UNI, LDO, LTC and MATIC are struggling to hold critical support areas in May, which started with a bearish month. According to the technical analysis, there are few strong demand zones left that the bulls can hold to avoid selling. Critical levels to be considered towards the end of the week for 4 altcoins…

These 4 altcoins are just one step away from the risk of mass selling

Litecoin (LTC)

Litecoin has formed a double top pattern at a key resistance level. Technically speaking, the price has been climbing ever since it dropped to a yearly low of $41 in June 2022. In this process, it formed an uptrend structure and reached its annual high of $ 105.7 in February 2023.

However, the bulls are struggling to stay above the $100 resistance. In addition, the second rejection created a bearish candle and another bearish signal on the weekly RSI.

Technical signals for LTC suggest that its price will continue to decline in the short term. The potential first target of this move is $75 and the second support at $63. A break below the $85 support level will confirm this possibility. cryptocoin.comAs you follow, one of the bullish developments for LTC will be the halving on August 02.

Polygon (MATIC)

MATIC price opens with a 6% drop on the first day of the month, setting a record for May. A possible default in the US debt ceiling and recession fears are putting additional pressure on MATIC. This rapid breakout of the price means that if the US Dollar strengthens and strengthens a bit, more declines will follow.

Therefore, MATIC is not in a good spot as it broke the $0.96 support on Monday. Probably with many bulls out of the way, it’s only a matter of time before selling picks up and MATIC drops to $0.87. This move means another 10% loss will be added to the already sharp drop from Monday.

The bears may lose interest as MATIC hangs in the region along with the near-oversold RSI. After all, the RSI shows little room for further declines. This leaves room for a bounce higher at $1,025 where the 200-day SMA will either topple or be definitively rejected.

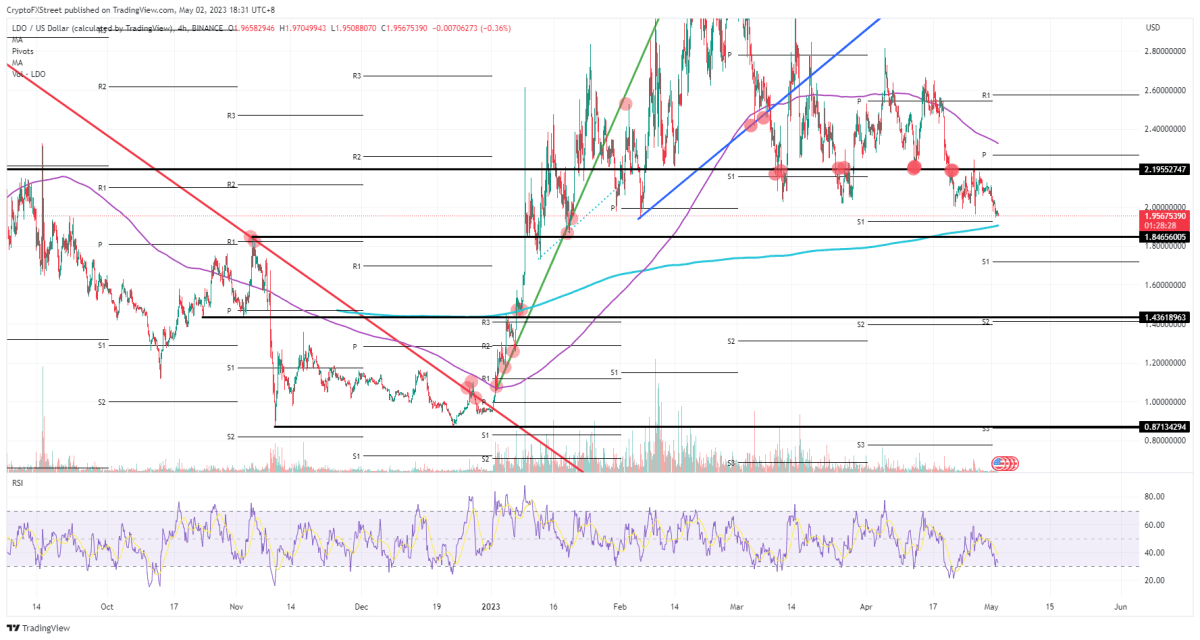

Lido DAO (LDO)

LDO price flirts with the break of the 200-day SMA. This breakout opened up a two-stage area where losses could range from 25% to 50%.

LDO has a small support at $1.85 which will still work if the 200-day SMA doesn’t hold. When $1.85 is broken, it could open an additional 25% to $1.43. A breakout here opens a large gap that will push the price below $1.87 to $0.87, according to analyst Filip L..

A bounce at any of the initial support will be enough to push LDO back above $2. At the same time, this possibility is strengthened by the re-oversold of the RSI. Unless there has been a downside break yet, there is little incentive for bears to get involved here. At the top, this $2.20 will be a solid test. However, the 55-day SMA is approaching just above $2.32.

Uniswap (UNI)

UNI price has been moving downwards despite attempts to recover for the past two months. In the process, it lost 30% in value and regressed to the $5 region.

One of the winds behind Uniswap is the transfer of capital from DEXs like Uniswap to liquid staking decentralized applications (Dapps) that occurred after Ethereum’s Shanghai upgrade. In the world of DeFi, liquid staking protocols are close to surpassing TVL on DEXs, ending two and a half years of dominance.

High speed is often associated with a healthy return on capital, which is important for an altcoin. However, this change is hard to come by as almost 85% of the entire UNI supply is currently held by HODLers.

Therefore, in order for these investors to get their supply moving again, they need to switch to profits. But more than 77% of investors are actually facing losses right now. Therefore, their beliefs will keep them from losing money while they are still at a loss.

In a nutshell, UNI bulls’ next chance will be to break through the $7.3 zone, where investors will profit again. In such a case, according to Aaryamann Shrivastava, investors will be looking for new opportunities at UNI price again.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.