Ethereum (ETH) The price, like other assets in the cryptocurrency markets, suffered from the big crash late Friday towards Saturday morning and experienced a huge drop. The price has lost about 17%. Later on Saturday, the buying pressure in Ethereum managed to close the 17% depreciation very quickly.

The Ethereum price performance on Saturday was spectacular. Considering that most of the altcoin market is down between fifteen and twenty percent, Ethereum’s daily close of just 4 percent is prime evidence of how strong it still is.

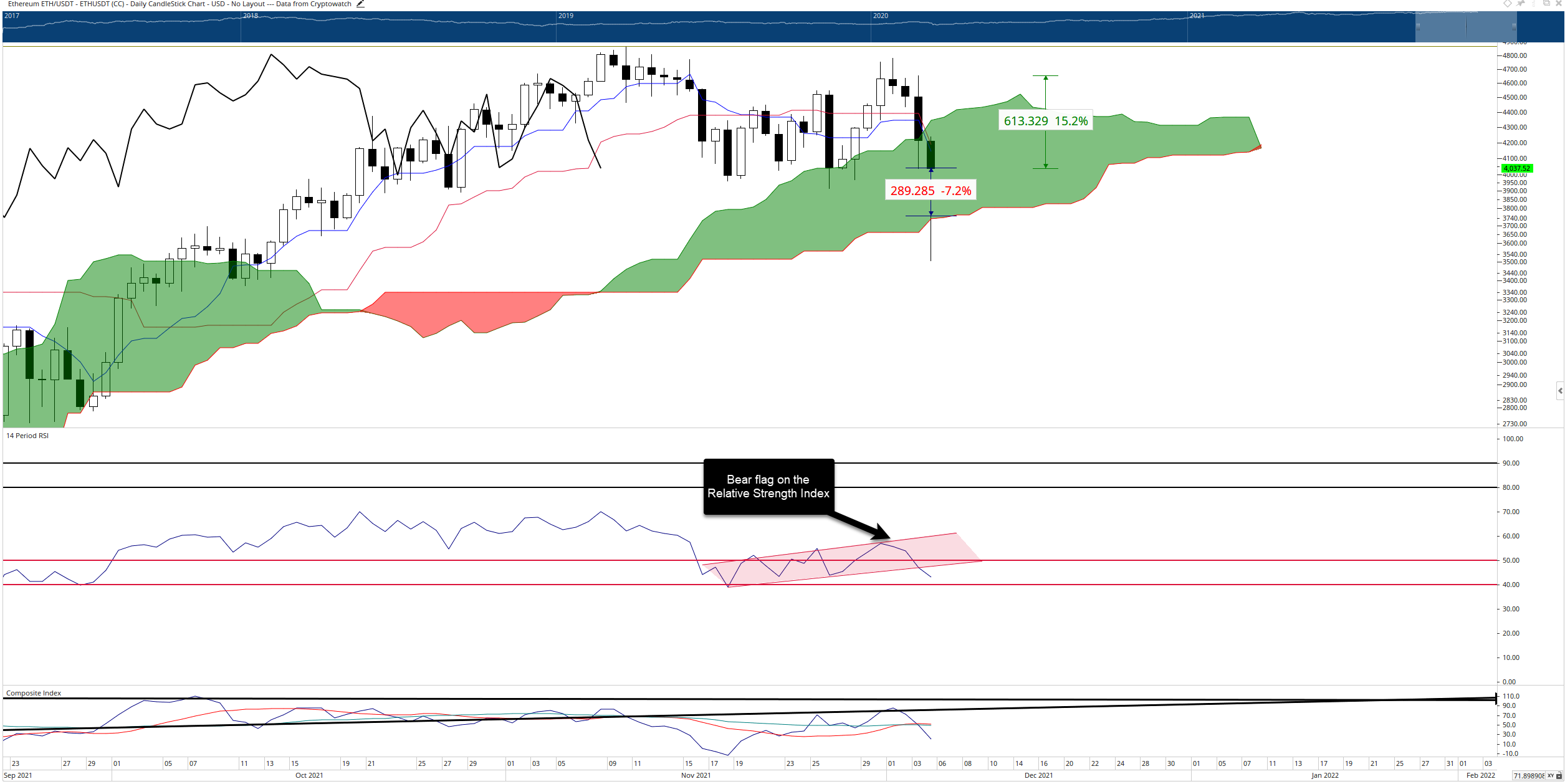

Ethereum The two main support levels keeping the price high are the Senkou Span B at $3,700 and the $3,410 level where the third highest volume node in the 2021 Volume Profile is located. While it is quite upside in the short term, indecision remains and downside risks remain.

Despite the massive recovery, Ethereum price remains in the daily “cloud,” an area full of volatility, volatility, and volatility. The cloud represents where trading accounts will die. Etheruem needs a daily close at or above the $4,650 price level to turn into a full-blown bull market.

Ethereum price is trending more bearish here, especially with the “Chikou Span” below the candles and in the open. In addition to the bearish outlook, we would also like to point out that there was a bear flag breakout in the Relative Strength Index. However, the recent oversold level at 40 on the Relative Strength Index may provide some support.

bears, Ethereum (ETH) The threshold that must be reached to turn the price into a “bear market” is a much more manageable price range than to turn it into a bull market. For example, Ethereum needs a 15% move above $4,000 to turn into a bull market, while short sellers only need a 7% move below $4,000 to turn Ethereum into a bear market.

Any daily close at $3,700 or below will position Ethereum “below the cloud” and in bear market territory.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.