A closely-followed crypto analyst has addressed Ethereum (ETH) and its two biggest rivals as the digital asset markets see a new leap forward.

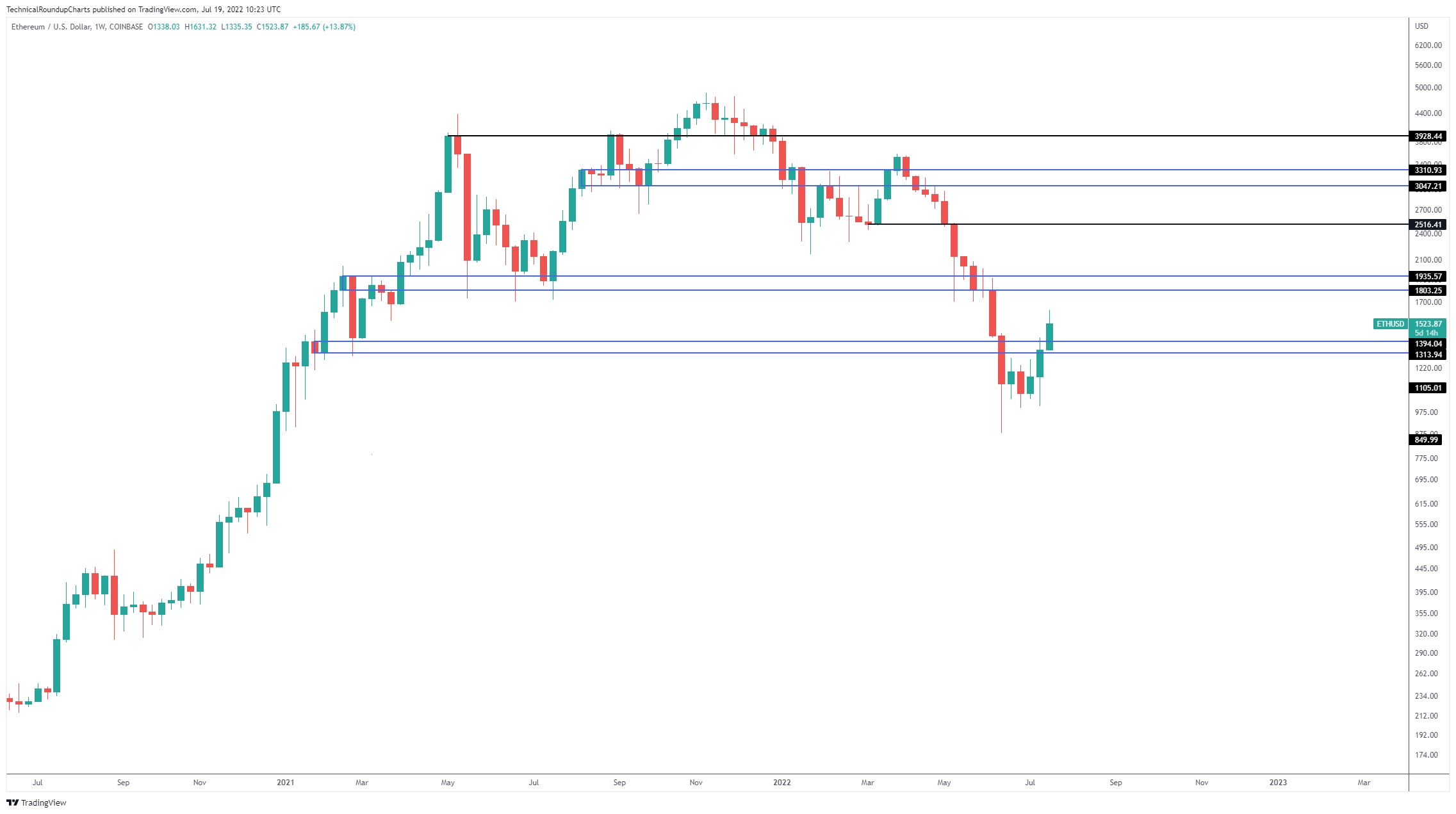

In the latest news release from TechnicalRoundup, pseudonymous analyst Cred emphasized that ETH is on the rise again, saying that Ethereum is at risk of a failed breakout.

“The breakout is significant, if it fails, that’s a very bad sign for the market in general. We think a similar claim could be made in this case, so if the breakout fails and Ethereum falls below the $1200 area, it would be a bad sign. Breaks are fine until they don’t.”

Supporting the bullish thesis for Ethereum, Cred adds that ETH has a “bullish price structure” in the Bitcoin trading pair (ETH/BTC), which could bode well.

