According to crypto analyst Valdrin Tahiri, Dogecoin’s plunge to new year lows is alarming. The analyst also voices concerns about another altcoin. Crypto analyst Ibrahim Ajibade, on the other hand, expects a bearish return from AXS. Finally, analyst Andrew Throuvalas says he saw a ‘Death Cross’ in the ADA.

DOGE price broke down from 360-day pattern

Technical analysis on the three-day time frame shows that DOGE price broke out of the 360-day ascending support line at the beginning of June. Breakouts from such long-term structures signal the end of the previous trend. It also indicates the start of a new trend in the other direction. In the case of DOGE, this means that the price may have started a new, long-term downside move. After the breakdown, the meme coin bounced around the horizontal support area of $0.060.

Despite the bounce, the RSI remains bearish. The indicator is below 50 and falling. This is also a sign of a bearish trend. It should also be noted that Elon Musk, one of the biggest Dogecoin advocates, was hit with the ‘insider trading’ lawsuit. Looking closer at the daily time frame, the bearish trend of the 3-day time frame is repeating. The main reasons for this are related to altcoin price action and RSI. Since April 3, DOGE price has fallen below a descending resistance line. More recently, this line caused a rejection on June 10.

Although DOGE price bounces back later, it is still trading below the combination of the $0.065 resistance area and the resistance levels formed by the resistance line (red circle). Hence, the trend is considered bearish until the price breaks. Alongside the descending resistance line, the RSI is also following a descending trend line (red line). Hence, the trend is considered bearish until the price breaks. If another rejection occurs, a drop in DOGE price to $0.050 is possible.

Despite this bearish DOGE price prediction, a break above the resistance line will at least mean that the short-term trend is bullish. In this case, the price is likely to rally to the next resistance at $0.073.

