More than 21,162 BTC options with a face value of $1.51 billion will expire today.

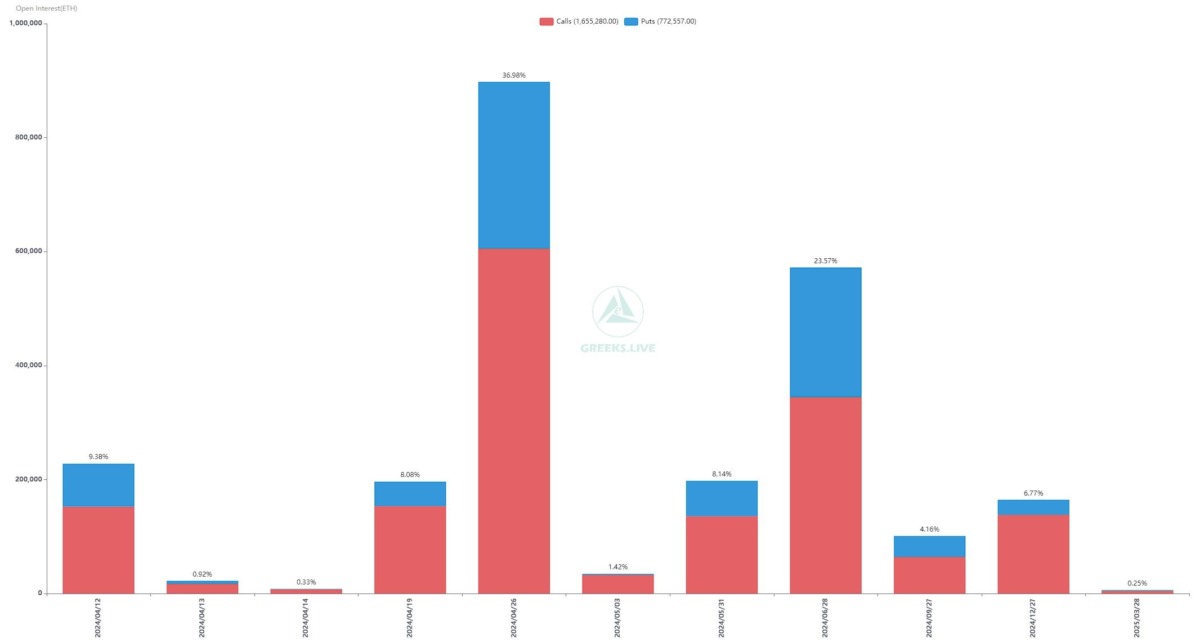

Additionally, 227,785 ETH options with a nominal value of approximately $0.81 billion will expire. The maximum pain point below the current price for both cryptocurrencies indicates selling today.

Billion-dollar options expiring on two cryptocurrencies

Bitcoin and Ethereum prices recovered slightly. However, Bitcoin and Ethereum options worth approximately $2.5 billion will expire today. Therefore, while the price momentum of cryptocurrencies is decreasing, they are still under selling pressure. Volatility ahead of Bitcoin’s halving has increased as traders price in subdued upside momentum amid headwinds such as macro and whale selling.

More than 21,162 BTC options with a face value of $1.51 billion will expire. The put-call ratio in these options will be 0.62. The maximum pain point is $69,000. It shows that the Bitcoin price remains under selling pressure compared to the current price. Implied volatility (IV) is witnessing significant declines in all major terms. This means that volatile price movements will cause BTC price to drop below $70,000.

Meanwhile, 227,785 ETH options with a face value of approximately $0.81 billion will expire. These options will expire with a put-call ratio of 0.49. The maximum pain point is $3,425. This is lower than the current price of $3,535. This shows that traders still have opportunities to trade at a lower price. For further guidance on ETH price directions, it is necessary to keep an eye on trading volumes.

According to analysts, selling is a good option in the medium term!

cryptokoin.comAs you follow from , hot CPI data set the agenda of the market this week. Additionally, there has been a massive decline in volumes in the derivatives market. Due to the accumulation of such negative conditions, experts point to selling sentiments in the crypto market. They also note that the crypto market will remain volatile before and after the Bitcoin halving.

Greekslive analysts revealed that sales contracts were the most dominant trade of the month. He also pointed out that halving expectations were overextended. They note that with the recent slowdown in ETF inflows, there are no new hot spots in the market and more subdued sentiment. According to analysts, selling is indeed a better option in the medium term. They also say the short term will be worth it due to the sentiment surrounding Bitcoin’s halving.

BTC futures OI remains strong but volatile

At the time of writing, BTC is trading at 70,888, up just 0.50% in the last 24 hours. The 24-hour low and high are $69,571 and $71,256. However, trading volumes are down over 22% in the last 24 hours. This pointed to a lack of interest among traders. Total BTC Futures Open Interest increased by 2% in the last 4 hours. However, it has been fluctuating in the last hour. CME BTC futures OI is down 1% in the last hour.

ETH, on the other hand, is trading at $3,539, down 0.80% in the last 24 hours. The 24-hour low and high are $3,477 and $3,616. Additionally, trading volume has dropped over 16% in the last 24 hours. This pointed to a lack of interest among traders. Total ETH Futures Open Interest decreased by 2% in the last 24 hours. However, it increased by 1% in the last 4 hours. Futures activity continues to be volatile ahead of options expiration.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!