The ongoing uncertainty of crypto regulation in the United States is poised to witness a decisive moment. Senators Cynthia Lummis (R-WY) and Kirsten Gillibrand (D-NY) are preparing to announce regulatory proposals for cryptocurrencies. Known as the Lummis-Gillibrand Responsible Financial Innovation Act, the controversial bipartisan bill aims to bridge the regulatory gap that has underpinned the crypto industry in America. Here are the details…

Lummis-Gillibrand law provides regulatory clarity for cryptocurrencies

An escalating dispute between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) over the precise nature of cryptocurrencies has left businesses in limbo. Both regulators use their own enforcement powers against crypto exchanges Coinbase and Binance. The Lummis-Gillibrand Act aims to “enable responsible financial innovation and crypto assets within the regulatory environment.” In stark contrast to the SEC’s ongoing enforcement actions, most define crypto as a commodity under the jurisdiction of the CFTC.

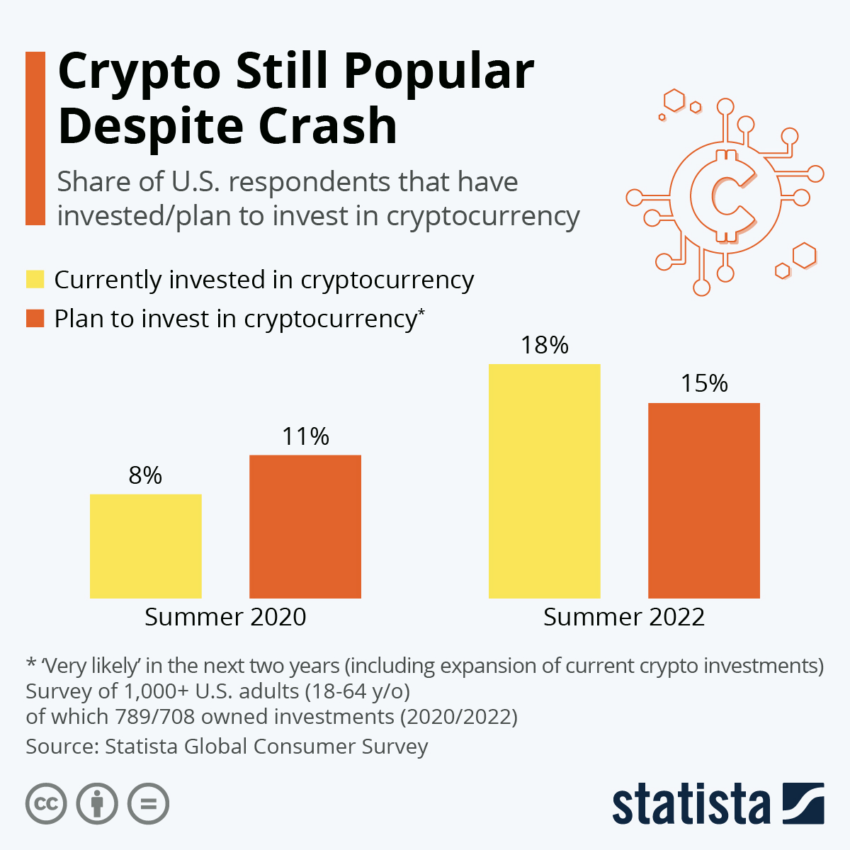

The legislation makes a proposal to avoid further turmoil in the crypto industry, which has witnessed a series of high-profile crashes over the past two years that have resulted in significant investor losses. “This legislation is the most comprehensive proposal to date that provides robust consumer protections and appropriately addresses the current landscape surrounding crypto assets,” Senator Lummis said. The proposed law would require crypto exchanges to securely store client assets in third-party trusts. Next, prohibiting “proprietary trading” or trading with their own funds on their platform.

Crypto exchanges are held accountable

The US crypto regulatory bill could also signal a regulatory tightening on the “material subsidiaries” of crypto exchanges. This comes after allegations that FTX lent large amounts of client funds to its sister company, Alameda Research, before the liquidity crisis that triggered its collapse. “It is critical to integrate crypto assets into existing laws and use the efficiency and transparency of this asset class to address risks… As this industry continues to grow, it is critical that Congress carefully draft legislation that encourages innovation while protecting the consumer against bad actors,” Senator Lummis said. .

Also, the proposal aims to prevent “re-mortgage” of crypto assets. It effectively bans high-risk, yet profitable crypto services like staking. It also imposes stricter standards on new tokens before they are listed on crypto exchanges. Amid substantial opposition to SEC Chairman Gary Gensler, the proposal emerged, due to be announced Wednesday (July 12th). Steps have been taken to reduce Gensler’s influence, especially in the Republican-dominated House of Representatives.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow on. Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.