Leading economists and financial experts, leading cryptocurrency Bitcoin He believes that the price will make a significant move by 2025. A report published on Finder by Frank Corve shows that participants expect the BTC price to be $87,000 by 2025. Expectations range up to $220,000 in 2030. Here are the critical details of the noteworthy report.

As Koinfinans.com reported, expectations were at higher levels in a similar report published in July. Financial experts interviewed predict that Bitcoin will be at $30,463 by the end of 2023. This represents an 11% loss from current prices of $34,260 on October 26.

The main reason behind the bullish predictions is wider institutional adoption, technological advancements and increasing recognition of digital assets in the traditional financial sector. Experts credit Bitcoin’s increasing mainstream integration and evolving network technology for their positive predictions, contributing to its widespread adoption and greater market stability.

While 14 out of 30 participants believe that the lowest price BTC can reach by the end of 2023 is between $22,500 and $25,000, 9 out of 30 participants believe that BTC could drop to $17,500 by the end of the year. On the other hand, 13 out of 30 people surveyed do not believe that BTC will trade above $ 30,000 as the highest price, while 7 out of 30 people think that the leading cryptocurrency will break the psychological resistance of $ 35,000 for the rest of this year.

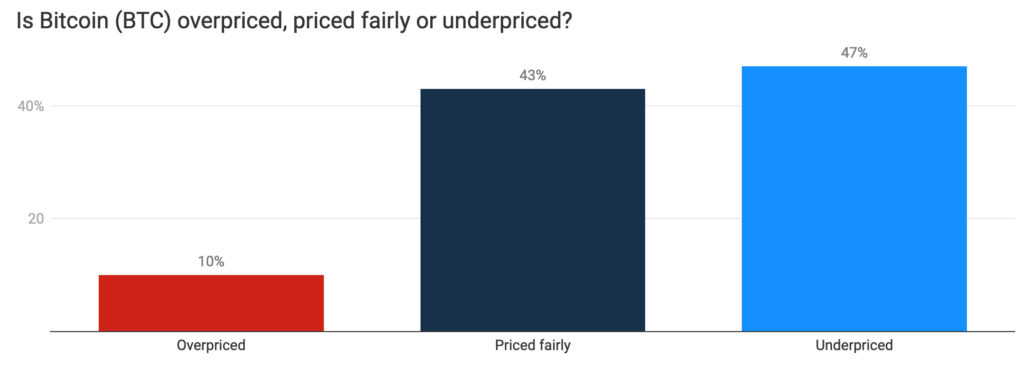

However, almost half of financial experts believe that the price of Bitcoin is either trading lower (47%) or at its fair value (43%). Only 10% of respondents think BTC may be overpriced.

Despite these differing opinions, it is notable that the majority of experts are bullish on Bitcoin’s long-term trajectory. According to Finder’s research, more than three-quarters of respondents believe now is the time to buy BTC.

However, this optimism does not ignore ongoing concerns about Bitcoin’s structural weaknesses and macroeconomic challenges. Fundamental technological issues such as volatility, regulatory uncertainty, economic recessions, and scalability are considered obstacles that could hinder Bitcoin’s growth trajectory.

We live in highly unpredictable geopolitical and economic conditions where recession remains a significant risk, predictions are difficult to make in the current macroeconomic environment, and those who argue otherwise are probably hopelessly overconfident.

– Pav Hundal, chief market analyst at Swyftx

Bitcoin Price Prediction for 2025

The study continues to highlight Bitcoin’s future potential, with experts mostly highlighting two related events. Approval of a spot Bitcoin ETF by the SEC and halving of Bitcoin’s block subsidy by April 2024. According to Finder’s participants, both events could bring higher prices for BTC.

However, not all panelists were so optimistic about the halving:

The effects of Bitcoin’s halving on the price have weakened over time for two reasons. The first is that the supply of new Bitcoins to the market decreases over time compared to the existing supply of Bitcoins, causing the impact of mining on the price to weaken. The other reason is, [Bitcoin’in] When market capitalization reaches trillions of dollars, it accounts for a significant fraction of the size of the world economy, limiting room for further growth.

– Ruadhan O, creator of Seasonal Tokens

Interestingly, 4 out of 5 analysts are spot Bitcoin ETFHe believes it will be approved by the end of 2024. In addition, 60% agree that this event will increase the BTC price by 2025, while 47% are quite optimistic and predict that if this happens, the leading cryptocurrency will break its current all-time high earlier than the end of 2025.

As a result, although the majority of experts believe that Bitcoin’s price will rise towards 2025, the inherent volatility of the cryptocurrency should not be forgotten. As with all investments, potential investors are advised to do their research and exercise caution.