Almost two thirds of the companies in the electronics industry consider the direct consequence of a gas supply stop to be manageable.

(Photo: dpa)

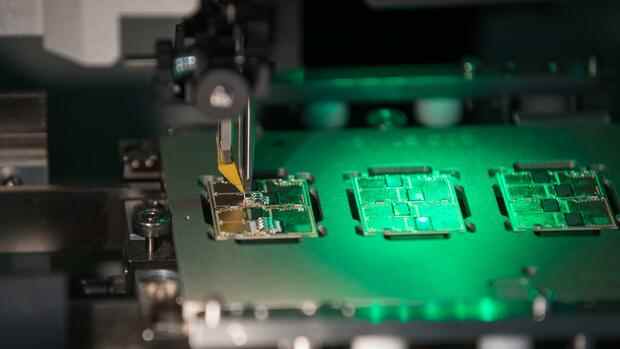

Dusseldorf Semiconductors, plastics, metal parts – there is currently hardly any material that would not be affected by supply bottlenecks in view of the aftermath of the corona pandemic and the upheavals on the global energy markets as a result of the Ukraine war.

The German electrical industry is also feeling the effects: According to a survey by the Association of the Electrical and Digital Industry (ZVEI), which is available exclusively to the Handelsblatt, 61 percent of members are currently expecting a further tightening of the supply for certain upstream services.

The industry believes that it is resilient to a possible energy boycott against Russia. 62 percent of the companies surveyed consider a possible gas supply stop by Russia to be “manageable”. However, 51 percent expect production losses if Germany has to do without Russian gas as a result of the war. 22 percent do not expect any serious effects. Only 13 percent fear damage to the production facilities.

“Our industry is only energy-intensive in a few areas, such as the manufacture of cables, batteries and semiconductors,” said Wolfgang Weber, Managing Director of the ZVEI, the Handelsblatt. Nevertheless, there is concern about economic damage (60 percent of those surveyed) if suppliers of gas supplies are excluded.

Top jobs of the day

Find the best jobs now and

be notified by email.

Energy supply stop would affect suppliers

Many fear that an energy boycott against Russia would also affect upstream industries, for example in the plastics or metals sector. “At this point in time, such a boycott would set back the German economy considerably,” said Weber. “Such a step would therefore have to be considered extremely carefully and weighed against other more effective options against the Russian war machine, for example on the export side.”

Many companies from the electrical and digital industry still see scope for export sanctions, which currently only affect 47 percent of companies. As a result, 52 percent restrict their business in Russia more than the sanctions require. According to Weber, this shows the industry’s great support for the federal government’s measures.

The most recent trade barriers hit most companies in the industry in a position of strength: during the pandemic year 2021, incoming orders in the German electronics industry had already grown in double digits at 24 percent. For 2022, the ZVEI expects an increase in production of four percent – even if the forecast is currently subject to great uncertainty due to the dynamic environment.

>>> Read about this: Green hydrogen is cheaper than hydrogen from natural gas for the first time

The industry hopes that the efforts of the European governments to reduce Russian energy supplies in the long term will give them momentum. “With or without an energy boycott, we will make ourselves independent of Russian energy and fossil energy imports as quickly as possible in the long term,” said Weber. Accelerated electrification and digitization as well as renewable energies play a special role here.

The companies are hoping for financial support from the federal government, for example in the form of grants for energy costs (62 percent) and tax breaks (53 percent). Weber also points out the importance of investment subsidies: “What is missing in many cases is planning security because of the financing – for example, the expansion of semiconductor production in Europe is currently stagnating because important funding commitments from the federal government are missing.”

More: ECB observers double their inflation forecast for this year.