In recent years, cryptocurrencies, which can find a place for themselves when the main investment tools are counted, attract the attention of investors more and more with their advantages and features compared to other investment tools.

It can now be said that cryptocurrencies have become the focus of attention of a certain group of investors. Especially compared to traditional investment instruments. advantages Because of this, people may prefer to invest in cryptocurrencies.

Well especially in the younger age group What are the logical reasons for cryptocurrencies, which are considered among the important investment instruments when investing, against traditional investment instruments such as gold or dollars?

First, let’s get acquainted with cryptocurrencies and traditional tools.

First of all, it would not be wrong to define traditional investment instruments with the following words: Low risk, low return and long-term investment objectives. For example, stocks and bonds usually offer regular returns, but their prices are not very volatile. On the other hand, gold and other commodities have been the safe haven for most people in times of crisis, but it can be said that they provide less return on long-term investments.

On the other hand, we can define cryptocurrencies with the following words: Higher risk, higher return potential and higher volatility. In addition, the fact that cryptocurrencies markets are less regulated can also bring other risks. However, cryptocurrencies stand out for their low cost and fast transactions, secure payments, decentralized finance (DeFi) applications and technological innovations.

Let’s go into a little more detail: What aspects of cryptocurrencies stand out?

First of all, of course, high earning potential

One of the main reasons why cryptocurrencies are gaining more and more popularity day by day high earning potential We are not wrong if we say that it has. Especially during the pandemic period, the fact that Bitcoin reached the level of $ 64 thousand and then the rise of other cryptocurrencies made cryptocurrencies attract the attention of everyone from 7 to 70.

The reasons for the sudden increase and decrease in cryptocurrencies do not end with counting, but supply-demand balance and speculations (for example, Elon Musk tweets about Dogecoin out of the blue) as the main reasons for the extreme activity in this market.

One of the important details for an investor: Fast and easy trading

In traditional financial markets, transactions are usually to intermediary institutions is needed. As such, it takes time to process and transaction fees can be high. On the cryptocurrency side, things don’t work that way. As trades can be transferred directly between individuals, intermediary institutions are eliminated and trade becomes easier.

In addition, we often hear day opening and closing hours It doesn’t exist in the cryptocurrency industry, and the reason is pretty simple: The cryptocurrency space has a 24/7 market.

Here are such advantages that trading in cryptocurrencies is much more convenient than traditional tools. fast and easy We wouldn’t be wrong if we say that these are the factors that make it happen.

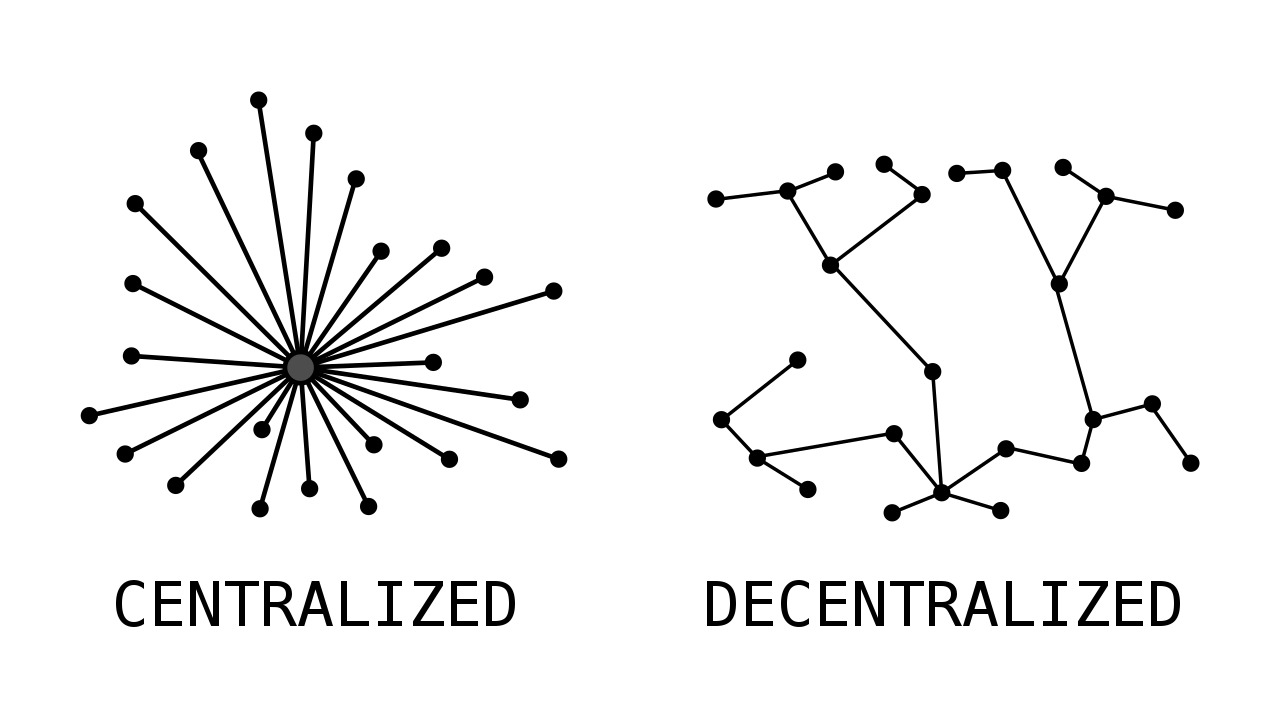

Another missing feature in traditional investment instruments: Decentralization

One of the beauties of blockchain technology decentralization it can be tried. This concept is actually one of the most important words in the world of crypto money and allows it to separate from traditional investment tools.

For example, unlike stock markets, cryptocurrencies state or central authority cannot be manipulated. Therefore, they can be a safer investment tool for users. Moreover, it is very difficult for cryptocurrencies to be stolen and counterfeited thanks to the encrypted and decentralized system. Of course, it may be better if you rely on these features and do not click on every link on the internet that you do not know.

long story short

Although the values of cryptocurrencies, the shining investment tool of recent times, show more volatility compared to some traditional investment tools, in the long run can generate significant gains. It can be said that the increase in the value of cryptocurrencies such as Bitcoin in recent years has attracted the attention of investors.

However, let us remind you again and again that investing without knowing about cryptocurrencies carries great risks. Since the prices of cryptocurrencies can change rapidly, making a wrong move can frustrate the investor. to big losses it can hurt. Therefore, it is not bad to do a good research and follow the markets before investing in cryptocurrencies.

RELATED NEWS

The Question That The Whole Crypto World Is Looking For An Answer To: Will Bitcoin Become $50,000?

RELATED NEWS