signs are now clearly pointing to an interest rate hike: “Today’s statements by the top US monetary authority were awaited with particular excitement because they were Powell’s first public statements on monetary policy since Russia invaded Ukraine.”

Speculations that the US Federal Reserve could shy away from the already clearly announced interest rate turnaround on March 16 in view of the resulting uncertainty seemed unfounded as things currently stand. “While there can be no certainty in the current extreme environment, the US Federal Reserve is too concerned with overheating US inflation to refrain from sending a clear signal to contain it.”

Otherwise, the Fed would run the risk of falling so far behind in fighting inflation that it would later have to shock the economy with an outright interest rate shock in order to rein in inflation. As a result, a recession would be almost inevitable, explained the economist. The impact of the coronavirus pandemic on the US economy is easing, according to Powell. He currently assumes that price increases will peak in the second half of the year.

However, lawmakers expressed concern about the Fed’s strategy. After all, their voters have long felt the significant rise in prices, both for groceries and for rent and petrol. The fact that prices will stop rising in a few months is not enough for many. After all, a decline in prices to the level before the pandemic is not to be expected anytime soon.

Powell urged patience. It will take time for prices to normalize. In addition, there is additional uncertainty due to the Ukraine war and the Russia sanctions, which could lead to shortages of certain raw materials and goods and to higher prices. It must be recognized that the economy is developing in an unexpected way. “We need to respond quickly to incoming data and the evolving outlook,” he said.

MEPs are also concerned about the increased risks of cyber attacks, specifically on the US banking system. Before the Ukraine war, Powell had signaled that cyber attacks are fundamentally a risk for the financial system. “We are doing everything we can to protect ourselves from these attacks,” the Fed chairman said. This also applies to the country’s major financial institutions. “And we will continue to be very vigilant.”

With agency material

More: Central bank expert Adam Posen: “The Fed has lost its bet”