Data received by digital asset manager CoinShares; While the cryptocurrency market is showing signs of recovery, institutional investors are heavily buying a popular altcoin, one of the main competitors to Bitcoin (BTC) and Ethereum.

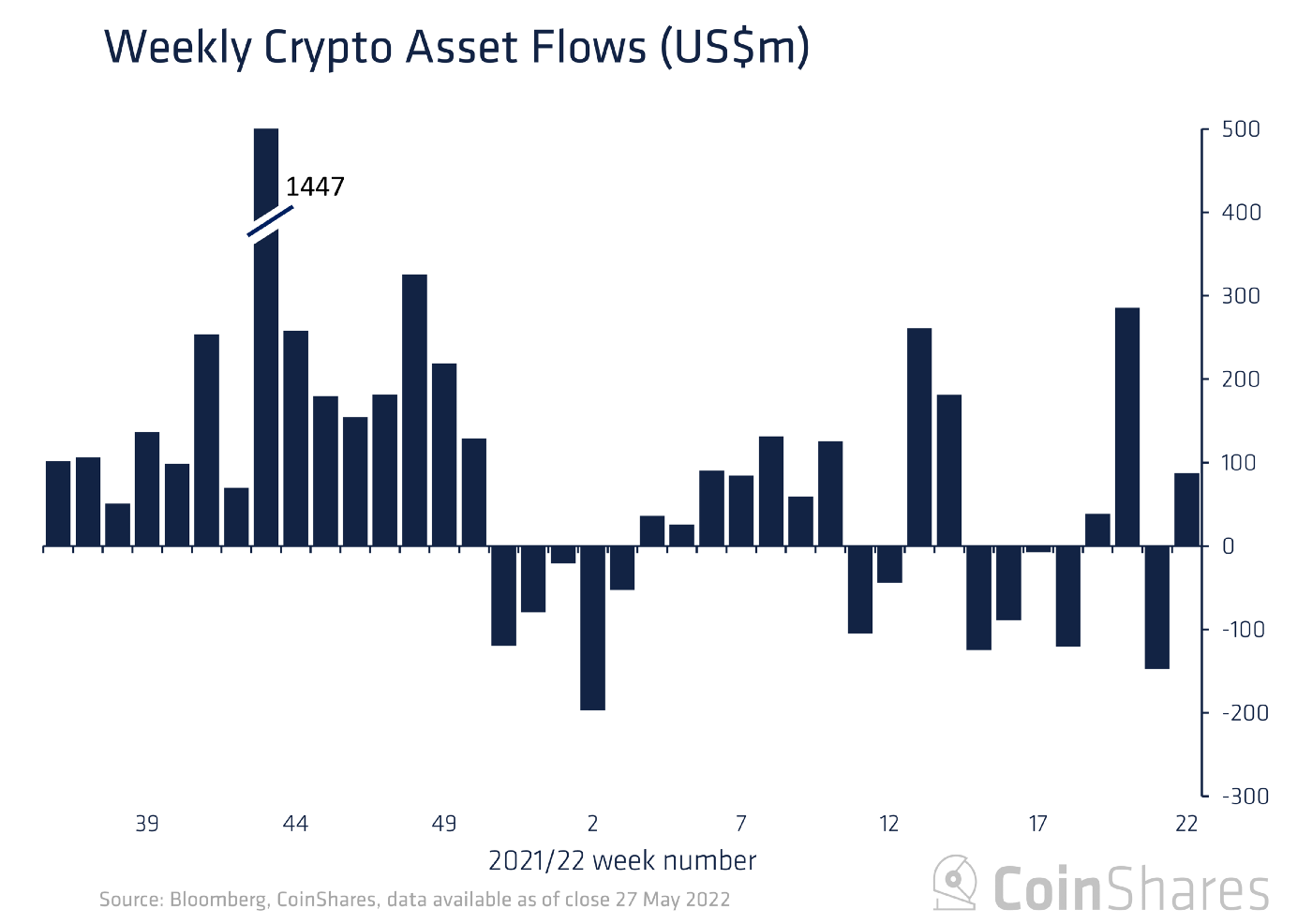

According to the latest Weekly Digital Asset Fund Flows report, CoinShares is benefiting from inflows of nearly $90 million in digital asset investment products last week, with the leading crypto asset Bitcoin making up the lion’s share of these inflows.

“Fund inflows in digital asset investment products reached $87 million last week, and inflows from the beginning of the year to date have exceeded half a billion dollars, reaching a total of 0.52 billion dollars.”

