Dusseldorf We have known each other for many years, met at the World Economic Forum in Davos or privately for birthdays. Now several well-known ex-CEOs from the German economy are founding their own company for corporate finance. You are dare to try the controversial model of the Spacs, i.e. the empty wallet – but with a new concept, as CEO Cornelius Baur emphasizes in an interview with the Handelsblatt.

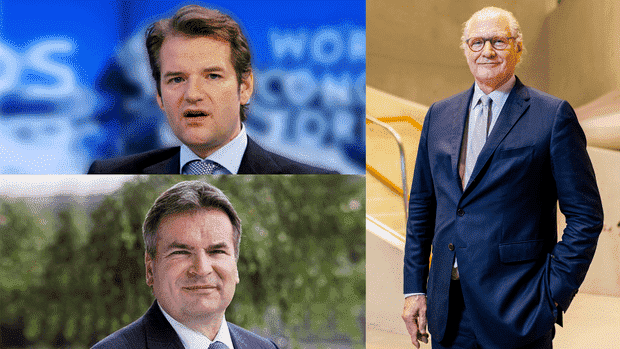

The former head of McKinsey Germany has brought together an illustrious group: On board alongside him are the former head of the Darmstadt-based pharmaceutical company Merck, Stefan Oschmann, the long-standing Qiagen CEO, Peer Schatz, and Axel Herberg, once CEO of the healthcare supplier Gerresheimer. Chairman will be the former Burda board member Stefan Winners, who brought the first German Spac to the Frankfurt Stock Exchange this year.

As so-called sponsors, they are behind the “European Healthcare Acquisition & Growth Company” (EHC), which is due to go public on the Amsterdam Stock Exchange this week. It is a shell company with no operational content, also known as the “Special Purpose Acquisition Company” (Spac).

Within two years, EHC is to take over a minority stake in a privately owned pharmaceutical company with a total value of one to two billion euros. After the merger of the two companies, it will become a global player. Baur has already created an image for this: “We see ourselves as a three-stage rocket, with the help of which a healthy and already profitable company can reach a new orbit.”

Top jobs of the day

Find the best jobs now and

be notified by email.

The steps look like this: 200 million euros in fresh equity is made available directly to the company. It is merging with EHC and thus virtually coming through the back door to a stock exchange listing with better access to the capital market and talent. Baur, Schatz and Oschmann then want to advise the company on its international expansion.

More than 100 target companies on the list

Their names and expertise in the pharmaceutical market have already sparked when they were recruiting for donors. For the IPO of the EHC, the books were already closed on Wednesday evening. According to the founders, the 200 million euros that have come together come from experienced European investors in the healthcare sector. The placement of the shares was overbooked according to the EHC.

They do not want to name any names, but there are numerous family offices – that is, asset management of entrepreneurial families. EHC is specifically looking for a family-run pharmaceutical company that has previously focused on a local market, but now needs capital and expertise for the necessary international expansion.

“After a rigorous market analysis, we have more than 100 exciting target companies on our list,” says Peer Schatz, who has led the diagnostics and biotech group Qiagen for many years, to Handelsblatt. There are no start-ups or pharmaceutical companies in the early research phase. It is realistic that EHC will invest in an established laboratory supplier for the biotech industry or a diagnostics provider.

In contrast to the model of a private equity company, the EHC concept does not aim to take complete control of a company. The previous owner should rather remain engaged as the main owner, while EHC only takes a minority stake.

The EHC managers had heated debates among themselves as to whether a Spac is the right model for their plans as an investor. Because the hype surrounding these stock market vehicles has meanwhile given way to a wave of criticism and disappointment.

Image cultivation for Spacs

The idea for “Special Purpose Acquisition Companies” was developed primarily by hedge funds in the USA. They were looking for a new way to quickly exit bridging finance with the highest possible return. They succeeded in doing this in many cases as Spac sponsors when they cashed in and said goodbye at the time of the merger with the acquired company. The bill was paid by the investors, because the prices of the respective companies fell sharply.

Ex-McKinsey boss Baur knows about the concerns. “There have been companies going public in the US that weren’t worth the money,” he says. “That spoiled the reputation of the Spacs and that’s why we developed a completely different concept.” EHC is to become a European Spac counterpart with long-term oriented partners.

In contrast to American Spacs, the sponsors want to get involved in the newly created company later: Baur with his McKinsey experience, the others with their knowledge as a pharmaceutical manager. “We will be measured by the fact that the company creates long-term value. We sponsors will only benefit if the share price rises significantly after the merger. “

In the course of the IPO, EHC issued a total of 20 million shares at a price of ten euros per share. For every three shares, investors also receive an option to purchase another share at a price of EUR 11.50. These warrants are listed separately on the Amsterdam Stock Exchange.

The sponsors bring 11.6 million euros in risk capital from their own coffers into the company. This capital is intended to finance the costs of the IPO and the costs of selecting and examining potential merger targets. The 200 million euros from the IPO will initially be parked in a trust account.

Sponsors see themselves as pioneers

The founders receive a total of around 6.67 million shares for 1.47 million euros (at a price of 0.22 euros per share) and also acquire options for another 6.7 million euros for 10.1 million euros Shares. Schatz, Oschmann & Co will therefore initially have a 25 percent stake in the company. If all option rights are exercised, their share can theoretically increase to 33 percent.

In order to underline the long-term commitment, however, their shares will only be converted into regularly tradable shares after a merger has been completed and then depending on the price increases achieved. In addition, holding periods of six months to one year apply to these shares.

Baur sees EHC as the only European Healthcare Spac so far – and an innovation in the concept with entrepreneurially oriented sponsors. “If we are successful, we will help more companies in Europe to access market capital more easily using a Spac vehicle. Then they can grow faster, ”he says with conviction.

More: Money for green business – Ex-CEO of Klöckner & Co. is planning Spac IPO in Frankfurt