of bitcoin as interest rates become more sensitive and investors adjust to the Fed’s tightening policies. cryptocurrency The funds experienced a net outflow for two weeks in a row.

These data are considered useful in terms of learning the positions taken by institutional investors.

Net Exit From Cryptocurrency Funds Has Happened This Week

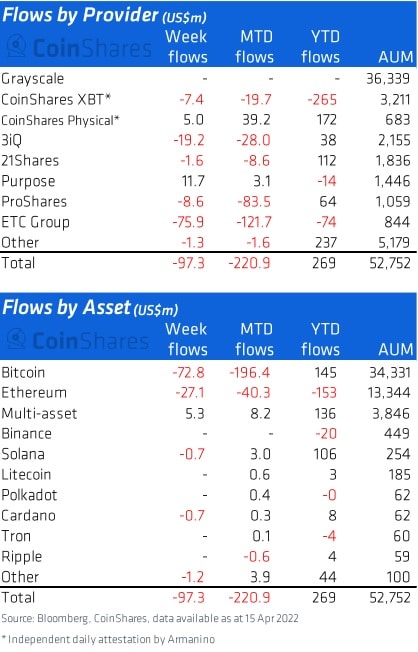

According to the report shared by CoinShares, crypto funds saw a net outflow of $ 97 million during the week, with the end day of April 15. Considering that the US-based funds were the center of the outflows last week, an unexpected development took place as the center of the outflows this week shifted to Europe.

The fund outflow last week was the deepest loss since January.

CoinShares had the following to say about the fund outflows:

“Throughout 2022, we have seen Bitcoin become increasingly sensitive to interest rates, similar to other savings tools.”

However, in products such as ETP, which is called short BTC investment products and tracks the reverse of the performance of crypto money, the net positive inflow that lasted for a few weeks ended, and this week there was an outflow of 1.8 million dollars.

BTC-related products experienced a net outflow of $73 million and were the main focus of the exits. However, the trading volume of BTC funds was at $651 million, half of the annual average, reflecting the overall decline in BTC’s trading volume, according to experts.

What About Altcoin Funds?

Ethereum focused funds saw a net outflow of $27 million this week. It is noteworthy that this value is considerably higher than the $15.3 million outflow recorded last week.

cardano and wither focused funds each saw a net outflow of $700,000, while multi-asset funds, contrary to the general picture, experienced a net inflow of $5.3 million.

When evaluated as fund providers, the funds managed by ETC Group took the lead with a loss of $95.9 million. 3iQ took the second place in net exits with $ 19.2 million.

*Not investment advice.