This altcoin has fallen below long-term support

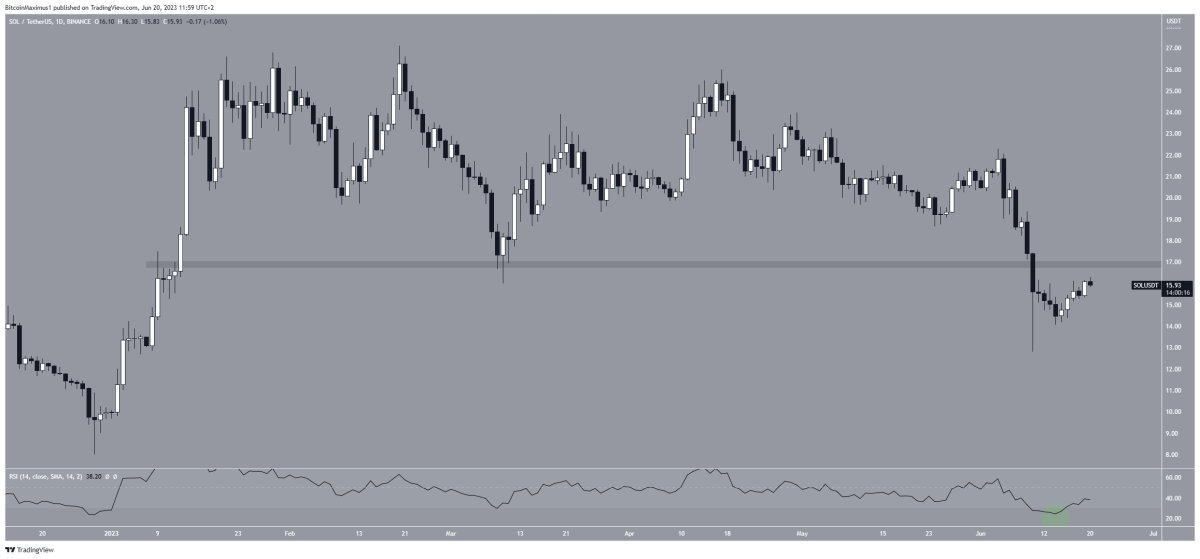

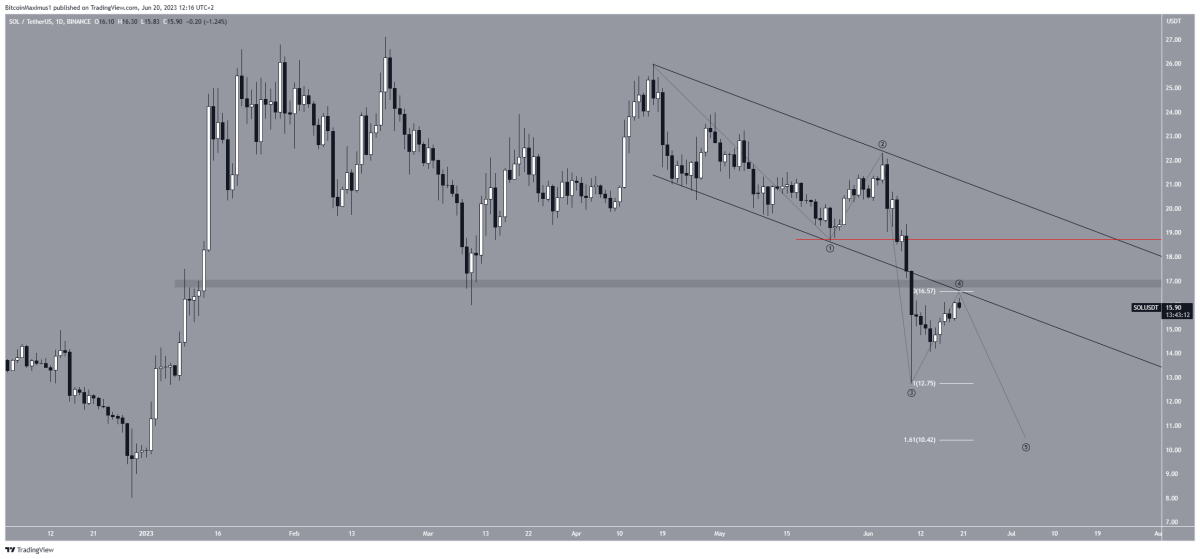

The daily timeframe technical analysis for SOL shows that the price has fallen since April 17. Solana formed a lower peak on June 4 (red icon) before increasing the bearish pace. The decline led to a low of $12.80 on June 10. This drop was crucial as it also caused the horizontal support area of $17 to break. Before the fall, this area had been in place since the beginning of the year. It is possible that SOL will re-establish resistance if it retests.

The weekly RSI is showing mixed signs. While the RSI is up, it is still below 50. However, it broke out of the oversold zone (green circle), a sign associated with the uptrend starting to reverse. The number of waves remaining on the daily time frame also indicates that more downside movements are expected. The wave count shows the price approaching the top of the fourth wave in a five-wave downside move (black). The fact that the price is trading at a point where the horizontal and diagonal resistance levels intersect supports this possibility. If the count is correct, the altcoin price will drop towards $10.42.

Despite this bearish SOL price prediction, a spike above the first wave (red line) at $18.72 would instead mean the trend is up. SOL price is likely to move to the next resistance at $23 in this case.

AXS forecast: Altcoin turns bearish towards $4

According to IntoTheBlock’s IOMAP distribution data, the altcoin price is likely to start a bearish trend towards $3.75. However, at the moment, 35 investors who purchased 55,000 AXS tokens for a minimum price of $4.70 are likely to give a significant boost. However, if this support folds as expected, AXS price will likely drop towards $4.05.

Still, AXS bulls could thwart this bearish narrative if it rises above $5 against the game stream. However, as seen above, 1,020 addresses holding 2 million AXS tokens at a maximum price of $5.02 could form significant resistance. And if it breaks this resistance level, it is possible to finally regain the $6 milestone.

‘Death Cross’ appears on ADA, which SEC calls securities

Cardano’s (ADA) price showed the ‘Death Cross’ over the weekend, a bearish technical indicator signaling bearish price momentum and a potential tail reversal. This situation, cryptocoin.comIt happened two weeks after the US Securities and Exchange Commission (SEC) sued Coinbase. The SEC argued that ADA is a security in this case.

A Death Cross occurs when an asset’s 50-day simple moving average crosses below its 200-day moving average. Almost all of Cardano’s moving average indicators give a “sell” signal. The asset last experienced a death cross in December 2021, at the start of a year-long downtrend for both Cardano and all crypto.

The altcoin then showed its counterpart, the ‘Golden Cross’ in March, as the collapse of multiple banks triggered a flow of capital into Bitcoin and other digital assets. While considered unreliable on its own, the ‘death cross’ came just as the SEC filed suit against two of the world’s largest crypto exchanges, Binance and Coinbase. In the second lawsuit, the SEC called ADA a ‘securities’, along with a dozen other cryptoassets. In addition, many of them were severely damaged after the lawsuit. Since then, ADA has dropped nearly 30% to $0.25.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.