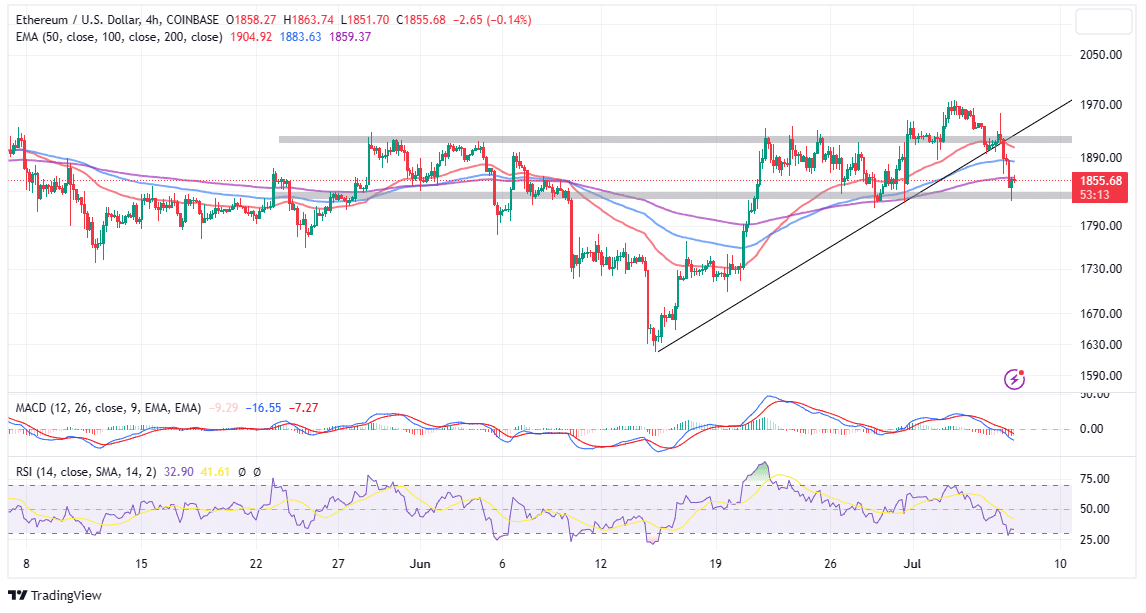

Ethereum The price faced the resistance at $1,950, the uptrend that spread throughout July. Initially, the rejection was gradual, with ETH returning at $1,920.

However, the bearish waves that swept the market on Thursday plunged Ethereum below $1,900. It only managed to hold on to the $1,825 support.

As reported in the Bitcoin price forecast, several economic indicators released this week did not sit well with investors worried that the Federal Reserve’s hawkish stance on inflation could plunge the United States into severe inflation.

The bulls are struggling to recoup about 3.5% of the losses that occurred within 24 hours. On the other hand, ETH price started trading at $1,856 at the time of writing.

Is Ethereum Price Ready to Rebound?

Crypto Market sentiment is still bullish as institutional investors reassure retail investors of a possible breakout to $2,000 and $2,200.

Similarly, the strong buyer congestion zone above $1,820 means more losses will be restrained. Therefore, it is possible that this drop will offer investors a chance to buy ETH at a lower price.

Investors seeking opportunities for exposure to ETH longs are likely to want to make sure certain conditions are met. For example, the Moving Average Convergence Divergence (MACD) indicator should confirm a buy signal.

If the momentum indicator is below the mean line (0.00), traders will watch out for the blue MACD line to rise above the red signal line.

Meanwhile, a break and hold above the immediate hurdle laid out by the 200-day Exponential Moving Average (EMA) will be required to confirm the breakout. This move should be accompanied by an increase in trading volume as traders trigger buy orders.

It is possible that some traders would prefer to book conservative profits at $1,890. However, those stubbornly bullish can wait until ETH retests the $1,900 resistance. Other key levels to watch out for on the upside include the 100-day EMA (in blue) at $1,883 and the 50-day EMA (in red) at $1,904.

Ethereum Fundamentals Are Healthy and Growing

To Santiment’s news according toThere has been an interesting shift in the growth of the Ethereum network this week. However, “new addresses were created at an accelerating rate”. This development pushed the network growth metric to over 550K newly created addresses.

📈 #Ethereum‘s network growth has somewhat quietly been on the rise. New addresses are being created at an increased pace, which is a signal for eventual market cap growth. We’ll monitor this #bullish divergence as $ETH ranges just below $1,900. https://t.co/TpiOUGgYGl pic.twitter.com/B0SrlrsrmB

— Santiment (@santimentfeed) July 6, 2023

According to Santiment, the increase in the number of newly created addresses is “a signal for eventual market value growth.” In other words, it marks an expected increase in ETH demand as investors double their bullish efforts.

However, buying the dip could offer a profitable entry point as ETH starts another recovery targeting the $2,000 and $2,200 price points.