Ethereum Classic (ETC) rose more than 200% in July, leaving behind its strongest gain. After this rise, many questions remained in the minds of ETC investors. Should ETC holdings be sold or should they hold and wait for more upside? Although it is difficult to give a clear answer on this subject, you can find some details that can guide you in the rest of our news.

After gaining 244% in July, ETC faced resistance just above the 0.786 Fibonacci retracement level.

This was the biggest comeback since the start of the bear market in 2021, but some investors have already left the market taking profits. After the sales, the price lost 28% of its value. Of course, after the great upward move, this decline is acceptable.

Despite the bearish trend, Ethereum Classic continues to be in good demand in the first week of August. Trading at $37.59, ETC has registered a 17% rally in the past two days after bouncing from the 0.5 Fibonacci level.

This is a significant development confirming that ETC is still experiencing healthy demand and, more importantly, relatively low selling pressure at its current level.

What Should Ethereum Classic Investors Do?

The developments we’ve talked about so far suggest that Ethereum Classic could hold the price level above $30 and potentially find more upside moves.

Naturally, this development will encourage investors to invest. The last rally Proof of Work This may have been supported by the expectation that many investors and miners who prefer the consensus will switch to Ethereum Classic.

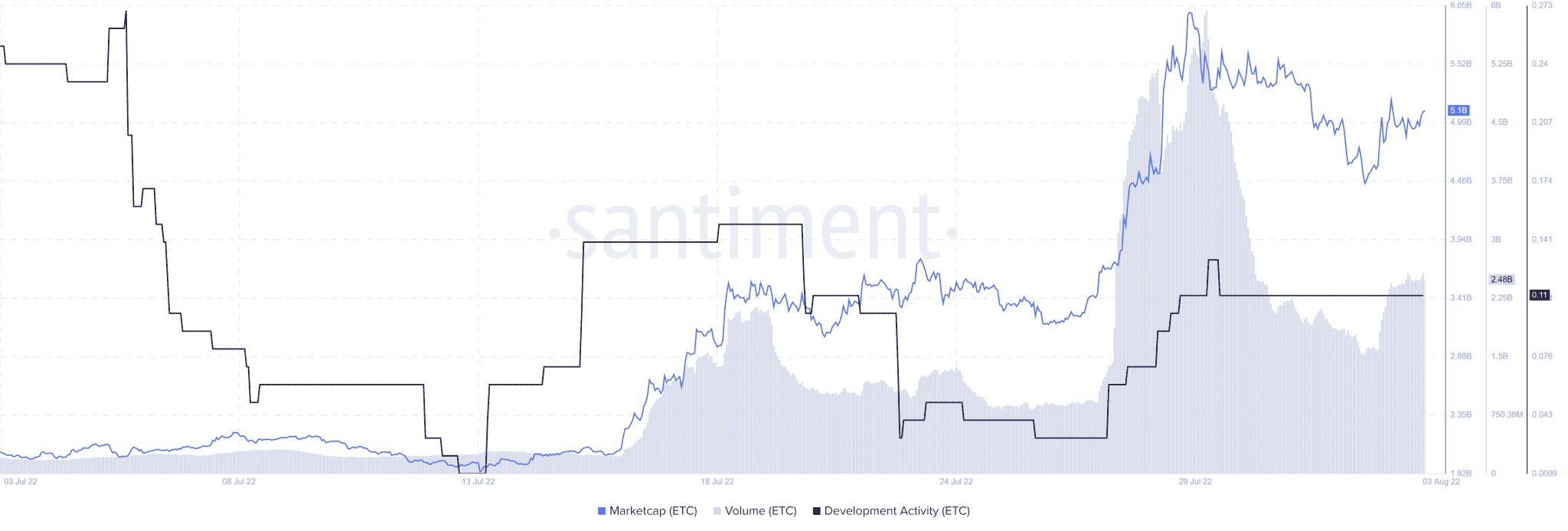

Ethereum Classic’s market cap growth confirms a strong capital flow, especially since mid-July. Its market capitalization doubled from less than $2 billion in mid-July to $5.9 billion by July 29. The network has also experienced a healthy increase in development activity, thus contributing to increased investor sentiment.

While the healthy developments experienced can provide an increase in sensitivity, positive developments in the markets will also find a response on the side of Ethereum Classic.

On the other hand, if the bears regain the dominance, they could destroy the gains of ETC. ETC’s strong rise in July is a testament to the strong demand the cryptocurrency has received after the previous heavy bearish period.

The crypto market generally showed bullish strength, but a similar result emerged in the second half of March. Therefore, investors should act with caution in case a similar outcome occurs.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.