Ethereum (ETH) expects a significant improvement with the Dencun update, which aims to increase the scalability of the network. However, with this expectation, experienced crypto asset trading firm QCP Capital points out a possible change in ETH’s price trajectory.

According to the firm’s analysis, a shift in Ethereum “risk reversals” is observed, resulting in a negative trend for future maturities. This signals increased concerns about a possible decline in the price of ETH, as a negative risk reversal indicates that the market is taking precautions against the decline.

In particular, with this trend, those speculating on price increases are seeing increased interest in put options, which protect against potential losses. Likewise, large altcoin market participants are following similar strategies to hedge and reduce risks on their investments in Ethereum.

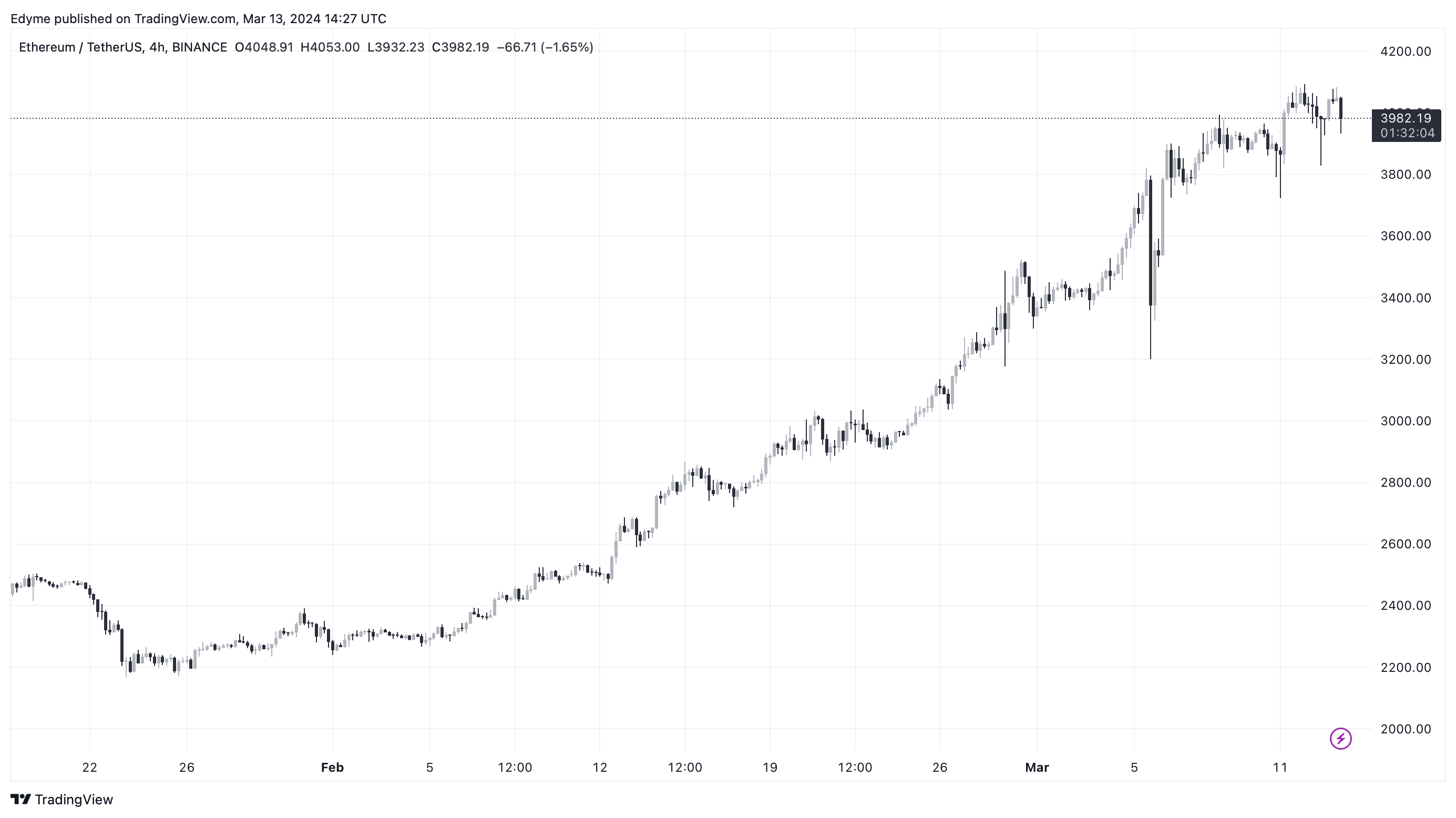

QCP Capital’s assessments of market dynamics highlight a key concern regarding Ethereum’s price stability, especially given the impact of leverage in the market. According to the company, there may be strong buying interest in the event of any price decline, but we should not ignore the possibility of a potential market correction.

Additionally, Ethereum’s spot-forward spreads have decreased slightly, unlike Bitcoin. This shows that sharp declines in the spot price, along with the decrease in long-term leverage, can also reduce forward spreads.

When it comes to Ethereum’s performance and outlook, it continues to be a solid performer in the crypto market. However, it does not reflect the significant increase that Bitcoin experienced following the approval of the spot Exchange Traded Fund and points to a more measured pace of appreciation.