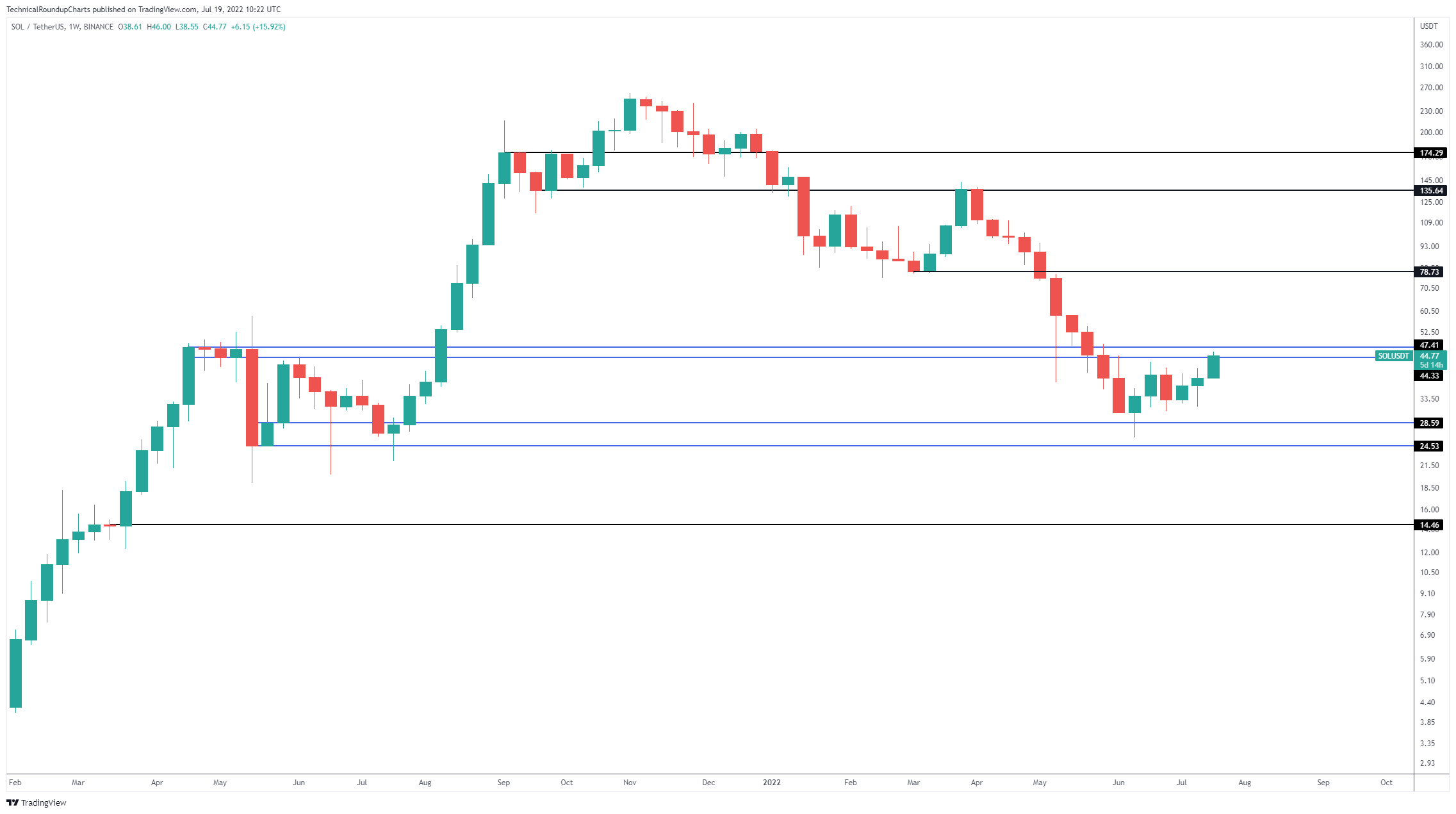

Cred also closely follows top Ethereum competitor Solana (SOL). The analyst is of the opinion that SOL and other altcoins show considerable strength:

“By its nature, this is one of the better areas to take profits and one of the less attractive areas for new longs. SOL saw a strong rally last week led by altcoins and these rallies have now reached key milestones on many charts. […]

It is not our preferred setup to buy from the first test of resistance as the market is so high, especially waiting for (at most) a week will probably give an indication of where the direction will be.”

According to Cred, Ethereum rival Avalanche (AVAX) is also facing a wall of resistance. The analyst is waiting for a convincing retracement of the $25 level before becoming more optimistic about AVAX.

“The logic here is very similar to the chapter on Solana: new resistance testing, poor contextual space for new longs, and it’s probably worth waiting a week (at most) for a reversal setup to form or for the resistance to do its job.

There is a recurring theme here: the very ‘easy’ part of altcoin bounces is mostly done and prices have now reached more difficult areas in the form of key weekly resistance levels.”

Finally, Cred says that a break to the $30,000 level for Bitcoin (BTC) would be an important catalyst for altcoin markets.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.