“There is a growing risk that a prolonged period of high inflation could uncomfortably inflate longer-term expectations.”

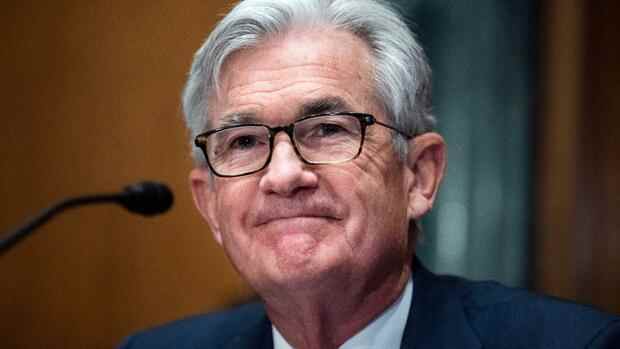

(Photo: AP)

new York The head of the US Federal Reserve (Fed), Jerome Powell, has brought up the possibility of faster increases in the key interest rate in view of the “much too high” inflation rate. The Fed could also raise interest rates by more than 0.25 percentage points at upcoming meetings of the Federal Reserve Board if needed, Powell said Monday, speaking at an Association for Business Economics (NABE) event.

“We will take the necessary steps to guarantee a return to price stability,” Powell said. “The job market is very strong and inflation is way too high,” added the Fed governor.

“There is an obvious need to act swiftly to bring monetary policy stance back to more neutral levels.” And then move to more hawkish levels if needed to restore stable prices.

The central bank completed the turnaround in interest rates last week and raised the key monetary policy rate by a quarter of a point to the new range of 0.25 to 0.50 percent. It was the first rate hike in three years. According to the head of the Fed, the US economy is strong enough to withstand a series of further interest rate hikes, despite the consequences of the Ukraine war.

Top jobs of the day

Find the best jobs now and

be notified by email.

Powell reiterated on Monday that the central bank could start trimming its balance sheet, which has been massively bloated by bond purchases, in May. US monetary authorities expect the Fed’s key interest rate to be around 2.8 percent by the end of next year.

Most Fed policymakers believe the neutral interest rate, which neither boosts nor slows economic growth, is somewhere between 2.25 percent and 2.5 percent.

US job vacancies at record high

The unemployment rate in the United States was 3.8 percent recently, and the number of vacancies is currently at a record high. However, inflation at the Fed’s preferred measure is now three times higher than the Fed’s 2% target.

This is also due to supply chain issues that have taken longer than most pundits expected to fix. These could also worsen if China reacts to new waves of COVID-19 with further lockdowns. In addition, the Russian invasion of Ukraine is pushing up oil prices, which threatens to fuel inflation further.

Powell warned that Russia’s war of aggression in Ukraine could have “significant consequences” for the global economy, including US growth. The extent of these effects is currently still “highly uncertain”. Both Russia and Ukraine are important raw material producers.

However, according to Powell, the US is now in a better position to withstand an oil shock than it was in the 1970s.

The economy is very strong and well positioned to face tighter monetary policy. Fed Chair Jerome Powell

“There is a growing risk that a prolonged period of high inflation could uncomfortably raise longer-term expectations,” the Fed-Cef warned. He expects inflation to fall to almost two percent in the next three years.

While a “soft landing” is not easy, there are many historical precedents. The Fed head is certain: “The economy is very strong and well positioned to handle tighter monetary policy.”

Increases in the key interest rate slow down demand. This helps bring down the rate of inflation, but it also weakens economic growth. It is therefore a balancing act for the central bank: it wants to raise interest rates so quickly and so much that inflation is slowed down – without stalling the economy and the labor market at the same time.

More: Investors worry about inflation – bond yields are rising significantly