Munich Europe’s ambitious targets for chip production are in jeopardy because there is a lack of suitable workers. According to calculations by the consulting company PwC Strategy&, which are exclusively available to the Handelsblatt, more than every second position in the industry could remain vacant in 2030.

PwC Strategy& warns that by the end of the decade Europe will need 350,000 employees to double the world market share for semiconductors to 20 percent, as the EU Commission is aiming for. Manufacturers are currently building rows of new chip factories for this purpose. Just a few days ago, the EU Parliament cleared the way for the European chip law, which is intended to enable 43 billion euros in support for the industry.

In the fight for skilled workers, however, the industry has so far not been attractive enough. “The chip companies have to position their jobs like a product. Many companies are still a long way from that,” says Dieter Kern, Partner at PwC Strategy&.

However, not only the companies are challenged. The states must also have an interest in producing more suitable candidates for the many jobs. Because numerous countries in the EU are promoting the construction of the new plants with billions in taxpayers’ money. The US group Intel alone is to receive almost ten billion euros for its planned factories in Magdeburg.

To ensure that the huge new buildings do not turn into investment ruins, a large number of staff are needed. Intel wants to create 3000 jobs in Saxony-Anhalt. The Federal Ministry of Economics estimates that for every job in the actual semiconductor production, an average of more than five additional jobs are created at suppliers. All in all, the companies are creating almost 20,000 jobs.

The US group wants to create 3,000 jobs in Magdeburg. At the same time, at least 15,000 new jobs will be created at suppliers.

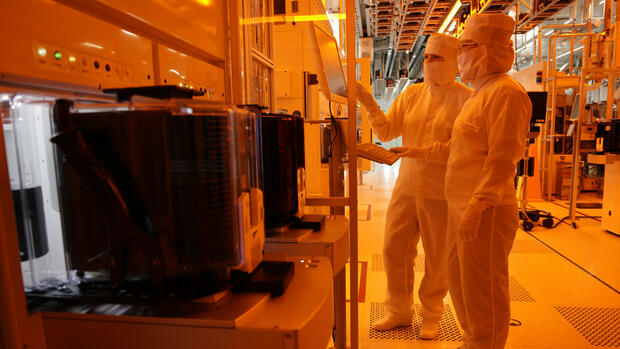

(Photo: Intel)

But that’s not all: In the Dresden region alone, around 100,000 high-tech jobs will be available by 2030, according to estimates by the industry association Silicon Saxony. That’s a good 30 percent more than today. The Saxon state capital is the most important location for semiconductor production in Europe.

The Dax group Infineon is currently building a new plant on the Elbe for five billion euros, with the state contributing a fifth of the sum. At the same time, Bosch and Globalfoundries are expanding their so-called fabs in Dresden. In addition, everything looks as if the Taiwanese contract manufacturer TSMC will soon be settling in Dresden.

However, the industry is already unable to fill many jobs. In a study commissioned by the BDI and ZVEI, the German Economic Institute (IW) recently determined that there is a shortage of 62,000 skilled workers in the semiconductor industry in Germany. There is a particular lack of candidates from electrical engineering, mechatronics and software development.

Chip factories never stand still

Unfavorable for the manufacturers: They are dependent on shift work, which is unpopular with many people. Semiconductor fabs operate 24 hours a day, all year round. But that’s not all: the works themselves also put many people off. “The clean room is a hurdle,” says expert Kern. The employees are forced to change clothes in order to get to their workplaces in areas that are strictly shielded from the environment.

>>Read here: The hardware of the future for AI could come from Europe

The chip companies must therefore make a special effort to attract employees. According to the experts at the IW, companies should increasingly explicitly address all genders, because women are severely underrepresented in industry. They also suggest working from home for manufacturing jobs. Systems can now also be controlled remotely.

“We have to focus much more on the needs of women, career changers and young people than before, and we shouldn’t be afraid of unusual solutions,” says Gunther Kegel, President of the ZVEI industry association.

However, that alone should not be enough. Higher salaries are also needed. “Payment at the chip companies is often not yet competitive with Big Tech,” says Tanjeff Schadt, semiconductor expert at PwC Strategy&. In plain language: Instead of working for Bosch or Infineon, the chip specialists can also work for more money at Amazon, Apple or Google.

Silicon Saxony relies on immigration

The industry is well aware that it cannot wait and see. With four million euros in funding from the EU, the industry association Semi therefore founded the “European Chips Skills Academy” in the spring; it is scheduled to start in the fall. “With the semiconductor industry growing rapidly in Europe and globally in the coming years, we must rapidly scale up education efforts in the region,” said Laith Altimime, President of Semi Europe. The needs of companies can only be met if there are enough qualified workers. Among others, Infineon and the TU Dresden will be there.

>>Read here: Europe’s decade-long slumber with computer chips is now taking its revenge

In addition, chip specialists are to be attracted from other parts of the world. “We rely on immigration, we need people from outside,” said Saxony’s Prime Minister Michael Kretschmer at the groundbreaking ceremony for the new Infineon factory in Dresden in spring.

Meanwhile, Wolfspeed has taken a rather unusual path. The US group is deliberately settling its new factory in Saarland, in an area that has nothing to do with semiconductors. Wolfspeed has teamed up there with the automotive supplier ZF, which has almost 10,000 employees in Saarland. “The most important thing for us is that we get access to staff from our partner ZF and from the region,” CEO Gregg Lowe told the Handelsblatt at the beginning of the year. By the time the plant opens in 2027, Wolfspeed would hire and train several hundred people from ZF.

However, most industry observers assume that Wolfspeed will remain an isolated case – and that companies with new factories will tend to settle at existing semiconductor sites. There’s a competition for heads there. But the advantages outweigh the disadvantages, believes Ondrej Burkacky from the consulting firm McKinsey. “A chip cluster like Dresden has a self-reinforcing effect. This is likely to have an impact on the workforce, among other things. Such a location is attractive for them, not least because they have good opportunities to change jobs.”

More: Chip dispute between the West and China escalates.