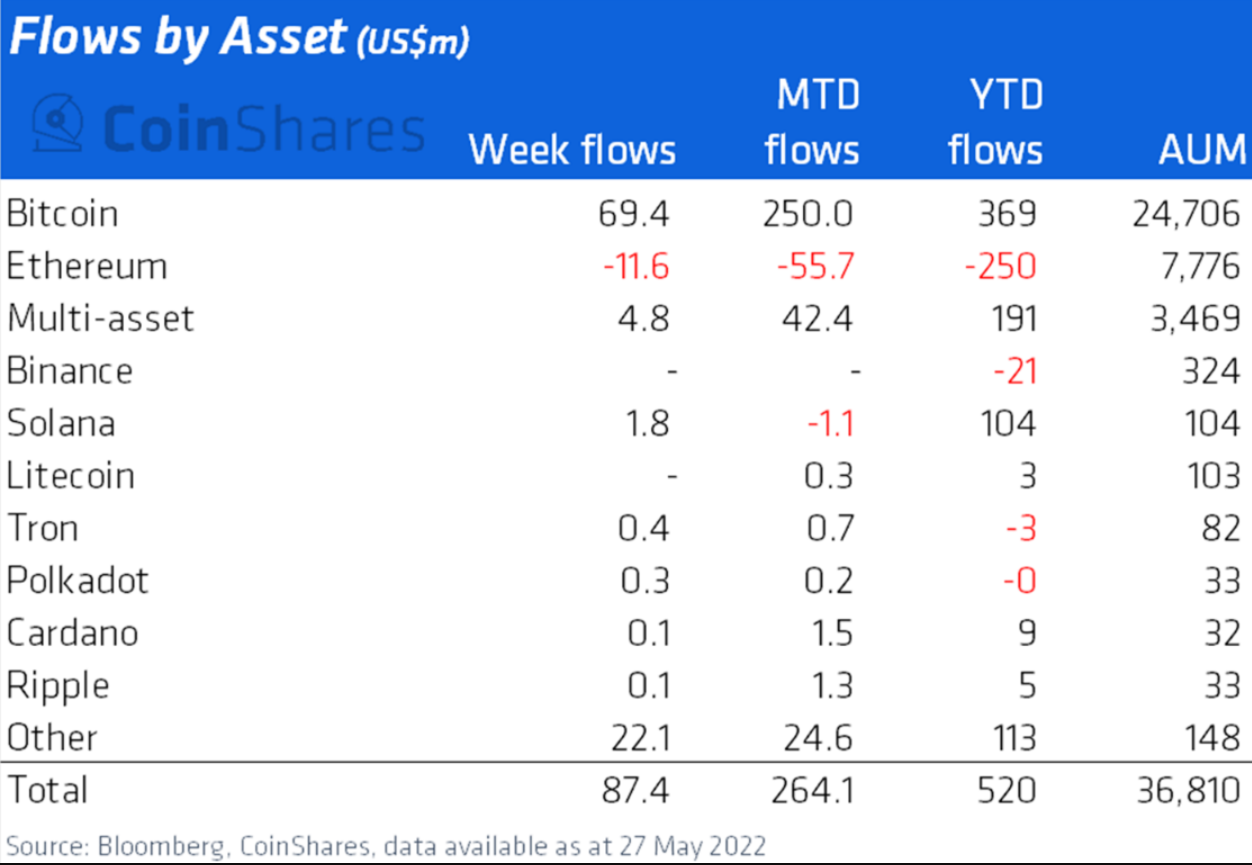

Bitcoin has seen a total of $69 million in fund inflows and has increased inflows to $369 million since the beginning of the year…”

Despite this cash flow, CoinShares still maintains that Bitcoin’s assets under management (AuM) It is at its lowest level since July last year.

For the first time in more than a month, both the North American and European regions saw inflows in digital asset institutional investment products, with cash flows of $72 million and $15.5 million respectively.

Ethereum products, on the other hand, had a very difficult time and lost $11.6 million last week, continuing the fund outflow trend experienced last week.

“Ethereum outperformed even lower last week with a total outflow of $11.6M, bringing year-to-date net outflows to $250M, which is in stark contrast to many other altcoins.”

Popular Ethereum competitor Algorand (ALGO) It exploded last week. According to the report shared by the company, the decentralized finance (DeFi) blockchain is facing a record $20 million in corporate investment inflows.

Tron (TRX), polkadot (DOT), cardano (ISLAND), wither (LEFT) and XRP Other blockchains, such as the blockchain, saw weekly inflows of $1.8 million, $0.4 million, $0.3 million, $0.1 million, and $0.1 million, respectively.

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.