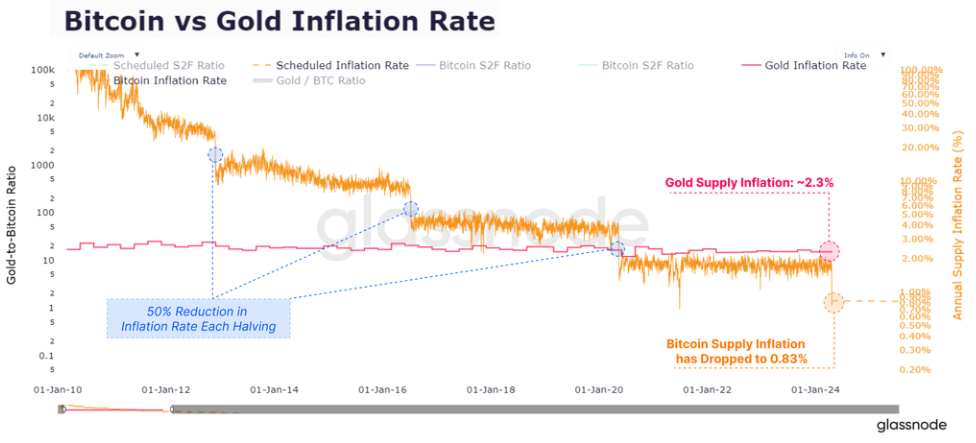

Bitcoin has successfully completed its highly anticipated 4th halving event. After this, experts began to discuss the effects of BTC scarcity. Analysis firm Glassnode says that after the recent fourth halving, Bitcoin has surpassed gold in terms of issuance scarcity. Well what does it mean?

Bitcoin is now more scarce than gold!

cryptokoin.comAs you follow from , Bitcoin stabilized at $66,000 after the successful halving. It remains a matter of curiosity what the effects of this important event will be. According to analysts at analysis firm Glassnode, Bitcoin’s fourth halving event worked in terms of BTC’s issuance scarcity. Because, Bitcoin has surpassed the safe haven gold in this regard. In this context, analysts shared the following assessment:

The fourth halving marks a significant turning point in Bitcoin’s comparison with gold, as it marks the first time in history that Bitcoin’s steady-state issuance rate (0.83%) becomes lower than that of gold (about 2.3%). Thus, it marks a historic handover in the title of the scarcest asset.

BTC’s issuance rate has fallen below gold’s long-term supply increase

Analysts state in the report that during last Saturday’s halving, the block subsidy dropped from 6.25 BTC to 3,125 BTC per block, or approximately 450 Bitcoins were issued per day. This observation is also noted by Ark Investment Management analyst Yassine Elmandjra. Elmandjra wrote in this week’s Ark Disrupt newsletter that “following the halving, Bitcoin’s issuance rate fell below gold’s long-term supply increase.”

Elmandjra noted that the annual issuance rate of gold is lower than the rate stated in the Glassnode report. However, he noted that it was still significantly higher than the annual post-halving Bitcoin supply increase from block rewards. In this regard, the analyst made the following statement:

Last Friday, Bitcoin supply growth halved for the fourth time in history, dropping from 1.8% annually to around 0.9%. As a result, Bitcoin’s supply growth has fallen below that of gold, which is predicted to be around 1.7% in 2023 long-term.

Glassnode: BTC supply decreases over cycles too!

However, Glassnode analysts explained that the impact of Bitcoin halving events on the current supply of traded BTC may be decreasing over the cycles, not only due to the decrease in coins mined, but also due to the expansion of the size of the asset and the ecosystem around it.

Meanwhile, according to the latest data, Bitcoin was trading at $66,141, down 0.34% in the last 24 hours. The leading altcoin Ethereum increased by 1.52% to $ 3,250 in the same period. Total crypto market cap increased by 0.14% in the last 24 hours. Thus, it stands at $2.44 trillion at the time of writing.

To be instantly informed about the latest developments, contact us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!